The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

‘Entertaining’ isn’t a word normally associated with speeches from economists, so Westpac Group Chief Economist, Luci Ellis’ keynote talk at last week’s Morningstar investor conference in Sydney came as a surprise. And it was informative to boot.

Ellis is a former Assistant Governor at the RBA and known not only for her knowledge of the central bank but also the intricacies of the domestic economy.

In the speech, she first delved into the potential impact of the trade wars and she didn’t hold back. Ellis described the tariffs episode as a “self-destructive act” by the United States. She thought some commonsense would prevail and tariffs for most countries would end up between 10% and 20%, with China, Mexico, and Canada being somewhat higher.

She said the tariffs would result in a major economic shock for the US, though it shouldn’t end with a recession, either in America or globally:

“We will see trade patterns shift but what we won’t see is a huge amount of production relocating back into the US. They’re not going to start making the bicycles and T-shirts in the US again.”

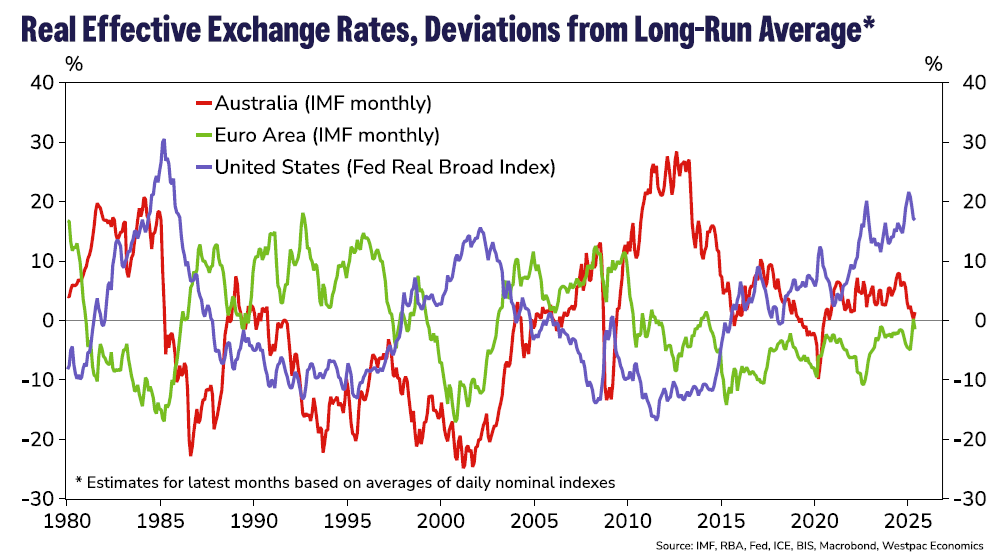

Part of the reason for this was that the US dollar remained 15% overvalued, making America “quite uncompetitive”, according to Ellis. She described the dollar as more overvalued than at any time since the Plaza Accord in 1985.

How did she come to this conclusion? She highlighted this chart measuring real effective exchange rates:

USD is overvalued, will unwind over time

Ellis also supported her case by asking the audience of financial advisers if anyone had visited the US recently as she had – and cited how expensive things like restaurants were there, even without the tips. She said that’s currency overvaluation at work.

By contrast, she then asked the crowd if they had been to Japan of late. A lot more people raised their hands than for the US. Ellis said most of the audience wouldn’t have been able to afford a holiday in Japan 20 years ago. And the change in exchange rates was behind this.

The US dollar overvaluation and senseless tariff wars were two big reasons why investors were starting to invest more outside of the US, Ellis believed:

“… they’re not getting out [of the US] entirely, but everyone just wants to be a bit less long.”

She cited two triggers for the unravelling of the ‘US exceptionalism’ narrative. First, the Oval Office meeting with the Ukrainian leader, which made investors realise that America could no longer be counted on as a reliable ally and trade partner. Second, Germany changing its constitution to allow more defence spending. Investors were looking into the opportunities presented by more spending in Europe.

