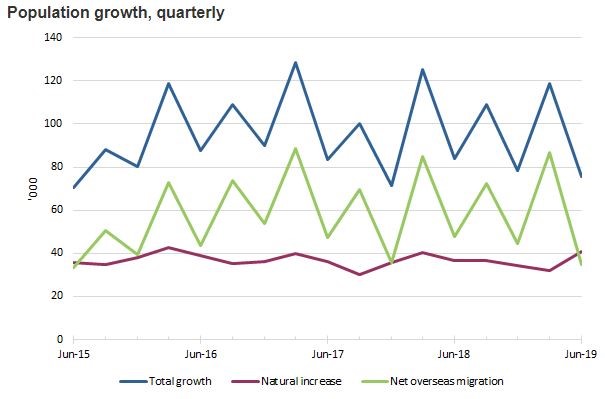

In this new decade, Australia is expected to add another four million to its population, as it did in the previous decade. We have the fastest-growing population in the developed world (1.5% in the year to June 2019), which is one reason for nearly 30 years of economic growth. More people means more stuff. It's driven by net overseas migration of about 250,000 a year, and when most live in Sydney and Melbourne, the prosperity comes at a cost in transport, crowding and property prices. Natural increases are 0.5% of the population.

Source: Australian Bureau of Statistics, June 2019

An even bigger impact this decade will come from the ageing Baby Boomers, the youngest of which is already 55 (and the oldest is 73!). By 2030, most Boomers will have transitioned into retirement. Not only will this cause a major workforce (and tax payment) exodus, it signals greater drawdowns on pensions and health, and will put further pressure on policy change. For example, while the Labor franking policy is buried for now, the ATO recently advised that over one-third of company tax is returned to shareholders as franking credits.

This week's new articles start with a food theme, fitting after the long festive season. For investors looking for a more familiar way to think about an investment portfolio, we compare it to choosing foods in a diet. Christine Benz continues the idea with an 'investment pyramid', defining where you should spend most of your time and energy for the best results.

Amid these terrible fires comes a warning for all from Chloe Lucas, Christine Eriksen and David Bowman on the consequences of underinsuring our homes. They quote a common mistake in how we guess the insurance amount we need:

"I think we had about $550,000 on the house and the contents was maybe $120,000. You think sure, yeah, I can rebuild my life with that much money. But nowhere near. Not even close. We wound up with a $700,000 mortgage at the end of rebuilding."

Then Hugh Dive looks back over the last decade of ASX company performance and identifies the factors driving winners and losers.

We continue the raging debate about fees paid to advisers on new listed investment funds and the implications for investors, while Paul Heath argues the incentive fees are incompatible with impartial advice.

And finally, a reminder to check our free ebook based on wide-ranging interviews conducted with many leading global and local investment experts.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.