Listed Investment Companies (LICs) are firmly established in the Australian investment landscape, with a market capitalisation in excess of $40 billion.

A particular feature is that LICs will trade at a share price premium or discount relative to their net tangible assets (NTA), creating both opportunity and concern for investors. Whilst the underlying portfolio performance will explain the majority of the variation in the share price, other factors that affect listed equity prices include management fees and other costs, market sentiment, liquidity, forecast earnings and ability to sustain an ongoing dividend.

A common misconception of the premium/discount is that an LIC at a discount will return to trading at par to their NTA over time. As equities trade in perpetuity with no redemption date, this belief is often not realised, nor should it be expected in many cases. LICs will instead tend to trade around an historical premium/discount and a key consideration is comparing the current premium/discount to the historical average. Calculating a Z-score can assist in determining whether or not this difference is significant.

What is a Z-score?

Put simply, investors need a measure of how much the current premium or discount of the share price to the NTA varies from historical norms. If a LIC is trading at a 10% discount but is normally at a 20% discount, it might return to the norm rather than towards par.

A Z-score calculates how many standard deviations the current premium/discount is away from the historical average. A Z-score of +1 is 1 standard deviation above the mean, etc. A Z-score of -1 is 1 standard deviation below the mean. It is calculated by dividing the difference of the current premium/discount to the historical average by the historical standard deviation to produce a figure which can be used to assess whether a LIC is currently attractively priced or expensive based on price history.

A positive Z-score indicates a current premium/discount that is greater than the historical average. It may be expected to decrease back to the average over the long run, and vice versa for a negative Z-score. Due to this, a negative Z-score may be considered more attractive. For example, it might mean the current discount is worse than normal.

Key considerations and an example

For the Z-score to be meaningful, we make the assumption that the historical premium/discount figures are normally distributed around the mean value. Using this assumption, 68% of premium/discounts fall within 1 standard deviation of the historical mean and 95% within 2 standard deviations. However, the data may not be normally distributed and a larger error is expected when using a shorter timeframe. A statistical analysis is therefore used to illustrate a theory that may not be statistically accurate. It is important to take into account all factors that will affect the premium/discount to NTA including options outstanding, dividends and takeover announcements.

For example, Watermark Global Leaders (WGF) has a 1-year average discount of -16% to the pre-tax NTA. On 20 December 2018, the Board declared the intention to restructure WGF as an unlisted unit trust with a value that reflects the after-restructure cost NTA. The discount decreased given the probability of the proposed scheme being implemented. This example shows one of the limits of Z-scores, as other events can overwhelm comparisons with historic norms.

This news will have little effect on the NTA, but the share price rose leading to a decrease in the discount from ~16% to ~5%. The discount won’t go to zero because investors are still factoring in the cost of the restructure that will come out of the NTA and also the possibility that the proposal may not happen.

In time if the restructuring seems more probable of occurring, the risk of it not happening decreases and investors are then happy to pay a little more for the shares, upto the price of the NTA minus restructuring costs.

As an illustration, consider a company receiving a takeover offer at $50, which let's assume is a premium to its current price. The share price will rarely begin trading the next day at $50 because of the possibility the takeover is shut down. But over time if the probabity of occurring increases, the share price will shift to $50, e.g. decreasing the arbitrage opportunity or discount.

The explanation of Z-scores can be rather confusing, as we are considering both an increase in a discount (say from -10% to -20%) or a decrease in a discount (say from -20% to -10%). For anyone interested in more detail, consider:

Example 1 (trading at a discount):

- LIC historically trades at a discount of 10%

- NTA is $1.00 and the Share Price is $0.90

- The next month the NTA decreases to $0.95 and the Share Price decreases to $0.82. Now the discount is 13.7%

- Under the theory that the discount converges to the historical average (and holding the NTA constant - important) we should expect the Share Price to rise to $0.855

- Whether or not the Share Price is increasing or decreasing, you would be able to purchase the underlying portfolio at a relatively cheaper price (%) than has historically been available

Example 2 (trading at a premium):

- LIC historically trades at a premium of 15%

- NTA is $1.00 and the Share Price is $1.15

- The next month the NTA increases to $1.10 and the Share Price increases to $1.20. Now the premium is now 9.1%

- Under the theory that the premium converges to the historical average (and holding the NTA constant - important) we should expect the Share Price to rise to $1.265

Whether or not the Share Price is increasing or decreasing, you would be able to purchase the underlying portfolio at a relatively cheaper price (%) than has historically been available.

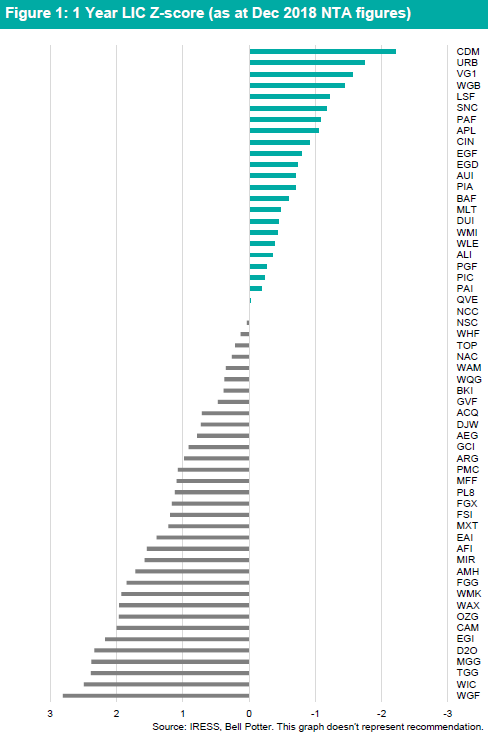

The chart below compares Z-scores and the relative attractiveness of prices as at 30 December 2018, however, all factors need to be considered.

In reading this table, remember that a negative Z-score may be considered more attractive because it might mean the current discount is greater than normal. A positive Z-score may be considered less attractive because the current premium is more than usual.

Each LIC should be reviewed and considered on its merits, and Z-factors are simply another input. Again, I wish to highlight that the assumptions used may not be statistically accurate.

Will Gormly is an ETF/LIC Specialist at Bell Potter Securities. This article is for general information only and does not consider the circumstances of any investor.

Cuffelinks provides regular reports on LICs trading at discounts and premiums in the Education Centre.