Ellis said there were other challenges to US exceptionalism. While tariffs would provide an inflationary impulse to America, the rest of the world would continue to experience a deflationary shock from China due to its weak domestic demand and inflation.

Implications for Australia

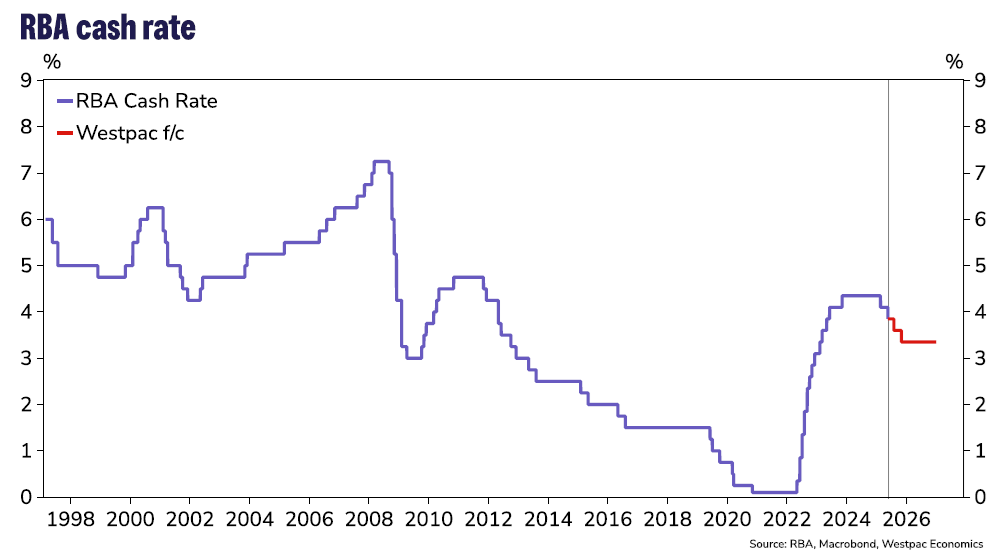

Ellis said the RBA had been a reluctant rate cutter but the global risk shift combined with slowing inflation and wages led it to reduce interest rates in May. And we’re likely to get two more rate cuts this year.

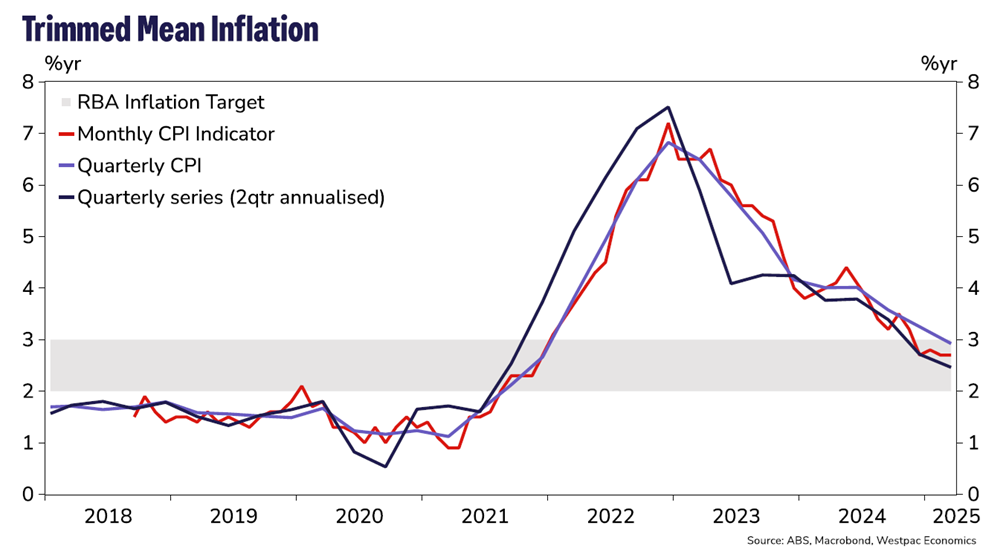

All data on inflation indicate it’s headed lower.

