The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The first half of the year is over and how have markets fared?

The All Ordinaries Index returned 4.2% for the half and 9.5% for the financial year. That’s pretty solid given the numbers exclude dividends and compare to total returns of close to 10% per annum over the past century.

However, Aussie stocks again lagged the US. The S&P 500 returned 5.5% for the half, and 13.6% for the fiscal year.

Standout stock markets year-to-date included the DAX which benefited from Germany turning on the debt tap to fund massive spending on defence and infrastructure. Also, Hong Kong did well, due to signs of an economic rebound in China, a revival in the IPO market, and AI sparking renewed interest in Chinese tech stocks.

Meanwhile, bonds underperformed, continuing a wretched run of losses.

In commodities, gold, copper, and Bitcoin were all significantly higher in the 6 and 12 months to June. They partly benefited from the US dollar having its worst start to the year since 1973.

Iron ore and oil were the laggards among the commodities. Iron ore suffered from subdued Chinese demand, while oil picked up as the Middle East conflict started, though it quickly retreated when the battle ended.

The Aussie dollar did well as other countries cut interest rates earlier and at a faster pace.

The ASX higher on CBA, Telstra

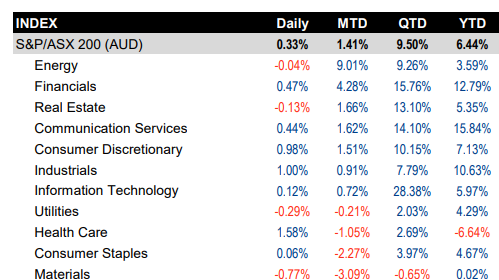

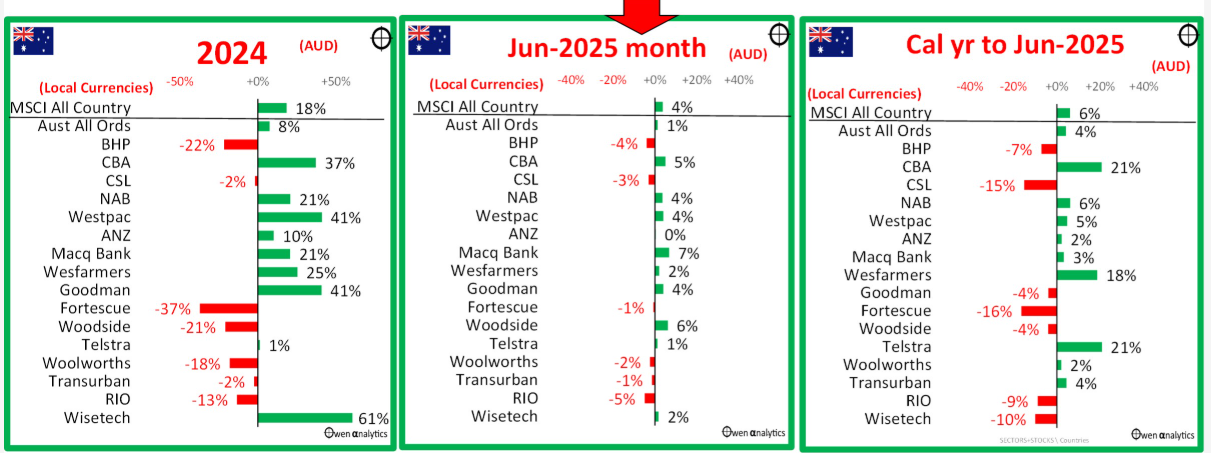

Now onto the performance of ASX stocks. By sector, financials, communication services and industrials led the way in the first half. Healthcare was the only sector in the red, largely thanks to the 15% drop in CSL’s share price. Materials were the other major sector to drag on the index, with falling iron ore and oil prices weighing on heavyweights, BHP, RIO and Woodside.

Source: S&P Global

Tech performed best on the ASX during the June quarter. This may be a sign that institutional investors aren’t finding value in banks, and with mining stocks going nowhere, they’re now switching to other sectors, including tech.

Looking at the performance of large cap stocks, CBA was the big winner, up 21% year-to-date. The rise and rise of CBA has perplexed investors, though it seems to have benefited from US market outflows, passive money, and few sellers as long-term holders don’t want a large tax bill from selling the stock. At 31x price-to-earnings (PE), CBA trades like a tech stock yet doesn’t have much earnings growth to justify the hefty price tag.

Telstra was the other notable large-cap performer, as first half earnings beat expectations.

Digging deeper, growth and momentum factors continued to dominate on the ASX in the first half, up 9% and 7% respectively. Yet, low volatility stocks were the other significant outperformer, rising 9%. That seems to suggest that investors are searching for growth in technology and industrials but also looking for defensive exposure in the likes of CBA and Telstra.

