The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular stock pick articles from the week. You can check previous editions of the newsletter here and contributors are here.

Already about 800 responses to our retirement income survey. Now it's the weekend and you have more time, let's push well over 1,000 and show Treasury a good sample of what you think.

***

Weekend market update

From AAP Netdesk: Iron ore miners' share price losses hampered the ASX for most of Friday but a late market rally helped the S&P/ASX200 close at an all-time high of 7,538. Technology shares fared best and were up 2%. Financial shares were also among those to climb late as investors look forward to earnings next week from banks and insurers. This includes the Commonwealth Bank's full-year earnings on Wednesday. However, the latest lockdowns caused by the Delta spread could complicate matters as the Reserve Bank of Australia trimmed its economic growth forecast for the year from 4.75% to 4%.

From Share Oliver, AMP Capital: Global share markets rose over the last week with US and European shares making new highs helped by good earnings and economic data offsetting Delta concerns. For the week US shares rose 0.9%, Eurozone shares gained 2.1%, Japanese shares rose 2% and Chinese shares rose 2.3%. Bond yields rose in the US, UK and Australia and iron prices fell, down -24% from the May high. The $A was little changed. On Friday in the US, the S&P 500 added a small 0.2% but NASDAQ shed 0.4%.

On the face of it shares and bonds seem to be telling us a contradictory story with bond markets seemingly more worried about the threat to growth from Delta but shares just powering on. But there are a bunch of factors driving the divergence.

Bond markets are focussing more on the risks to short-term growth, with ongoing QE keeping bond yields down and confidence that the inflation spike will be transitory. Shares are supported by strong earnings, easy monetary policy, the valuation boost from lower bond yields and optimism that vaccines will ultimately allow global recovery to continue. While shares are at risk of a short-term correction, we ultimately see the rising trend continuing and bond yields will trend up again once it's clear that economic recovery will continue despite the short-term disruption from Delta.

***

It's tempting to assume our good investments are due to skill and poor investments are due to bad luck. Of course, it's not like that. Every investment decision is made with imperfect knowledge, and it is often luck whether the favourable elements outweigh the problems, known or unknown. As professional poker player, Annie Duke, writes in her excellent book, Thinking in Bets:

"Why are we so bad at separating luck and skill? Why are we so uncomfortable knowing that results can be beyond our control? Why do we create such a strong connection between results and the quality of the decisions preceding them?"

Nobel Laureate Daniel Kahneman goes further in his famous Thinking, Fast and Slow, saying we are delusional to think we can forecast accurately:

“It seems fair to blame professionals for believing they can succeed in an impossible task. Claims for correct intuitions in an unpredictable situation are self-delusional at best, sometimes worse. In the absence of valid cues, intuitive ‘hits’ are due either to luck or to lies ... Remember this rule: intuition cannot be trusted in the absence of stable regularities in the environment.”

Hamish Douglass supports this view in the current market. In his article on current market conditions (and why Bitcoin will become worthless), he says:

"A common question from investors is: “What’s your outlook for the next 12 months?” My honest answer these days is: “I don’t know.” That’s because the world confronts its most complex set of economic circumstances for at least 30 years. Charlie Munger, Vice Chairman of Berkshire Hathaway, said at the company’s recent annual general meeting: “If you are not a little confused by what's going on, you don't understand it."

This week, we focus on luck at a more fundamental level. Charlie's mate, Warren Buffett, puts most of his success down to the lucky circumstances of his birth, and he issues a challenge. What type of political and social system would we create if we did not know our privileged place in the world? He pushes the discussion into the types of equitable taxes we should adopt, with relevance this week to the Labor Party abandoning a range of policies it clearly believes in. Pragmatic politicians realise the only way to power is to drop your principles if they might be unpopular. No use being right and on the opposition benches.

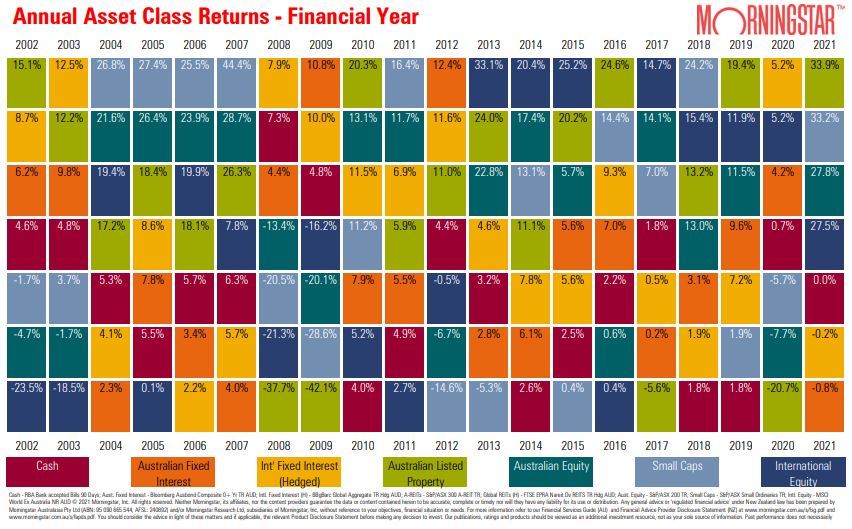

On luck, see below at how the winners and losers change every year and try predicting it. Morningstar has updated its annual gameboard and there's no pattern, but notable that the bottom place from FY20 is the top place for FY21. It shows the risk of selling your losers. It also emphasises the poor returns from cash and bonds and it's no surprise equities continue to see record inflows in the TINA trade.