Near-term inflation momentum is constructive

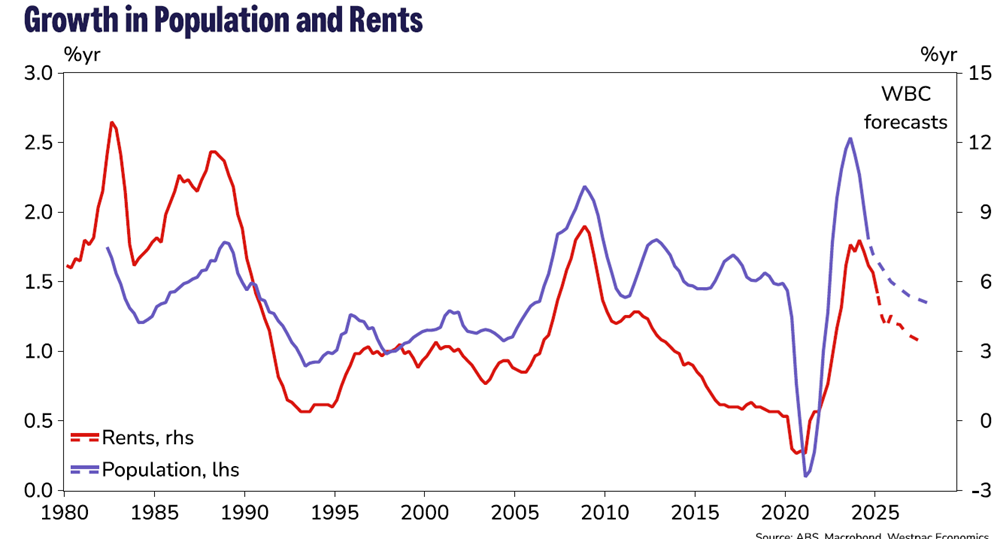

Rental inflation is part of the picture. It’s fallen faster than Ellis expected as population growth normalised.

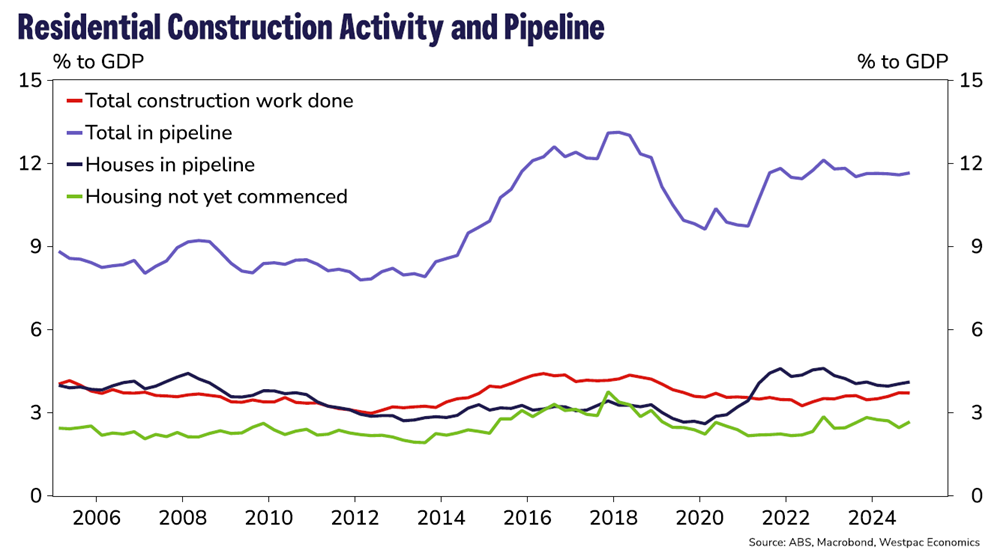

Ellis said the housing market was caught in a tug of war between slowing population growth and cuts to rates. It’s expected to result in moderate house price increases.

The other issue is housing supply. Ellis suggested there’s a severe backlog in construction, with homes being approved but not being built due to high costs. A gradual increase in supply is going to be another part of the tug of war that will keep a lid on house prices.

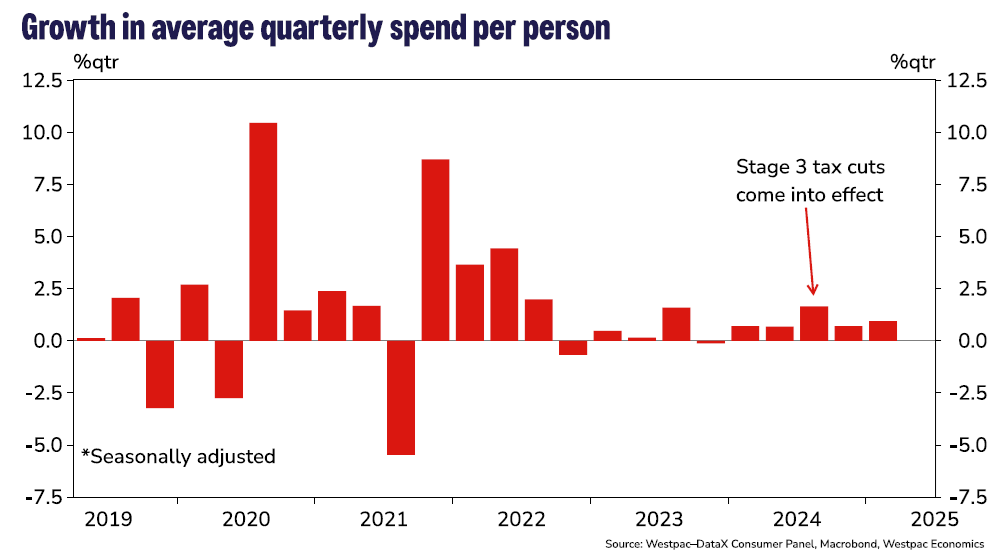

Ellis said the economy was being held back by subdued household spending. She cited proprietary Westpac data on all of its individual customers (as a Westpac customer, this had me a little concerned) that showed people only spent 20% of the recent tax cuts.

Modest spending response to Stage 3 tax cuts

Consumer sentiment remains subdued despite a recent uptick in wages growth. And that’s despite most having a secure job, with the country’s unemployment rate remaining low.

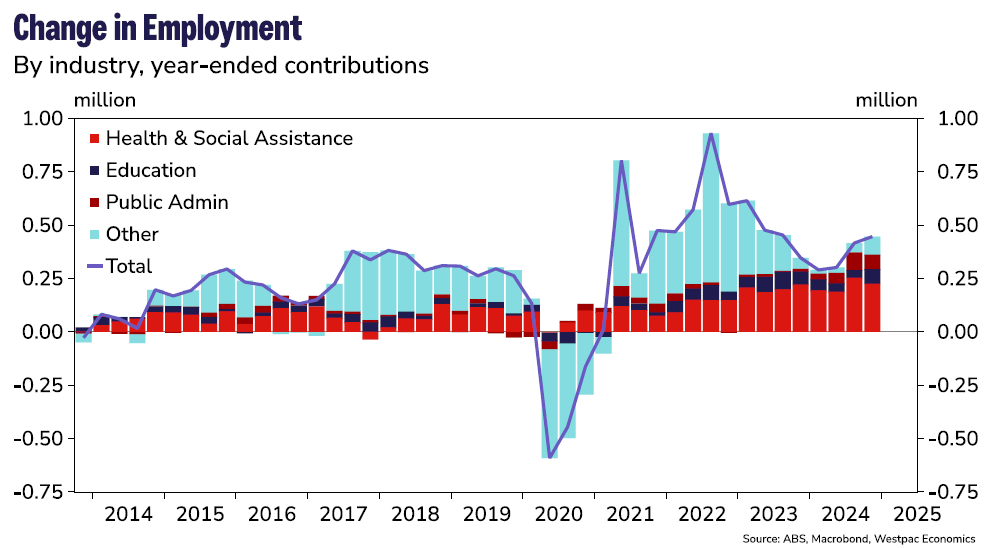

Ellis said that’s deceptive though. In 2023-2024, 80% of jobs growth came from the ‘care economy’, which constituted only 28% of total employment.

Ramp-up in ‘care economy’ has dominated employment growth

What happens in 2026?

Ellis said the outlook for Australia hinged on how the global trade disputes panned out. She doesn’t expect a global recession. For Australia, the election result implied no big changes to the outlook for government spending, and she thought consumer spending would remain weak.

Does the RBA end up providing extra support via more rate cuts? That’s not Ellis’ base case, though most of the risks were on that side.

One bonus chart

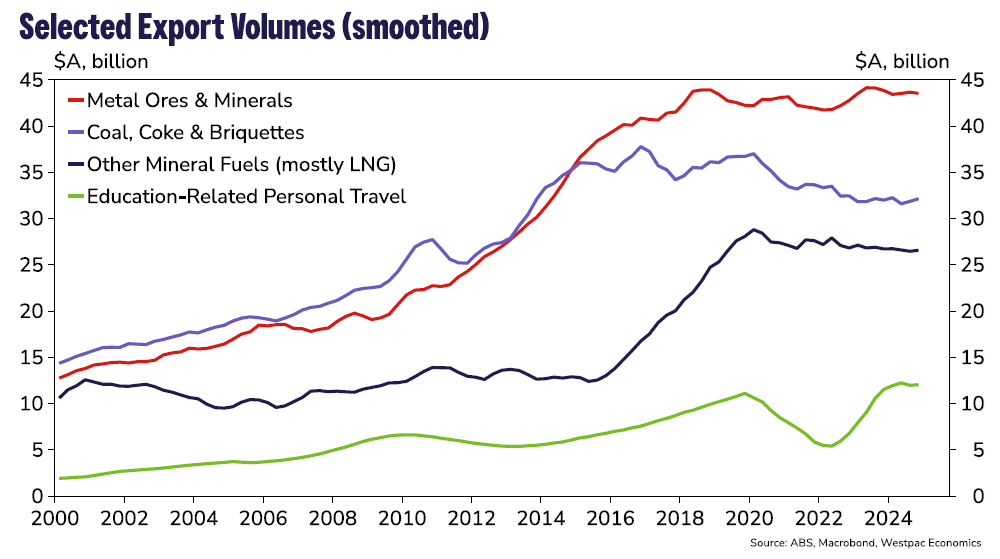

This chart from Ellis on Australian exports was fascinating:

Key Australian export volumes are ‘capped’

It showed that the largest sectors for exports – iron ore, coal, LNG, and university education – were flatlining.

They all had a huge ramp-up in the first couple of decades of this century, and they’re now “capped out”, in Ellis’ words.

On iron ore, Ellis said China had reached peak steel, though it would remain steel intensive. While that means iron volumes and prices won’t increase much, they won’t tank either.

Was Ellis worried about the big four exports being capped out? Not especially. She thought growth would come from elsewhere. For instance, we have a growing export industry called software licensing, worth about $7.5 billion. Think Canva, WiseTech, and Atlassian. We now export more in software licensing than we do in copper, aluminum, barley, or rice.

I’m not so convinced on Ellis' optimistic take on the issue given software remains small fry compared to the likes or iron ore and coal.

One bonus thought

Ellis was asked about our productivity issues. Given all the moaning from business leaders for the Government to do something about it, Ellis’ answer was refreshing:

“I want to make it clear that Australia is the only country that thinks that productivity is something the Government does to you, and it's somehow the Government's responsibility to fix our productivity problem.”

She said aside from the US, the whole world has had a productivity issue. And America may be a statistical anomaly as some of its labor force wasn’t documented, thereby impacting the data.

Ellis thought it’s our responsibility to fix the productivity problem, not the Government’s. We need to ask ourselves how we can be more productive. How can we change business processes? What can we invest in? What technology should we adopt?

To that I say: hear-hear.

James Gruber

Also in this week's edition...

The $3 million super tax debate has heated up since the election led by vocal lobbyists against the tax. Harry Chemay, a long-time consultant and adviser across wealth management, super and SMSFs, jumps into this discussion with a contrarian view - that the tax represents a reasonable step to making a fairer super and retirement system. In a detailed note, he explains why.

Staying on the super tax, Clime's John Abernethy says the inequities in the super system date back to poor policy decisions made by Parliament in 2005-2006. He goes through the history and how it's connected to the debacle now emerging with the defined benefits scheme for public servants. It's a must-read for those who want to understand how our super system got to this messy point.

We need to have an honest conversation about migration and housing, Cameron Kusher believes. He says our Government is running world-leading rates of population growth while underinvesting in housing and infrastructure. He outlines what needs to change.

Who doesn't love to buy a stock on the cheap? Almost always within sectors, there are companies that appear inexpensive versus others, and are perhaps due to play catch-up. Yet Rudi Filapek-Vandyck has gone through the recent history of the ASX and suggests that buying the 'cheap' stocks hasn't paid off, on average. Instead, purchasing the pricier market leaders has been the better strategy.

What's the outlook for dividends on the ASX? Plato's Peter Gardner runs through the different sectors to identify the opportunities and risks for dividends from our large cap companies.

With bonds looking shaky and stocks offering less in the way of dividends than they use to, where do investors go for income? One potential source is corporate bonds. Jenna Hayes gives an overview of the asset class, how retail investors can access it, and specific opportunities that offer high yield.

Two extra articles from Morningstar this weekend. Brian Colello reflects on an impressive set of results from Nvidia, while Roy Van Keulen weighs up a transformative acquisition by WiseTech.

Is the US still a model for democracy? John West thinks not, and it's not just a Trump issue. As a long-time Asia hand, West compares the US to the Asia Pacific region, where democracy is becoming more entrenched and, barring China, the future for democracy and freedom appears brighter.

Finally in this week's whitepaper, Vanguard offers its views on the outlook for economies, markets, and asset classes.

****

Weekend market update

In the US on Friday, the bulls demonstrated their dip-buying prowess once more on the final trading day of the month, with the S&P 500 promptly erasing a near 1% mid-day downdraft to log a flat finish and wrap up May with a heady 6.3% advance, its best such showing since 1990. Treasurys saw some modest bull steepening with two-year yields dropping three basis points to 3.89% and the long bond holding steady at 4.92%, while WTI crude stayed put at US$61 a barrel and gold ebbed to US$3,291 per ounce. Bitcoin remained under pressure at US$104,400 while the VIX ticked below 19.

From AAP:

Australia's share market climbed higher for a second month in a row and is within striking distance of its all-time peak. The S&P/ASX200 overcame an early dip to rise 0.30% on Friday to 8,434.7. The broader All Ordinaries gained 0.26%, to 8,660.3. The top 200 lifted 3.5% in May to within 1.5% of its best ever close and, despite some choppy sessions, only posted six red days all month.

Seven of 11 local sectors made gains on Friday, with financials and materials pushing the bourse higher and as investors took profits on IT stocks, May's best performing sector with gains of more than 20%.

Financial stocks pushed 0.7% higher on Friday as CBA notched its highest monthly close of $175.95 after rallying almost 6% in May.

Gold miners helped lift the materials sector, which rose 0.3% on Friday and less than 2% for the month, as weak iron ore prices continued to weigh on large cap miners.

Energy stocks under performed the broader market, shedding 1.4% on Friday as oil prices slipped on the reinstatement of US tariffs. The sector is up more than 8% for the month as it continued to recover from a tariff-fuelled sell-off, but it's more than a third below its highest value this decade.

From Shane Oliver:

Global shares mostly rose over the last week as Trump backed down again on tariffs on Europe, the US Trade Court found most of Trump’s tariffs illegal although the decision has been stayed pending an appeal and Nvidia reported a 56%yoy rise in March quarter earnings serving to highlight continued strong US profit growth. This saw US shares rise 1.9% for the week, Eurozone shares gain 0.9% and Japanese shares rise 2.2%, but Chinese shares fell 1.1%. The positive US lead also boosted Australian shares despite soft local economic data with the Australian share market up 0.9% for the week with gains led by IT, energy, health and financial shares. The weekly gains also wrapped up a solid month with US shares up 6.2% in May, global shares up 5.7% and Australian shares up 3.8% as Trump backed down on tariffs. Bond yields eased in the past week after the previous week’s worries about public debt. Oil, metal and iron ore prices fell with gold and Bitcoin also down on reduced safe haven demand. The Australian dollar fell as the $US rose slightly helped by the slightly better news on tariffs.

Good short-term news on US tariffs. Trump’s tariffs are becoming a never ending story with new dramas each week. Fortunately, apart from Trump announcing that he would raise the tariff on steel to 50%, the news in the last week has been good.

For Australia, while the US tariffs remain in place for now there is some chance that the 10% general tariff on our exports won’t remain. While the tariffs on steel and aluminium and likely on pharmaceuticals are less likely to be struck down by US courts, if Trump’s appeal against the Trade Court decision fails, he may struggle to successfully re-apply the 10% tariff on Australian goods as it will be hard for him to establish a threat to national security or unfair trade practices in order to keep that tariff.

While the rebound in share markets has continued and has been supported by good breadth and signs that economic conditions so far are holding up reasonably well, Trump policies pose an ongoing macroeconomic risk for shares.

- The mayhem around the tariffs is causing immense uncertainty which will particularly impact business investment which likely still means weaker economic conditions ahead.

- The Trump Administration’s attacks on US universities and research threatens a key source of America’s ongoing technological advantage.

- Its attacks on the US court system and rule of law threaten investor and business confidence.

- A section in the One Big Beautiful Bill Act (OBBBA, Section 899) will potentially impose taxes on foreign investors in the US if their home country is deemed to discriminate against the US with taxes, which will threaten foreign investment in the US.

- The OBBBA tax bill will worsen the US public debt outlook and without tariff revenue will look even worse.

All of which is driving a loss of faith in the US as a safe haven and in US exceptionalism and could see global investors demand a higher risk premium to invest in US shares, bonds and the $US. I suspect its likely to be a slow burn and US tech and particularly AI dominance will serve as a powerful offset for some time to come. But it means ongoing bouts of high uncertainty and volatility.

The bottom line is that shares have had a good rebound – with the ASX 200 just 1.4% below its record high - and may even break to record highs in the near term, but the macroeconomic risk flowing from Trump’s policies remains high so the ride is likely to remain volatile. Ultimately, we continue to see Trump pivoting from the focus on tariffs to tax cuts and deregulation which along with rate cuts from the Fed in the third quarter and other central banks should help shares stage a more sustainable recovery.

Australian inflation for April was not weak enough on its own to speed up rate cuts, but soft economic data in the past week means that the July RBA meeting still remains “live” for a rate cut. While inflation was a tick higher than expected this looks partly seasonal, both the CPI at 2.4%yoy and trimmed mean at 2.8%yoy are still in the target range and services inflation looks likely to slow further as some items like education are indexed to past inflation which has fallen.

Curated by James Gruber, Joseph Taylor, and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website