The U.S. Department of Agriculture's food pyramid, designed to help set healthy dietary priorities, debuted in 1992, urged us to indulge sparingly in fats. Meanwhile, bring on the carbs: pasta, rice, bread, and cereal made up the bottom of the pyramid graphic, with a recommended six to 11 servings per day.

Oopsie. Dietary scientists eventually determined that eating a lot of refined carbs isn't that good for us after all, so the original pyramid was replaced with another, more confusing-looking pyramid in 2005. The revised pyramid showed fruits and vegetables on a near-equal scale alongside grains.

Alas, in 2011 the pyramid was scrapped altogether in favor of a square food plate called MyPlate. Vegetables take up more than one fourth of the MyPlate plate, followed by smaller portions of grains, protein, fruit, and dairy.

A guide to allocating time and resources

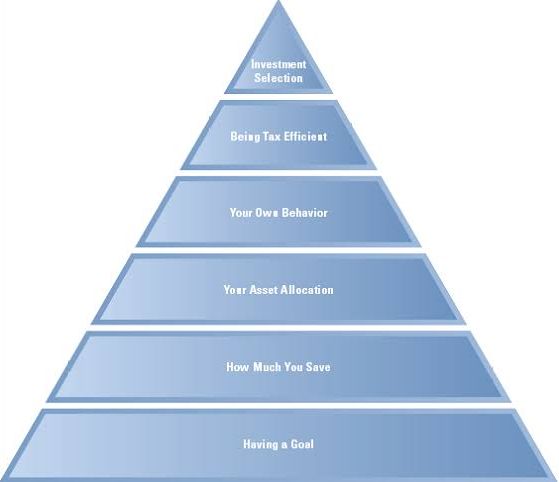

Yet even though the USDA abandoned the pyramid as an image to help set dietary priorities, it's still a useful shape to convey how to allocate your time and resources, including when you're investing. At the bottom of the pyramid are the activities that you should spend the most time and energy on because they have the biggest impact on your results. They're the equivalent of broccoli and brown rice. Meanwhile, at the top are tasks that, though worthwhile, will have a smaller impact on your bottom line.

The following investment pyramid can help guide priorities for new investors. It can also assist in keeping more experienced investors on the right track. After all, the more you know, the more likely you are to geek out about small matters such as whether to own a high-yield exchange-traded fund or an actively managed fund. In so doing, it's possible you'll lose sight of game-changers such as your saving and spending rates and your total asset allocation.

Here's a look at the investment pyramid I would propose, ranging from what should be investors' top priorities - the base of the pyramid - to the least important ones.

The pyramid's base: setting your financial goals

You know how it is when you don't start a day with a to-do list? You get buffeted around by whatever comes up. Phone calls, answering emails, chatting with colleagues about favorite childhood candy bars, and whoops – how on earth did it get to be 11:20 already?

Managing your finances without first articulating your near- and long-term goals is similar. Rather than operating with the amorphous goal of ‘wealth accumulation’, take a step back and articulate the specifics of what you're trying to achieve, when you'll need the money, and how much.

Paying the full freight for college for each of your kids? Retirement while you're still young enough to enjoy it? A move to a bigger house within the next five years? By quantifying each of your financial goals, you may see that it's not going to be possible to achieve them all, but it's better to know that early on so you can prioritise. And each of those goals likely carries its own time horizon, which in turn will dictate what types of investments you hold and where.

The next band: managing your saving and spending

Budgeting is boring, which is why it's easy to give short shrift to it in favor of sexier pursuits such as trading stocks. But even if you select the very best investments, you'll be hard-pressed to make up for a shortfall if you haven't saved enough.

This is key to ensure that your savings rate puts you on track to achieve the above-mentioned goals. This concept matters long after you've stopped saving, too. Retirees are obsessed with the topic of spending rates and for good reason. The difference between a 4% and a 6% withdrawal rate can be enormous when it comes to the viability of a retirement plan. Being able to adjust one's spending rate – especially downward in times of market duress – has also emerged as a best practice in the realm of retirement portfolio management because it helps a retiree avoid turning paper losses into real ones.

The next band: choosing your asset allocation

There's near-universal consensus among market practitioners that the asset-allocation mix you choose matters. A lot. A portfolio that consists entirely of cash and short-term bonds will exhibit very few fluctuations, which can provide peace of mind and may be appropriate for very short-term goals. Over time, however, it will get eaten alive by a portfolio that includes a stock component.

Specific recommendations about asset allocation will vary by adviser and financial services company, but the basic rules of the road should hold you in good stead during your investing career. For your long-term goals, start heavy with stocks, then gradually shift more into safer securities as your need for the money draws near. And be careful not to gorge on niche investments such as gold and emerging-markets stocks, whose returns are sometimes explosive but so is their downside potential. Diversify reasonably among the core asset classes – high-quality stocks, high-quality bonds, and cash – and you'll be OK. Setting an asset allocation in retirement is a bit more complicated than asset allocation in the years leading up to retirement.

The next band: managing your own behavior

Even if you've gone to the trouble of creating a well-allocated portfolio, none of it is going to matter if you freak out and retreat to cash in times of turmoil. Many financial advisers say one of their most important contributions to their clients' financial well-being is to help them manage their emotions and stick with their plans through good and bad market environments. It's important to identify and manage your own potential behavioral hang-ups, such as a tendency to be too risk-averse for your life stage or to have more confidence in your investing abilities than is warranted.

The next band: managing for tax efficiency

Paying attention to tax efficiency encompasses a very broad and important set of issues, including taking advantage of tax-advantaged superannuation accounts, using low turnover stock funds, proper asset location, and employing tax-efficient withdrawal strategies during retirement. In fact, tax-efficient decision-making is one of the key factors that add value in the financial planning process.

The top: making investment selections

Ta-da! We're finally at the top of the pyramid and on to the fun stuff - investment selection. Its placement here shouldn't indicate that picking securities is not important. Needless to say, we at Morningstar think there's a big difference between investing with a high-quality fund than a C-list fund, and that investors will be better off buying a wide-moat stock that has a Morningstar Rating of 5 stars than one with no moat and a high valuation.

Rather, investment selection appears at the top because it needs to be informed by the factors beneath it in the pyramid. It's not always the case that tax considerations will trump your investment selection, but taxes should be an input in what securities you choose, as should your allocation needs, your expectations for the investment (having the right expectations should ameliorate bad behavior), and the rest of your financial plan.

Once those factors point the way toward a certain category of investments, you can then look at fees, management, and other investment-specific hallmarks of quality. And if you have little time left once you've made it to the top of the pyramid, you can reasonably skimp on investment selection by opting for a portfolio that consists of inexpensive index funds.

Christine Benz is Morningstar's director of personal finance and author of 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances and the Morningstar Guide to Mutual Funds: 5-Star Strategies for Success. This article does not consider the circumstances of any investor, and minor editing has been made to the original US version for an Australian audience.

Try Morningstar Premium for free