A survey on retirement incomes

Our recent focus on retirement incomes has attracted strong readership with some articles receiving over 10,000 views. We add to the background with noted author Satyajit Das who looks to a future where many retirees live on tight pensions and drawing on the value of their homes.

So it's time to learn your views. It will take only a couple of minutes to complete our short survey, and we will share the results with policymakers in Treasury as well as reporting back here with the full results. Where are retirement income policies taking us?

Back in November 2020, senior portfolio managers from Neuberger Berman looked ahead to 2021 at what might happen (a summary is in the article, the full version is in our White Paper section). Recently, they undertook a mid-year review, again showing how difficult it is to make predictions, but it's good input to see how things have worked out so far.

The impact of COVID on real estate has been fascinating to watch, proving what a heterogeneous sector it is. Of course, residential property around the world has gone crazy on the back of cheap finance. I have been 'on-the-ground' recently on behalf of a family member and it really needs to be seen to be believed, what people are paying in Sydney for dumps. Even the real estate agents are shocked as buyers casually add half a million to top guidance. Steve Bennett takes a look at business conditions in industrial, retail and office segments of commercial property.

In the latest episode of our podcast 'Wealth of Experience' with Morningstar's Head of Equities Research, Peter Warnes, we discuss which companies have done especially well and badly over recent years with a focus on a favourite stock pick, Brambles. We look at the Retirement Income Covenant and I have a rant about how performance fees are measured. We also share some ideas from Nick Griffin of Munro Partners as he looks around the world at major growth themes.

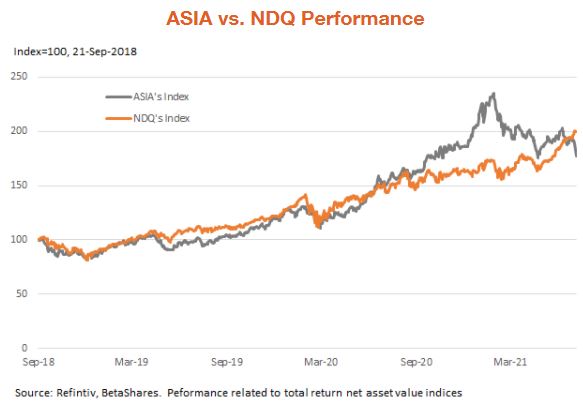

One subject both Hamish and Nick discuss is the crackdown on leading Chinese companies. Many investors may think this has little impact on them, but names like Tencent and Alibaba are both down 40-50% from their highs. These two companies alone comprise 10% of the MSCI Emerging Market index. Some leading fund managers say China is currently uninvestible due to the unpredictable actions of Chinese authorities. The Government is reminding outspoken tech billionaires who is in charge. The chart below shows how two BetaShares ETFs, NDQ based on the US NASDAQ 100 and ASIA based on Asian tech, have performed in the last year. As NDQ hits new highs, ASIA retreats.

Gold, gold ... and last

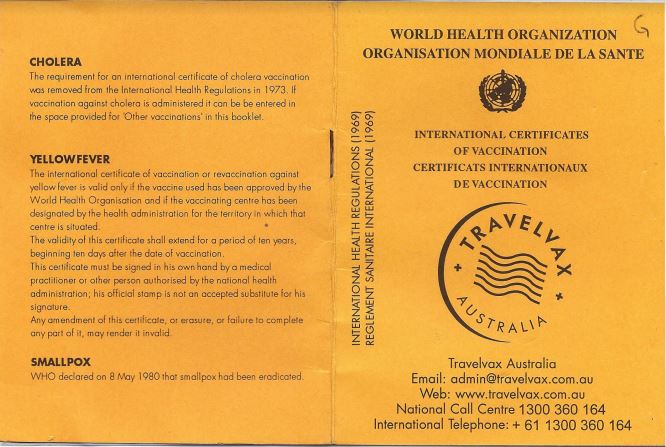

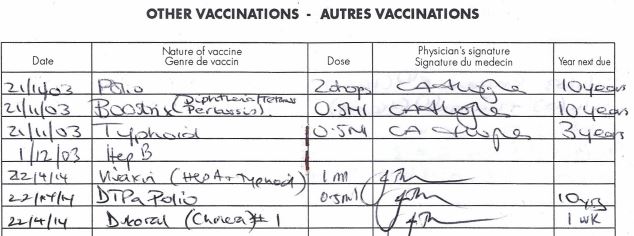

With the background of Australia's golden success at the Olympics, we have gone from world beaters at managing the spread of the virus to laggards in the vaccination process. There is enough written elsewhere without covering the issues here but a vaccination passport of some type is a no-brainer. Travelling with a vaccination certificate has always been common. Here is mine, updated when I went to Brazil for the 2014 FIFA World Cup, with jabs for polio, cholera, typhoid and yellow fever. We were told we could not come back into the country without it.

So now I can add COVID because I jumped at the chance to receive two doses of AZ. Come on folks, get those jabs, get the certificates and get on with it!

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Back on Asia-themed ETFs as Beijing cracks down, Morningstar analysts believe the market's reaction is overblown and has opened some good buying opportunities. Check out Lewis Jackson's piece on three moat stocks trading well below their fair value. And Afterpay’s acquisition by US payments giant Square could start a wave of consolidation across the buy now, pay later sector Morningstar analysts say.

Finally, our Comment of the Week selected from 42 strong contributions made on 'Retirement income promise relies on spending capital' comes from David K:

"Graham, I think this topic of the best or right terminology is actually a really important one for the average Aussie. Thanks for raising it. Most people think of income as what is taxed; i.e. they pay income tax on it. In retirement, there is no tax so we need to frame it differently. It's now spending money for them, including the pension, investment earnings and some of their capital. That's a very different perspective."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website