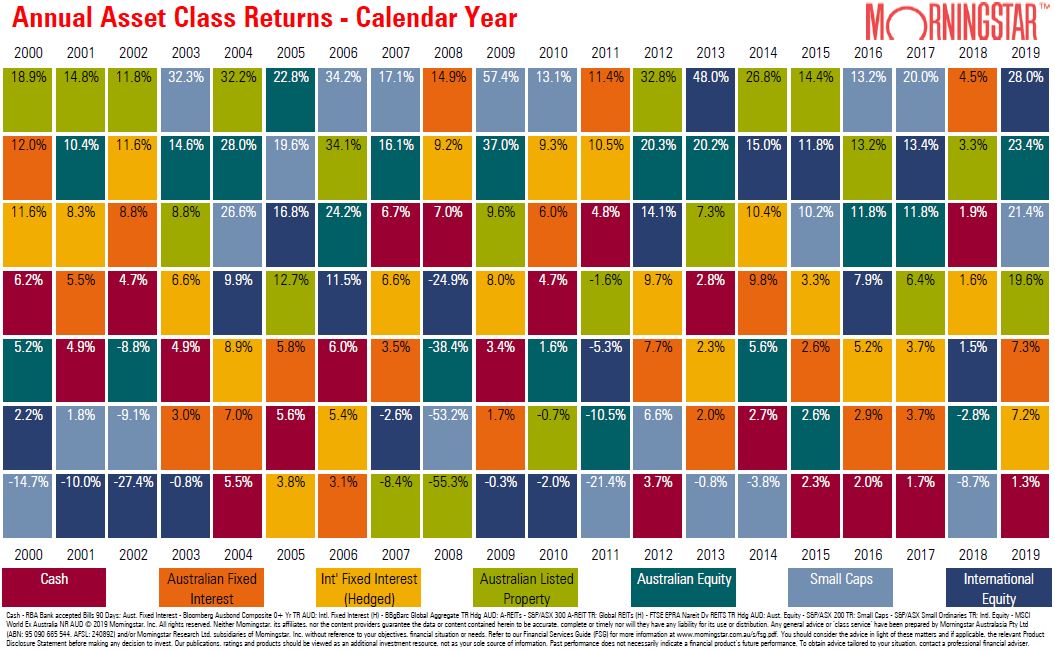

Investment returns in major asset classes in 2019 were wonderful, except for cash and term deposits. With growth super funds delivering around 10% a year for a decade, it's tempting to expect similar good returns in future. The Morningstar Gameboard below shows only two negative results across all asset classes in any year over the last five years.

It's as good as it gets. RBA Governor Philip Lowe delivered a warning for those who hope their retirement savings will enjoy a similar tailwind in the next five years. As well as saying the economic effect of climate change would be 'profound', he said the coronavirus will have a major impact on education, tourism and business generally. But the statement that really stood out was this on low interest rates:

“We’re going to be in this world for a long period of time,” and low interest rates could be around “for years, possibly decades”.

The big question is, how much will investors fleeing these low rates continue to support the equity market, even as it looks expensive on historical earnings measures?

Which leads to another question. Do you want your equity manager allocating your money to cash? In my case, I want fund managers to invest in the asset class of the fund selected, not make allocation decisions to go into another asset class. Our one question survey checks your opinion.

It's also timely to deep dive into where the strong share returns of 2019 came from. Ashley Owen shows that price rises were not matched by profit growth. The market is simply far more willing to pay more for each $1 of profit.

Faced with these doubts about shares and interest rates, both retail and institutional investors are turning more to alternatives. Simon Scott surveys the landscape and shows which diversified funds are allocating to alternatives, and the significant difference in results.

There's no doubt the big US technology companies are fantastic businesses and deserve a place in most portfolios. The table below shows the weight of the Top 5 in the S&P500, now at a record 16.5% of the entire S&P500.

But as Charles Dalziell explains, most of what we call 'disruption' is simply a variation on a long-term development, and few of the so-called disruptive companies have a genuinely innovative technology that will create a great business. Of course, all companies must move with the times, and it's only 15 years ago when Holden was selling over 150,000 vehicles a year. In 2019, it was only 40,000, none assembled in Australia.

Rob Prugue has spent decades in senior positions around Australian wealth management, and he believes the push for a mega national super fund accepting default contributions will not end well if implemented.

The arguments between industry fund, retail fund and SMSF peak lobby groups sometimes undermines confidence in super, so it's good to hear John Maroney say SMSFs are not for everyone. And still on SMSFs, Graeme Colley shows new reporting requirements facing all SMSF trustees, and why they matter.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.