The workplace response to coronavirus is further evidence that companies are paying increasing attention to the health and welfare of their staff. Employment policies have become far more enlightened in recent years, such as offering care leave, paternity leave, stress counselling, work-from-home arrangements and meditation classes in the workplace. In dealing with the virus, for example, companies are cancelling business travel and encouraging video meetings.

However, there's far less focus overall on sleep patterns. After recently flying east from Sydney to Santiago for 15 hours during the day, arriving discombobulated at 9am, it emphasised the value of sleep and its role in efficient functioning in the workplace. Scientific evidence about sleep patterns now confirms that many people do not work optimally during the normal working period of 8 to 5.

Professor Till Roenneberg, a chronobiologist at Ludwig-Maximilian University in Munich, is a leading researcher on sleep. He says:

“If you let people sleep within their own sleep windows and work during their optimal times, you could potentially shorten their working hours by 30%; with better sleep patterns people can be more productive.”

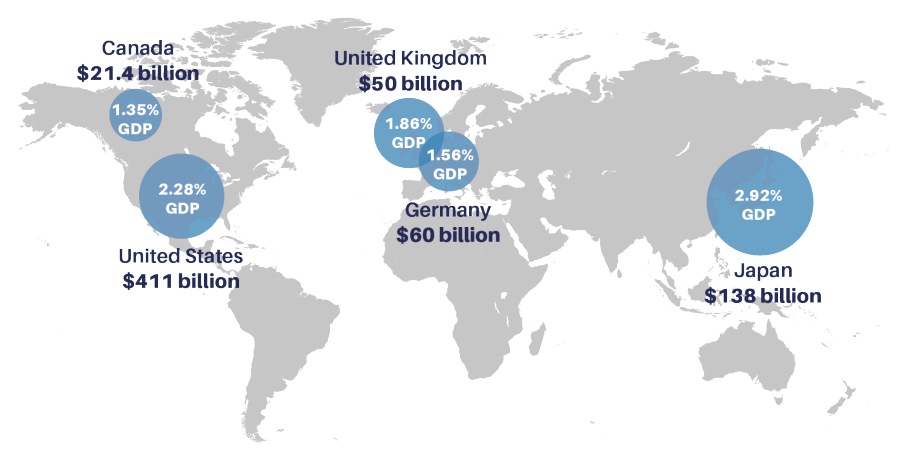

Let’s put more effort into recognising chronotypes, that is, the propensity of people to sleep at a particular time. Lack of sleep has a financial cost. It is estimated that 1% to 3% of GDP is lost due to poor sleep, based on research from RAND Corporation.

Map showing economic costs of insufficient sleep across five OECD countries

Source: Jess Plumridge/RAND Europe

This week, which culminates with International Women's Day on 8 March, Suzie Toohey discusses the latest online investor survey by Investment Trends. This shows encouraging growth in the number of women investors in Australia, and their desire for more investment knowledge. If you've ever wondered what it takes to gain good investing skills, we compare this to other professions.

The collective skills of Australian bank boards are also under the microscope, as Donald Hellyer's analysis finds they are lacking in several areas.

In a week where falling and rising financial markets suggest investors have shrugged off coronavirus complacency, Ashley Owen examines the reaction and describes the economic effect of major pandemics of the 20th century and beyond.

Michael Collins details the exciting, but probably distant, potential of quantum computing, and Andrew Stanley explains how tax treatment distinguishes separately managed accounts from other investment vehicles.

The Morningstar Fund Manager of the Year awards were presented last week, with Fidelity International taking the top honours alongside winners in global and domestic equities, fixed interest, listed property and multisector, as summarised by Emma Rapaport.

This week's White Paper is Channel Capital's recent three-part series on unconventional monetary policy and the lessons learned from Germany and Japan. There is an increasing likelihood that the Reserve Bank will head this way to help deal with the virus.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.