The case for sitting on your rear

It is times such as this outbreak of coronavirus which test whether a portfolio is properly positioned for a person's risk appetite. A major hurdle to investor success is the urge to do something in reaction to news, especially as market experts are issuing lists of companies which will suffer from the lower activity caused by the virus. We don't yet know how widespread and sustained it will be, and investors take a risk selling out of high-quality companies and then not investing again. The S&P/ASX All Ordinaries Index fell almost 10% last week and the S&P500 is 12% down from recent highs. Consider how investors jumped out of Apple years ago when a quarterly sales figure did not quite meet target.

Berkshire Hathaway’s dynamic duo Warren Buffett and Charlie Munger do not even worry about buying businesses that are undervalued, and they ignore short-term noise. Charlie has a special name for it:

“Sit on your ass investing. You’re paying less to brokers, you’re listening to less nonsense, and if it works, the tax system gives you an extra one, two, or three percentage points per annum.

“What we really like is buying good-sized to very large first-class businesses with first-class management and just sitting there. You don’t have to go from flower to flower. You can just sit there and watch them produce more and more every year.

“If you buy a business just because it’s undervalued then you have to worry about selling it when it reaches its intrinsic value. That’s hard. But if you can buy a few great companies then you can sit on your ass … that’s a good thing.”

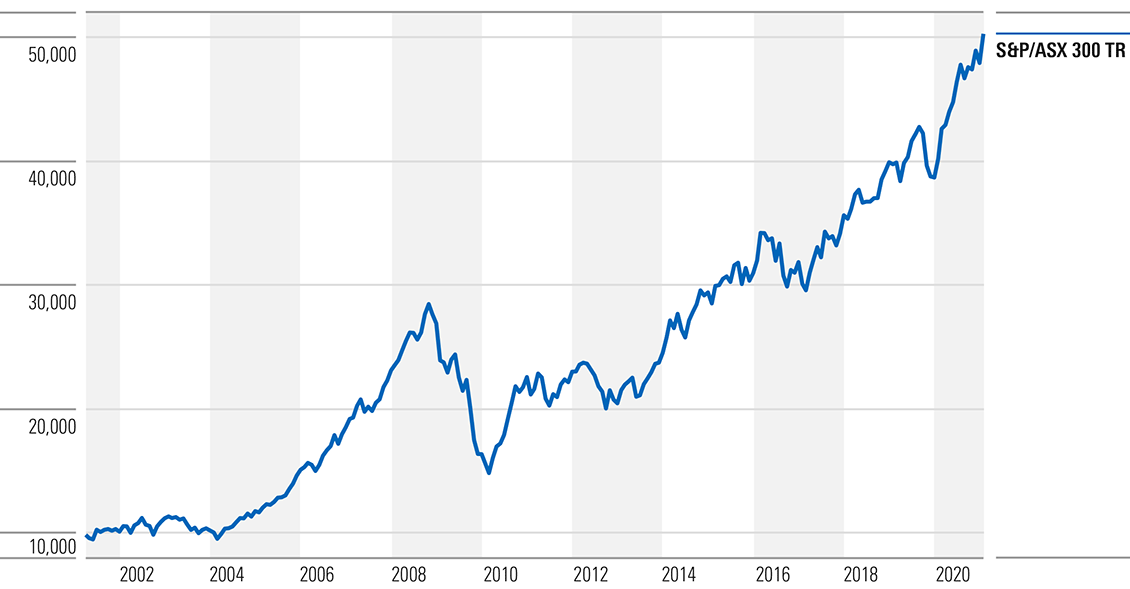

Sit back and have a look at this chart, for instance.

S&P/ASX 300 growth of $10,000 since inception

Elsewhere, Morningstar CEO Kunal Kapoor was in Australia earlier this month. I caught up with the company veteran and former analyst. In a wide-ranging interview, he expands on the importance of democratising investing, why saving in your youth is crucial, and why most investors care more about paying off their debts than comparing their results against benchmarks.

Does your portfolio hold any companies who ply their trade in alcohol, tobacco or firearms? Many investors are happy to hold their nose, knowing that companies that engage in activities considered unethical or immoral nevertheless deliver good returns. David Walsh has crunched the numbers and the data will surprise you.

Coronavirus took a bite out of world markets this week, and Wall Street woke up with a nasty head cold as the disruption to global supply chains strangles company cashflows. Moray Vincent examines its effect on the Australian economy and the world at large.

Roy Agranat puts the spotlight on what he argues is poor pricing of life insurance products and the impact it is having on Australians, and Dermot Ryan shows you how to spot trouble in your retirement portfolio.

Did you know bond funds are hotter than Tesla? Or that private credit is fuelling the next crisis? These stories and much more are covered in Jonathan Rochford’s monthly digest of media worth consuming. And finally, Leisa Bell examines the results from the survey poll on equity manager cash allocations.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.