This week's interview with Hamish Douglass has been quoted from extensively in newspapers including as the Australian Financial Review and Sydney Morning Herald. It gives perspective to the statement to the ASX by Magellan Financial Group (ASX:MFG):

"The trading halt is being requested pending an announcement to be made by MFG. The announcement relates to the termination of a material contract."

Media reports are that the contract relates to the £10 billion ($18 billion) mandate from UK wealth management firm, St James’s Place, a long-term client of Magellan.

***

The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular articles from the week.

Weekend market update

From AAP Netdesk: The S&P/ASX200 index closed up 8 points, or 0.1%, to 7,304 points on Friday. The market had its fifth week of decline (0.7%) in the past six. In stock news and moves, National Australia Bank held its Annual General Meeting and shares were up 0.3% to $28.83. The Commonwealth had the biggest gains of the banks. It rose 2.4% to $99.12. Magellan Financial Group's shares swapped higher by 1.8% before the trading halt news. Transurban will pay $2.22 billion more for Melbourne's West Gate Tunnel project after settlement between contractors and the Victorian government. The project, originally slated to be finished in 2022, has been extended to 2025. Shares were down almost one per cent to $13.53.

Among the larger miners, BHP added 1.8% to $41.40, Fortescue gained about 1% to $18.98, Rio Tinto was even at $98.00. Oil Search will disappear from the ASX after its $21 billion merger with Santos took effect.

From Shane Oliver, AMP Capital: Global share markets mostly fell over the past week with worries about the latest coronavirus wave and central bank monetary tightening and tech stocks remaining under pressure. For the week US shares lost 1.9%, Eurozone shares fell 0.9% and Chinese shares fell 2%, but Japanese shares rose 0.4%. The soft global lead not helped by surging coronavirus cases locally saw the Australian sharemarket fall with declines in health, IT and retail stocks offsetting gains in material, utility and property stocks. Long term bond yields and the oil price fell, but metal and iron ore prices rose.

On Friday in the US, the S&P500 lost 1% while the NASDAQ was flat.

Over the last 10 years, the period from mid-December to year end has seen an average gain of 0.4% in US shares with shares up in this two-week period six years out of 10. In Australia, over the last 10 years, the average gain over the last two weeks of December has been 1.4% with shares up seven years out of 10, although it hasn’t worked over the last two years.

***

Inflation ... it seems such a dry subject and Firstlinks does not normally spend much time on a macro theme, but this is a fascinating and unique moment. The US CPI is up 6.8% in the last 12 months but the 10-year US bond is holding at around 1.5%, pushing the real yield to an unprecedented minus 5.3%. Central bankers are responding. US Fed Chair Jerome Powell and the Reserve Bank's Philip Lowe fear inflationary expectations are becoming baked into prices and wages. Powell said in 2018 of the Federal Open Market Committee (FOMC):

"The reality or expectation of a weak initial response could exacerbate the problem. I am confident that the FOMC would resolutely ‘do whatever it takes’ should inflation expectations drift materially up or down or should crisis again threaten."

'Do whatever it takes' in raising rates is a big change for a central banker who has been waiting for firm evidence before moving. For most of his first term, Powell (like Lowe) wanted to see inflation higher, which he referred to as 'achieving the goal'. He would be happy to see it settle anywhere from 2% to 3%.

Overnight, the Fed doubled the pace of bond tapering and forecast three rate hikes in 2022 and another three in 2023. The Fed noted that:

“supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation”.

Powell said the Fed Funds rate increases could start as early as March 2022 as there is a "real risk high inflation becomes entrenched".

Meanwhile, as this screenshot from the AFR this week shows, the stockmarket was not worried about the high CPI number as it pushed to a record high. It's a remarkably sanguine view.

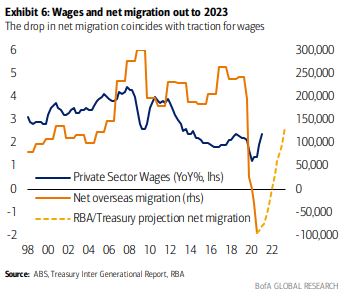

In Australia, the drop in immigration has encouraged a rise in wages, as the chart below shows. Expectations are that a return of net migrants towards the recent norm of 200,000 or more a year would have the reverse effect, and reduce the pressure on rising rates. This is why Omicron is so important for inflation, as case and hospital numbers may threaten the return of foreign labour.

So inflation, wages, the virus and house prices are all linked, and Hamish Douglass gives some important warnings in our edited transcript of his presentation to Stanford Brown clients this week. Douglass touches on some issues at Magellan that have made headlines this week, including explaining underperformance, but it is his worries about the virus and inflation, plus a black swan of a Middle East war, which are most important for investors. He shows why conditions are so dangerous and the markets are 'playing with fire':

"We're watching this party of the century occurring at the moment and I feel like the person who is failing the ID check at the door."

Meanwhile, Social Services Minister Anne Ruston announced this week that the Pension Loan Scheme would be renamed the Home Equity Access Scheme with a couple of important tweaks: from 1 January 2022, the interest rate will fall from 4.5% to 3.95%, and from 1 July 2022, lump sums of $12,000 a year for singles and $18,000 for couples can be drawn. The name change is good because the scheme is open to Australians aged 66 and over who own residential property and not only those on the age pension.

In other potential news, a friend told me on Thursday that his banker had called him late in the day to come to the office and sign loan documents on a new transaction. He was told mortgage lending rules will be changing on Monday. APRA is at least six months late cracking down on runaway prices but macroprudential tightening seems to be underway.

Perhaps it is one response to charts like this. While falling auction clearance rates might be expected to deliver some respite for the next generation of home buyers, CoreLogic shows a lift in mortgage activity:

"CoreLogic systems monitor more than 100,000 mortgage activity events every month across our four main finance industry platforms ... the Mortgage Index provides the most timely and holistic measure of mortgage market activity available."

The pandemic has accelerated many trends, particularly in tech, creating faster growth paths for some companies. Shannon McConaghy identifies three companies benefitting from such changes. But there is less focus on the other side, where the market is expecting pandemic patterns to continue, and two of these are identified as shorting (selling) opportunities. That's one of the strengths of managing a long/short portfolio.

Two articles from legends of Australian financial markets with well over 100 years in markets between them. For 40 of those years, Don Stammer has been recording the market's annual X-Factor ... the big issue of the year likely to have a major impact next year, and he also shows his full 40 year list. Lots of issues long since considered irrelevant. Then Noel Whittaker explains why financial advice is worthwhile for all retirees, as he describes some little-known rules that could be costly if ignored.

Still on great hints for later in life, Rachel Lane analyses the claim that people need the proceeds from their house sale to pay for aged care services. Owning a home has many advantages and selling it may not be the best strategy.

Fixed interest funds may seem like the poor cousins of equity funds, with less of the glamourous stock stories and elevated returns in booming markets. But as Andrew Cummins and David Hutchinson show, many investors and financial advisers still rely on a core group of fixed interest funds for their income, capital protection and diversity, and they reveal the funds that have identified what these investors need.

Then James Abela and Maroun Younes reveal the global themes they follow in managing a portfolio of mid-sized companies where the investible universe is immense. What do they look for to whittle down the almost unlimited choices?

Going back a couple of weeks, an article on green hydrogen by Michael Collins drew many comments, including an expansion of the ideas by Allan Blood. The technology becomes even more relevant when we read this week that our truck transport system depends heavily on diesel topped up with AdBlue, which uses urea, most of which comes from China. We are learning more about our dependency on fragile global supply chains, another subject that Hamish Douglass covers.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Remember meme stocks? 2021 started with a bang, as social-media-fuelled trading led to massive returns along with huge up and down price swings. But heading into 2022, much of the buzz has worn off for these stocks, writes Jakir Hossain. And, if you're anything like the staff at Morningstar, summer is a time to escape the market tumult, reflect and perhaps learn a new approach. So here's a selection of books that engrossed the team over the year - Morningstar Summer Reading List 2021/22

And I was struck by a comment by Harold Mattner on my article on the stocks I expect to own for decades despite my market pessimism:

"Thanks Graham for all your articles…thoroughly enjoyable and useful. I lost money for the first twenty years of investing, and reached a stage where I had to change, or give it up. I found investing was an extension of who I was as a person, so to change oneself before I could change my investing style was quite an insight."

This week's White Paper from Antipodes is a quick read with useful charts on the global outlook for 2022, noting the impact of the withdrawal of stimulus, the threat of inflation and a few surprises.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website