US: the comeback king

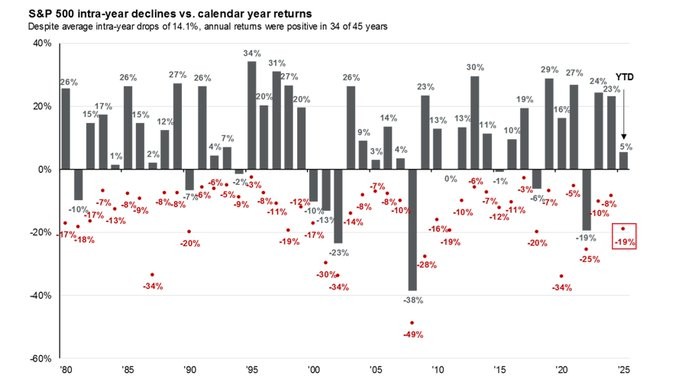

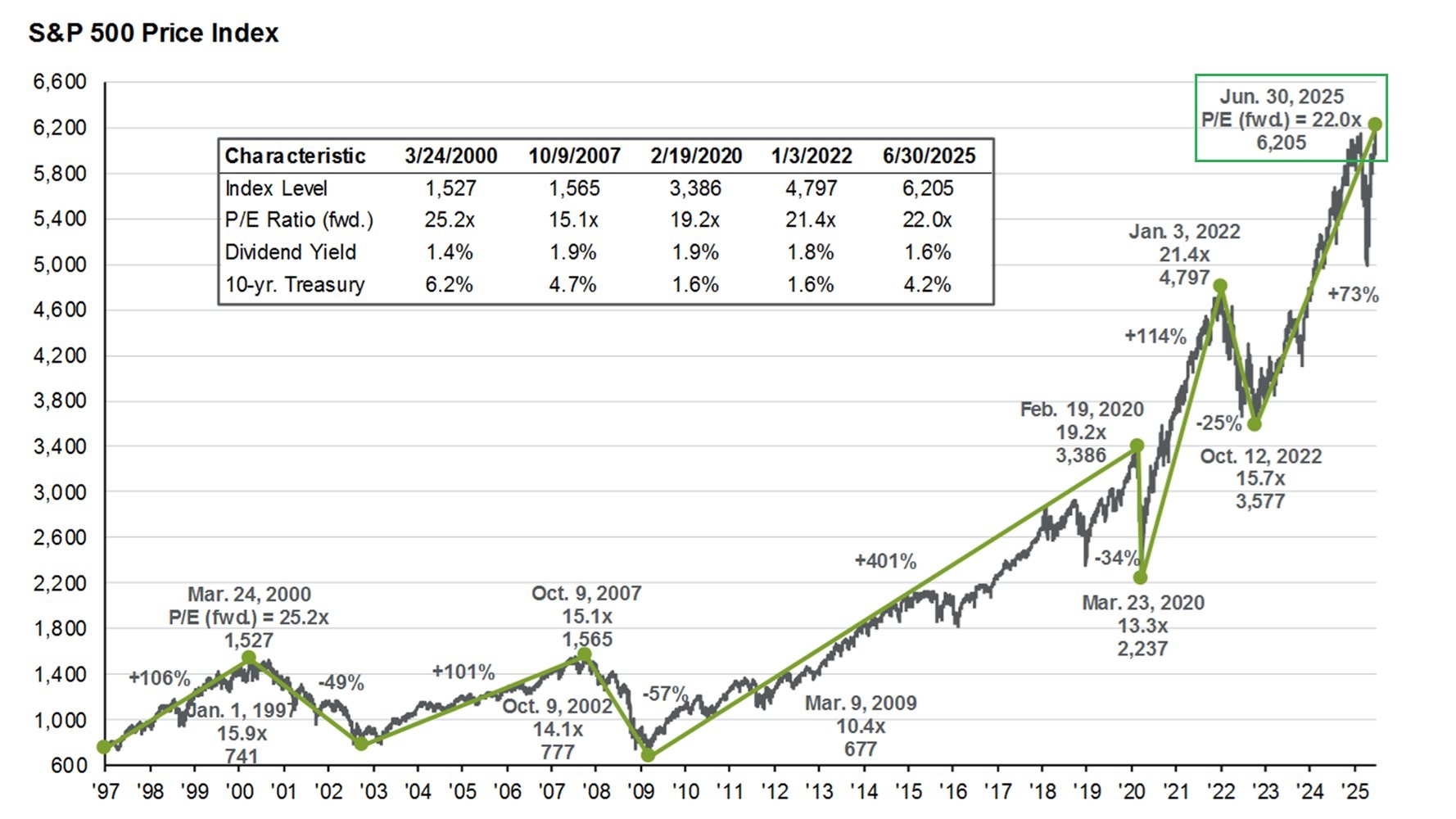

The S&P 500 closed out the first half at an all-time high — its 5th of the year. A few months ago, that would've seemed impossible.

On April 8, the S&P 500 was down 15% in 2025, the 4th worst start to a year in history. Yet, it managed to finish the first half up 5.5%.

Source: JP Morgan

The Magnificent Seven tech stocks have been big drivers of US performance in recent years, though that was less the case in the first half. They were up 9% in the June half. Performance among the seven were more dispersed with three of them – Apple, Alphabet and Tesla – falling 18%, 7%, and 21%, respectively.

Interestingly, the Magnificent Seven now have a combined market capitalisation of A$27.3 trillion versus Australia’s All Ordinaries Index’s A$3.2 trillion.

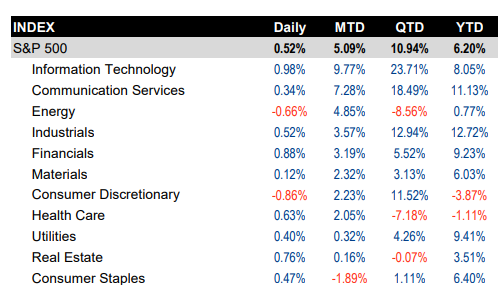

Looking at the market’s performance by sector, tech roared back in the second quarter of the year. Other outperformers were industrials, financials, and utilities. Meanwhile, underperforming sectors included consumer discretionary, healthcare, and energy.

Source: S&P Global

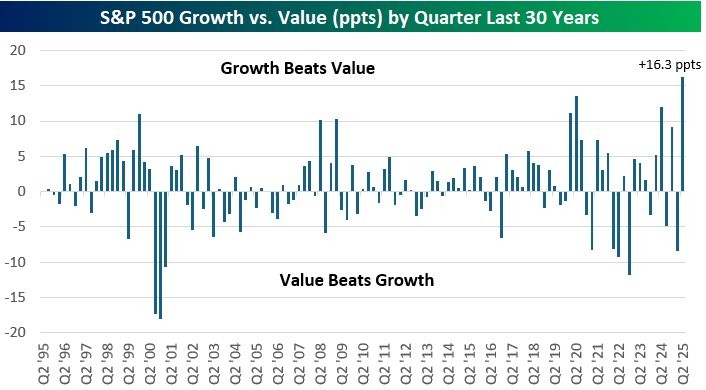

Like in Australia, growth stocks hammered value stocks. The second quarter saw the widest outperformance for S&P 500 Growth Index versus Value Index in the history of the two indices dating back to mid-1990s – the S&P 500 Growth index rallied 18.8% in Q2 versus a gain of 2.5% for S&P 500 Value Index.

Source: Bespoke Investment

The best performing stocks on the S&P 500 in the first half included Palantir, Newmont, Netflix, and Micron Technology.

Source: Charlie Bilello

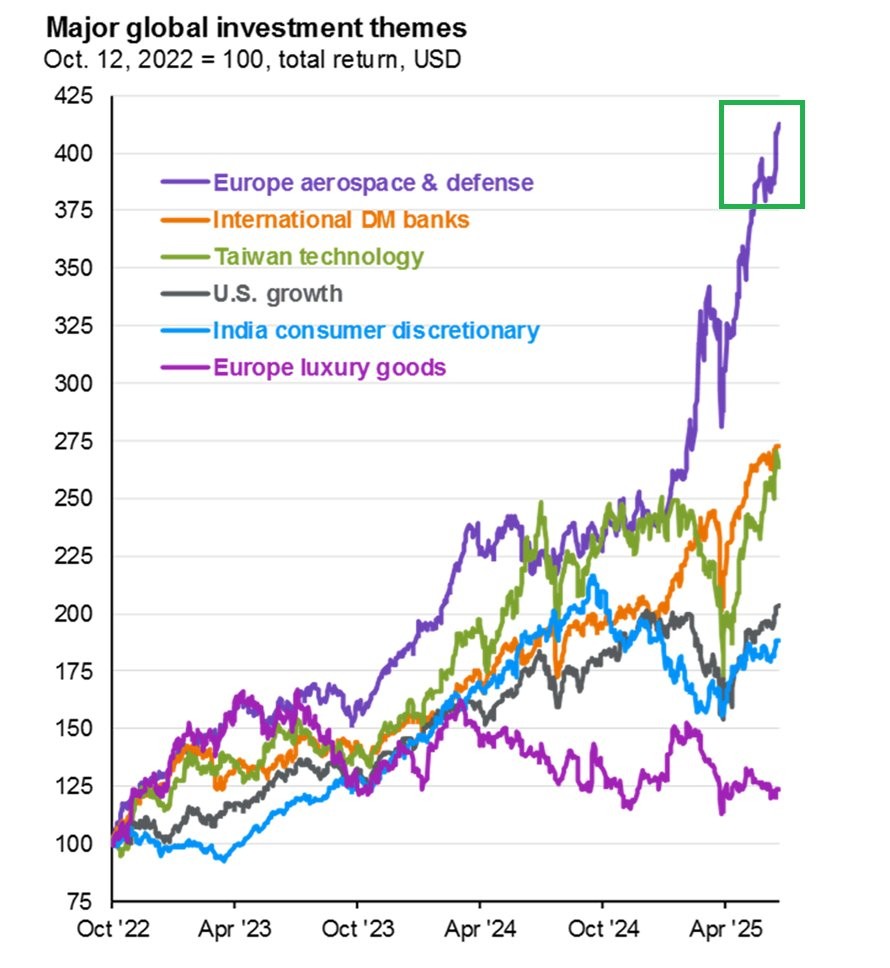

Money moving out of US stocks into other markets

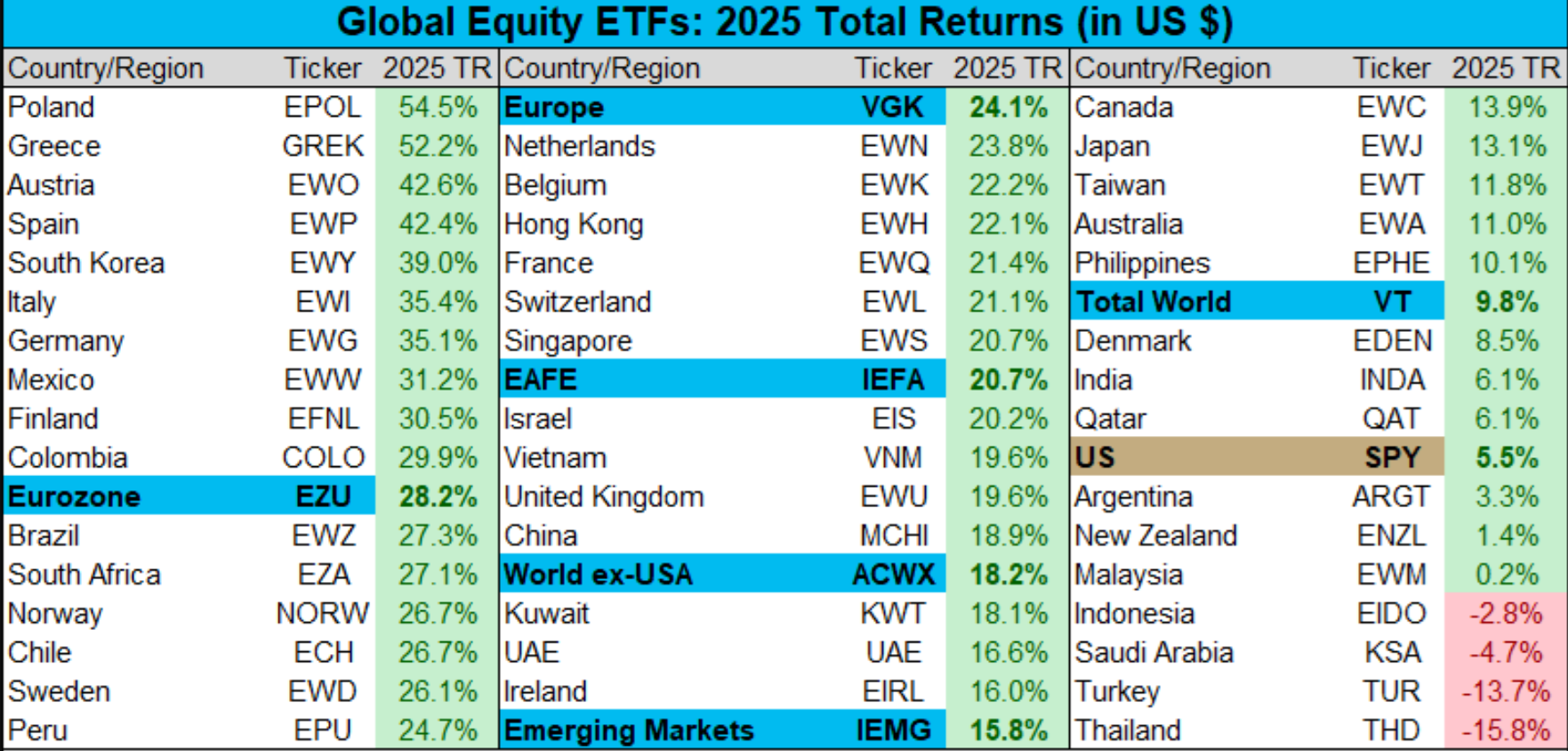

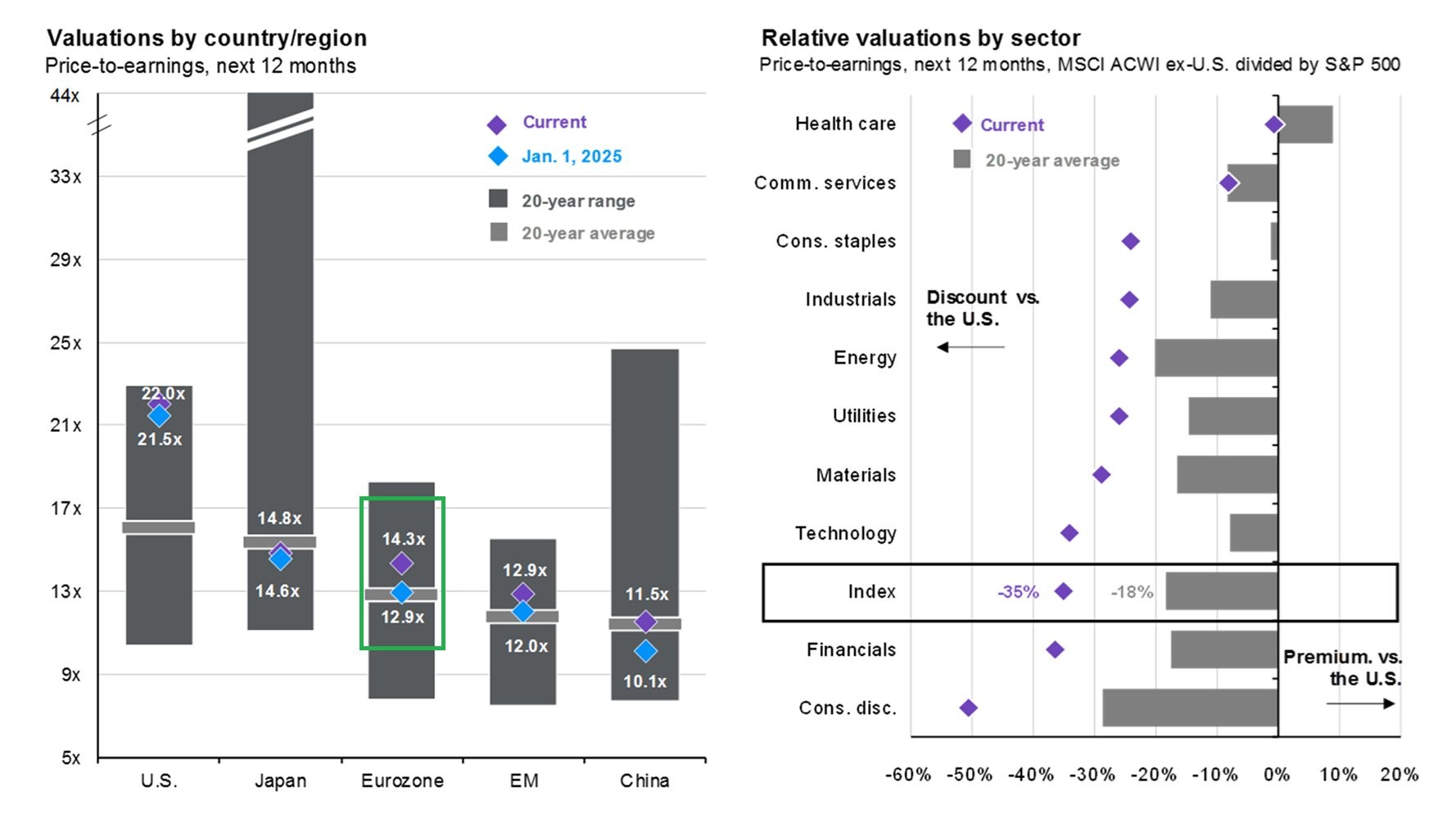

After US stock dominance over the past decade, 2025 saw the first signs of money flowing out of America into other markets. While the S&P 500 was up 5.5% in the first half, the world ex-US rose 18%, with Europe leading the way.

The four best performing markets in US dollar terms were European – Poland +55%, Greece +53%, Austria +43%, and Spain +42%.

Trump’s ‘big beautiful bill’ and tariffs eroded confidence in US assets and the US dollar, resulting in money flowing into Europe and emerging markets. Europe’s commitment to significantly increase spending on defence and infrastructure also helped its cause.

Source: JP Morgan

Where to over the next 6-12 months?

There’s no shortage of macroeconomic risks that could impact markets. First, the three month deferral on Trump’s tariffs expires over the next two weeks. There are also geopolitical risks, especially if Iran retaliates against recent US strikes. And Trump’s ‘big beautiful bill’ should soon become policy, adding around $3 trillion to the US budget deficit, and risking further concerns about America’s gargantuan debt load.

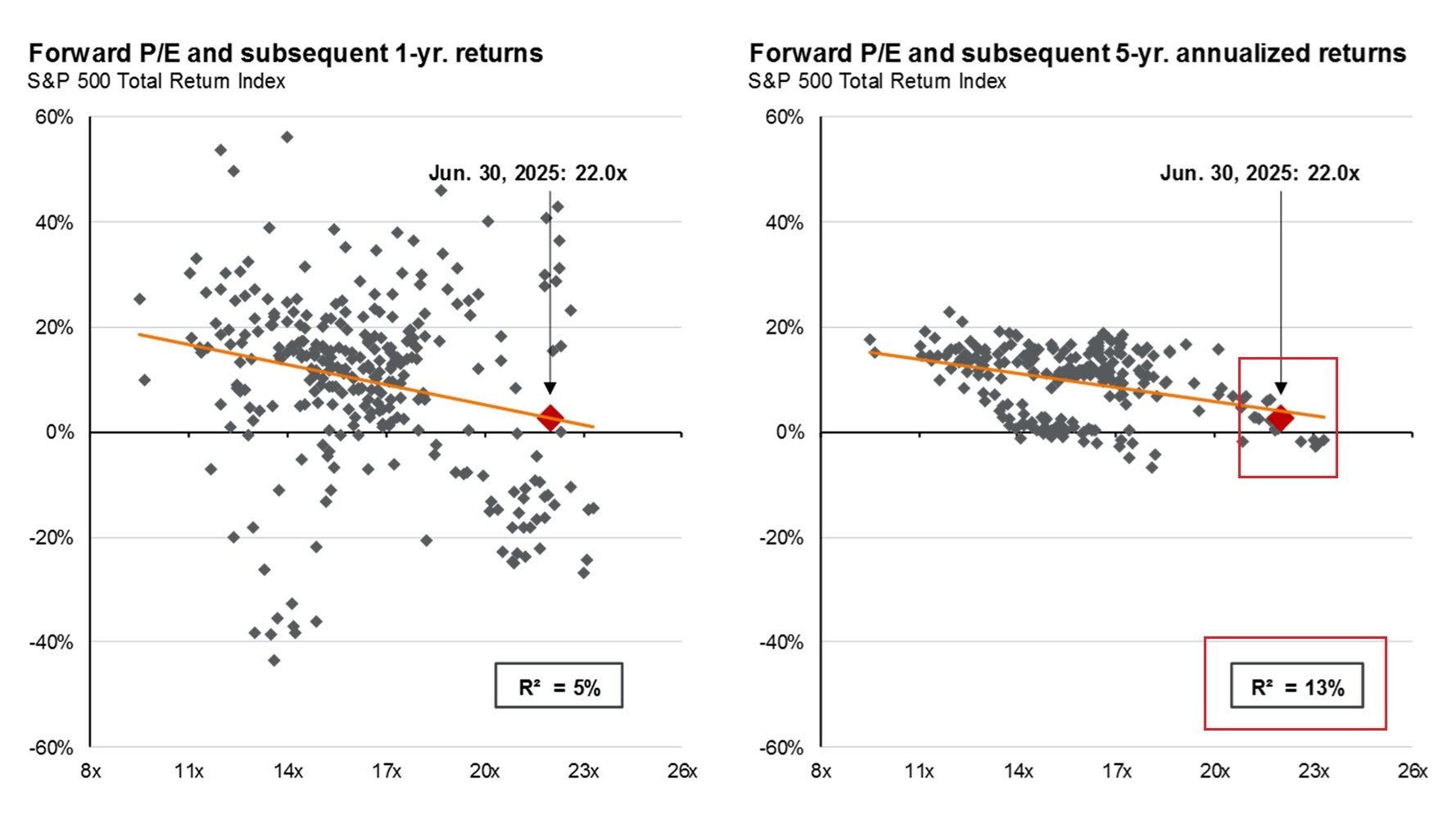

More fundamentally, valuations in most markets, including the US and Australia, look far from cheap. The US sports a forward P/E ratio of 22x, well above the historical average of 17x. At these levels, it doesn’t bode well for future returns.

Source: JP Morgan

Source: JP Morgan

Australia is expensive at current levels too, with a forward PE of 19x compared to a historical average 15x. And unlike America, earnings growth is modest here.

On the flip side, interest rate cuts could boost markets in the second half of the year. And while valuations are steep, earnings, especially in the US, are in decent shape.

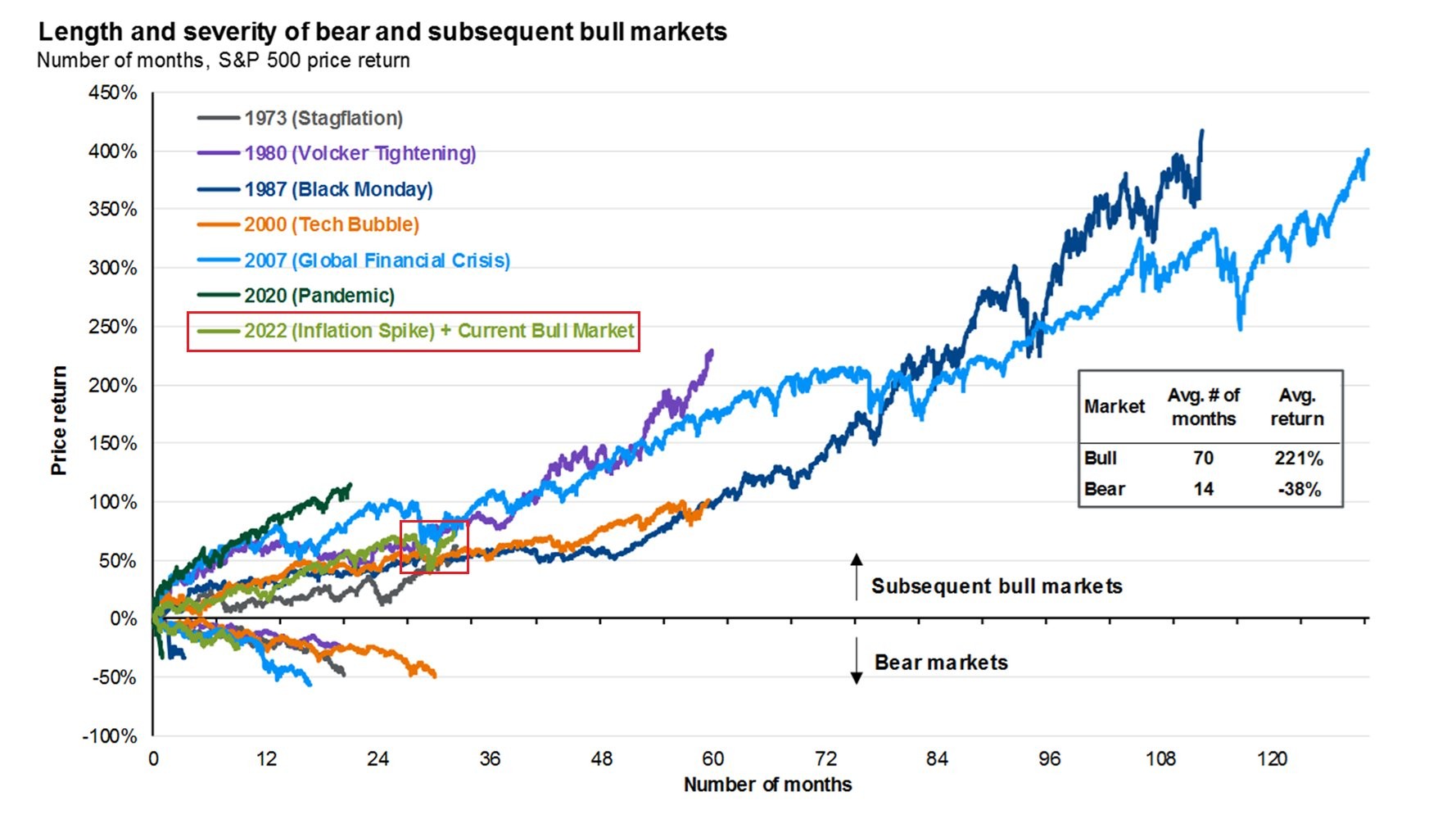

While there are signs of froth in sections of markets (cryptocurrency, AI, private credit), it isn’t broad-based and pervasive enough to think a large pullback is imminent. There’s also an argument that the current bull market may be in its early days.

Source: JP Morgan

One tentative prediction: the US share of the MSCI World Index may have peaked in December last year, and there’s a good chance that money will continue to move out of American markets to the rest of the world. There’s also the possibility that the rally in ex-US stocks could broaden to cheaper markets such as Japan and China.

As for Australia, the economic picture is pedestrian and so is the earnings outlook for companies. One thing to keep an eye on is the potential for a switch out of banks into the miners. Interest rate cuts are negative for bank earnings and one wonders if that switch may happen soon. Given the exorbitant valuations of the banks, especially CBA, it could be a sector rotation for the ages.

----

In my article this week, everyone has heard of Treasury's estimates of 80,000 people with super balances of more than $3 million dollars, yet little more is known of these people. An ANU study has unearthed new data on the income and wealth of these individuals and their capacity to absorb the super tax, including the tax of unrealised capital gains.

Meanwhile, Tony Dillon thinks the Division 296 tax is a mess. He says it penalises time and compounding, and is complex and unpredictable at a time when retirees need clarity and certainty of cashflow. Tony makes the case for an alternative, progressive tax model that aligns with income, encourages saving, and avoids harsh retirement penalties.

James Gruber

Also in this week's edition...

SMSFs have managed to match, or even outperform, larger super funds despite adopting more conservative investment strategies. Tim Toohey of Yarra Capital Management does a deep dive into the key drivers behind their strong performance - and the potential policy implications.

There are lot of different opinions on Australia's housing issues though it's not often that we get to hear from one of the largest property developers and what they're seeing in the market. In an interview with First Sentier, Stockland's development chief, Andrew Whitson, discusses supply constraints, government initiatives and green shoots in Australia's most troubled property market.

As the US debt ceiling looms again, the usual warnings about a potential crash in bond and equity markets have started to appear. VanEck's Anna Wu says investors can take confidence from history but should keep an eye on two main indicators.

US mega-cap tech stocks have dominated recent returns - but is familiarity distorting judgement? Werner du Preez of Orbis says investing success often comes from switching when it feels hardest to do so.

How would you have performed if you'd systemically bought a basket of the market's biggest losers? Jeffrey Ptak says you'd have done pretty well. He says that for the enterprising few with a healthy constitution and willingness to go their own way, opportunity beckons.

Two extra stories from Morningstar this week. Johannes Faul gives an update on Domino’s after a volatile week, and Joseph Taylor asks if Sigma Healthcare deserves a market cap similar to Woolies.

Lastly, in this week's whitepaper, ETFs that track the MSCI World ex Australia Quality Index are a popular investment for those seeking exposure to global companies with robust financials and stable earnings. Yet, Pinnacle's Anthony Doyle says the index has some significant weaknesses and he offers alternative ways to get quality stock exposure.

****

From AAP:

The local share market on Friday finished above 8,600 for the first time ever after a stronger-than-expected US jobs report reaffirmed the strength of the world's largest economy.

The benchmark S&P/ASX200 index edged 7.2 points higher to close at 8,603.0 on Friday, a gain of 0.08%.

The broader All Ordinaries rose 8.3 points, or 0.09%, to 8,841.9.

The gains follow another record-setting day on Wall Street on Thursday, where the S&P500 and the Nasdaq Composite hit new records after the June non-farm payrolls report showed US employment rising more than expected.

For the week, the ASX200 rose 1.0%, its best since mid-May.

Expectations that the Reserve Bank will cut interest rates next week have helped Australia's market.

The futures market this week has been giving 97 per cent implied odds that the Reserve Bank will cut rates on Tuesday following more softer-than-expected economic data this week.

Eight of the ASX's 11 sectors finished higher on Friday, with energy, industrials and materials closing lower.

The latter was the biggest mover, dropping 1% after its strong gains Wednesday and Thursday. Materials still rose 2.9% for the week, its best week since April.

BHP on Friday dropped 1.4% to $38.73, Rio Tinto lost 1.3% to $108.80 and South32 retreated 2.5% to $3.12.

Orica dipped 0.4% to $19.69 even as the federal government pledged $432 million to support the explosive maker's green hydrogen project in NSW's Hunter Valley.

In the financials sector, Commonwealth Bank fell 0.9% to $178, in its sixth day of declines out of the past seven sessions since June 25, when Australia's most valuable company hit an all time-high of $192.

The other big four banks all ended in the green, with ANZ up 0.8% to $30.32, Westpac adding 0.5% to $33.63 and NAB gaining 0.6% to $39.15.

Elsewhere, early education and day care provider G8 Education dropped 3.5% to a two-year low of 96 cents. Its shares have dropped 18.6% since Tuesday, when a former employee was charged by Victoria Police with multiple sexual offences against children. The company's board is also under scrutiny, with the Australian Shareholders' Association alleging that its limited experience in early childhood education and care raised questions about its capabilities to effectively oversee those responsibilities.

From Shane Oliver, AMP:

Another week of record highs in shares, but the looming tariff deadline weighed on Eurozone shares on Friday. Share markets mostly pushed higher over the last week, with US shares in a holiday shortened week rising 1.7% to a record high helped by hopes for trade deals, solid US jobs data and as Congress passed Trump’s tax cut bill. The surge in US shares also pushed the MSCI global share index to a record high with Eurozone shares up 0.6% and Chinese shares up 1.5% for the week but Japanese shares down 0.9%. The strong US lead along with expectations for another RBA rate cut in the week ahead also pushed the Australian share market to a new record high with a 1% gain for the week. However, tariff uncertainty did start to weigh again late in the week with Friday seeing Eurozone shares falling 0.8% and US futures falling 0.6%. Bond yields mostly rose on the back of okay economic data. Metal prices fell but iron ore, oil and gold prices rose. Bitcoin saw a further boost with “risk on” sentiment as did the $A, but the $US continued to fall.

US tariffs – here we go again? With the 9th July tariff deadline just a few days away the US is likely to announce more trade deals and Trump has indicated he will start sending letters to countries without deals notifying what their tariff rate will be, with a range of “maybe 60 or 70%...to 10 and 20%” commencing from 1 August! So, after a few months of relative calm, it could all be back on again!

The One Big Beautiful Bill Act (OBBBA) has now been passed by Congress and signed into law by Trump. Its economic impact is ambiguous. On the one hand the tax cuts likely provide a supply side boost to the economy, partly offsetting the negative supply side impact of the tariffs. It may provide some near-term stimulus via the front loading of tax cuts but again this is at least partly offset by the tariffs. And with the income tax cuts being skewed to the rich (who don’t change their spending much) and the spending cuts skewed to low-income earners it may mean that it could act as a drag on growth. The big, longer-term concern is that its likely to keep the US budget deficit running around 6-7% of GDP, even once tariffs are allowed for, which will mean a continuous rise in the ratio of Federal debt to GDP. And there may be upside risks to this if spending cuts in the out years and tariff revenue don’t materialise. A spike in UK bond yields in the past week on the back of political uncertainty over whether UK Chancellor Reeves and her attempt at fiscal discipline will remain in place provides a reminder of the risks facing the US if investors start to lose confidence in US fiscal sustainability making it harder to fund the US budget deficit, which could in time put upwards pressure on US bond yields and downwards pressure on the US dollar, which could in turn put upwards pressure on the $A.

In Australia, we expect that the RBA on Tuesday will cut the cash rate by another 0.25% taking it to 3.6% with guidance likely to remain dovish. This will be the third cut since the RBA started to ease in February. At its May meeting the RBA signalled less concern about inflation which it saw as being at target and more concern about the growth outlook. Since then we have seen monthly trimmed mean inflation drop further to 2.4%yoy, which is in the bottom half of the RBA’s target range, business surveys point to a further easing in inflationary pressures, March quarter GDP growth come in weaker than expected with subsequent monthly economic data also looking soft and Trump’s trade war continue to threaten the growth outlook all of which point to another cut. A rate cut is not guaranteed though with the main arguments to hold being that unemployment is still low, home prices are rising again and share markets are more settled. But we believe these are weak reasons to hold as: there is no evidence that low unemployment is putting upwards pressure on wages growth and forward-looking jobs indicators along with anecdotal evidence point to slower jobs growth ahead; the RBA has to set rates for the average of the economy not just the housing market and there is not much it can do to fix poor housing affordability; and while share markets are calm the threat to growth from Trump’s tariffs remains high.

Curated by James Gruber, Joseph Taylor, and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Plus updates and announcements on the Sponsor Noticeboard on our website