Share prices across the Australian market have risen by an average of 20% over the past 12 months. This looks like great news on the surface but we need to look deeper to see where those gains came from and whether they are sustainable.

People have a tendency to mentally ‘lock in’ past gains and assume they are ‘in the bank’. The problem is that almost all of the 20% share price gains over the past 12 months were probably only temporary and should not be assumed to be ‘locked in’ at all. The 20% share price gains were not underpinned by 20% higher company profits nor 20% higher dividends. Profits per share across the market actually fell over the period, and dividends per share rose by only 4% (and most of the dividend increases were due to temporary commodity price spikes from the miners).

Paying more for the same profits

Twelve months ago, investors were prepared to pay $16.25 per dollar of company profits, but over the past year, they bid the price up to $20.40 per dollar of profits. They are now paying 25% more per dollar of profit than they did a year ago.

Twelve months ago, investors were prepared to pay $23 per dollar of company dividends (i.e. dividend yield of 4.34%) but over the past year they bid the price up to $26.40 per dollar of dividends (dividend yield of 3.8%). They are now paying 14% more per dollar of dividends than a year ago.

What caused this miraculous 25% increase in the price paid for a dollar of profits and 14% increase in the price of a dollar of dividends?

The main reason is confidence levels. At the start of 2019 people were pessimistic and feared the late 2018 ‘global growth scare’ might turn into the next GFC or possibly worse, especially as the US Fed was still raising interest rates amid Trump’s trade wars. Investor pessimism quickly turned to confidence when the Fed switched from rate hikes in 2018 to rate cuts in 2019. Central banks raise rates when they are bullish on the economy and cut rates when they are bearish. The crowd (investors) do the reverse.

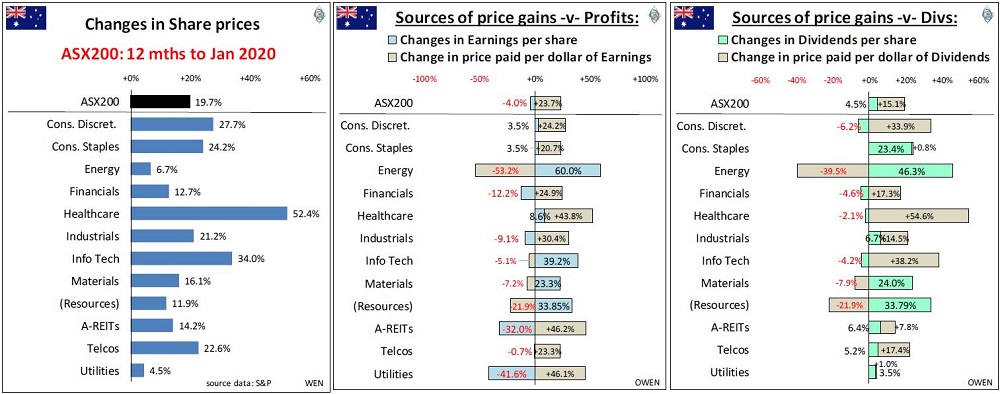

The charts break this down by market sector. The left chart shows price gains over the past 12 months; the middle chart splits this into changes in earnings (profits) per share and changes in the price paid per dollar of profits; and the right chart does the same for dividends:

Looking at the two big sectors:

First: Financials. Profits per share fell (across the Big 4 banks plus other disasters like AMP) but share prices rose 13%, so investors en masse boosted the price per dollar of profit by 25%, and the price per dollar of dividend by 17% (dividends also fell). The crowd assumes the current banking woes are temporary and banks will miraculously return to the golden years of double-digit profit growth. Our view has been that those golden years are gone. The banks are facing not only cyclical pressures (margin pressure from ultra-low rates, and bad debts from property developers/investors) but also more lasting structural pressures (crippling regulations, expensive remediation and compliance, higher capital costs, deteriorating demographics).

Second: Resources. Profits and dividends rose by 30%+ per share, a combination of recoveries from big write-offs from prior years, plus the fortuitous spikes in iron ore and oil prices. Investors have sensibly discounted this and only bid up share prices by 12% because they know this profit and dividend growth is not repeatable. Many of the miners are probably underpriced at current levels.

The market is now in expensive territory, with price/earnings ratios above 20 (more than $20 being paid per dollar of profits) and dividend yields below 3.8% ($26.40 per dollar of dividends). In order to hold on to the recent price gains, either profits and dividends need to rise substantially in 2020, or central banks need to keep cutting rates and buying up assets. That is, central banks need to remain bearish and pessimistic so that the crowd remains overconfident.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual.