The Weekend Edition includes a market update plus Morningstar adds a link to a popular article from the week.

Weekend market update from AAP Netdesk: Australian shares closed higher amid broad-based gains on Christmas Eve as investors discounted fears about the economic impact of the Omicron coronavirus variant. The benchmark S&P/ASX200 index closed 33 points, or 0.4% higher, at 7420 points on Friday. Gains in four of the five sessions ahead of the Christmas break left the index 1.6% higher for the week.

Investor sentiment globally has improved after reports that Omicron is less likely to lead to hospitalisation compared to previous coronavirus variants, and indications that both Merck's and Pfizer's COVID-19 anti-viral pills are effective against the variant.

Every sectoral index bar one ended higher, but gains were led by the financials and materials sectors. Financial stocks were led by a 6.4% rebound in AMP shares after the wealth management giant agreed to sell AMP Capital's infrastructure debt division to US-based Ares Management for $428 million.

Each of the Big Four banks also ended firmly in the green.

The big iron ore miners closed higher but took a backseat as copper and lithium miners rose 3-4% each to remain at the forefront. Lithium explorer Pilbara Minerals climbed 5.3% to a new record of $2.96. Energy shares benefited from an overnight rally in oil prices, with Santos up 2.2% at $6.40 while Woodside also ended higher. Technology shares staged a turnaround after Thursday's decline, in line with the gains for the sector on Wall Street. Afterpay shares rose 1.5% to $86.65, while Wisetech Global recovered 1.4% to $59.50.

Consumer staples was the only sector to close in the red, as both supermarket giants Woolworths and Coles drifted lower and Blackmores dropped 1.8% to $90. Among other standout performers, telecoms giant Telstra hit a fresh 52-week high of $4.15 at the close, rising 0.7% for the day. Sonic Healthcare also hit a fresh year high of $46.63 before easing.

On Friday in the US, the S&P500 added another 0.6% and NASDAQ was up 0.8%.

***

For most investors, 2021 will deliver good performance, with the benchmark All Ords Index rising from about 7,000 at the start of the year to 7,700 at the time of writing. Given the virus, the threat of rising rates and inflation, and heady valuations of leading stocks, it's better than many expected. The best superannuation funds are likely to deliver returns of about 12%, the 10th positive year in a row. Good times for investors, indeed, and that's before we include house prices.

If 2022 is worse, that is part of the deal all equity investors must accept. Some years are losers and nobody can pick the timing. Knowing how you are likely to react in advance will determine your long-term outcome.

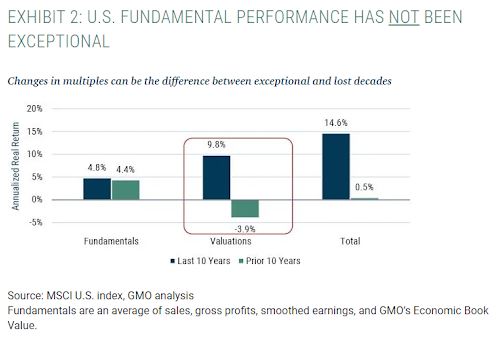

The US stockmarket has again outperformed Australia, with the S&P500 up nearly 1,000 points to 4,696, or 27%. More surprising over the last decade is that underlying performance of companies based on fundamentals (profits, sales, etc) has been flat, but the gains have come from valuation expansion, as shown below. That is, investors are paying more for the same earnings. It's all part of the unusual investing landscape that 2021 continued.

But what was weird, crazy and different about 2021 was not in traditional equities and bonds, but the new 'investments' delivering massive gains and losses unrelated to any underlying fundamentals. Some were new technologies which may become good businesses, but others will crash and burn. Charlie Munger said at the 2021 AGM of Berkshire Hathaway:

“If you are not a little confused by what's going on, you don't understand it.”

So we could not let 2021 pass without looking at the worlds of crypto, Bitcoin, memes, NFTs and finfluencers ... and new businesses devoted to BNPL, esports and gaming to see if there's more to the mania and mayhem.

I turned 64 on Wednesday, and if (like me) some of these opportunities have passed you by, you might be feeling your portfolio is a bit traditional and old style. But ask yourself this. In 10 years from now, will such a traditional portfolio be in better shape than a mix of the new ideas? I know which side I'm on.

In the second part of the interview with Hamish Douglass, he too admits, "It doesn't seem like we're in a normal world."

But there's a more serious side. He explains the conditions needed to cause a recession, the likelihood that some assets will become worthless, and the impact of inflation on most portfolios. Little wonder he invests cautiously.

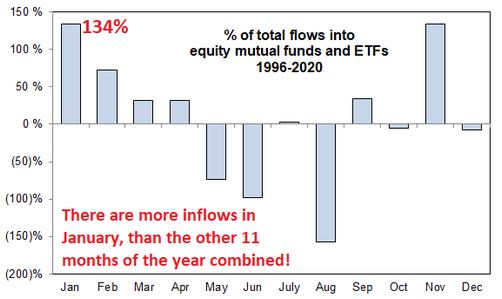

There's always another side, with Goldman Sachs putting out a report this week arguing the negative sentiments may reverse in January, for two simple reasons: the flows into equities remain strong and January is the month of 134% of annual inflows versus -34% the rest of the year since 1996.

In our final edition for 2021, our usual mix of investing insights and policy opportunities ...

Beatrice Yeo warns that making predictions is fraught, especially timing the turning points when it looks like markets are expensive. The common advice to hold a diversified global portfolio might sound traditional but it holds as true now as ever.

If there is one part of portfolio management that investors need to be wary of, it is holding money in long-dated fixed rate bonds as interest rates rise. Elsa Ouattara finds fixed income investments that minimise this risk, including bank hybrids and some OTC bonds available to sophisticated investors.

Many people who assume they are not eligible for the Commonwealth Seniors Health Card might be in for a pleasant surprise, as Jon Kalkman explains how it works. Please note we have edited this article from the first version published to clarify the calculation method.

Real Estate Investment Trusts (REITs) have characteristics of equities and bonds, but underlying sectors will be affected by inflation in different ways. Matthew Doherty and Robert Almeida suggest the subsectors with the most potential.

Andrew Mitchell and Steven Ng look at the impact of rising interest rates, inflation and Omicron on some leading companies in their portfolio, such as NextDC, EBOS, Elders, Pinterest, Robinhood and DocuSign. They analyse whether the small cap pullback in prices is justified.

In the Weekend Update, members of the Morningstar team selected their favourite examples of 10 charts to farewell 2021. A quick summary of the year assembled by Lewis Jackson.

This week's White Paper is Vanguard's 2022 Economic and Market Outlook, where they believe macroeconomic policy will be more crucial for returns than the pandemic.

Thanks to all our readers for your support and comments during 2021, when our Monthly Active Users exceeded 100,000 with well over two million pageviews for the year. Look for our 'Best of 2021 Edition' and let's hope Omicron does not spoil too many end-of-year events.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Funds Report from Chi-X

Plus updates and announcements on the Sponsor Noticeboard on our website