The primary source of data for this review is the 2017–18 SMSF annual tax returns. The key limitations associated with these returns are their frequency (only annual) and their currency - the deadline for the returns is long after the end of the financial year. However, the ATO has used 2018–19 information for registrations, wind-ups, total populations, demographic data, estimated total SMSF assets and asset allocation and auditor contravention reports (ACRs).

The 2017-18 financial year was the first financial year after the extensive 1 July 2017 superannuation changes, which included the $1.6 million transfer balance cap coming into effect. Accordingly, the statistics provide interesting analysis of the behavioural changes of SMSF trustees after these measures took effect, particularly in relation to contribution levels and benefit payments.

The key take aways are:

- SMSFs are continuing to grow

- A reversion to normal for contributions and benefit payments, and

- A greater understanding of actual operating costs of SMSFs.

In addition, more granular data which breaks down how expenses are apportioned within an SMSF and for different sizes of SMSFs provides a clearer picture of the actual costs of running SMSFs. The typical operating costs are below $5000 a year for most newly established SMSFs.

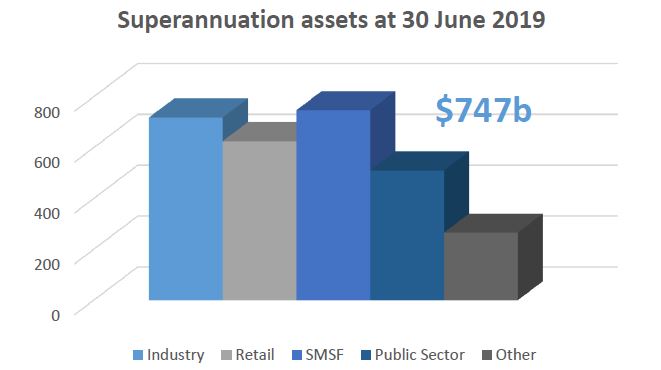

SMSFs accounted for 99.7% of all super funds in Australia and collectively held 26% or $747 billion of the $2.9 trillion in super assets under management. SMSFs, therefore, continue to be an integral and significant part of the superannuation system.

There are 1.125 million Australians in nearly 600,000 SMSFs with an average fund balance of $1.3 million and a median fund balance of $720,000 (the median value is more reflective of the typical SMSF as a small minority of very large SMSFs distort the average figure).

SMSFs are typically made up of a couple with an average of 1.9 people in an SMSF and 43% of SMSFs are in some form of pension phase. These are two crucial factors that are typically glossed over when analysing SMSFs. Median assets have grown by 36% over the five years to 2018.

Better explanation of expenses

The biggest change to the ATO’s statistics is a welcome update of the reporting of expenses for SMSFs. As many in the industry would be aware, recent expense data has made it difficult to objectively examine the operating expenses of an SMSF. This was recently highlighted in an ASIC SMSF fact sheet that we believe was well intended to help people consider whether an SMSF was a suitable choice. However, it lacked balance and would benefit from more context regarding different expense components.

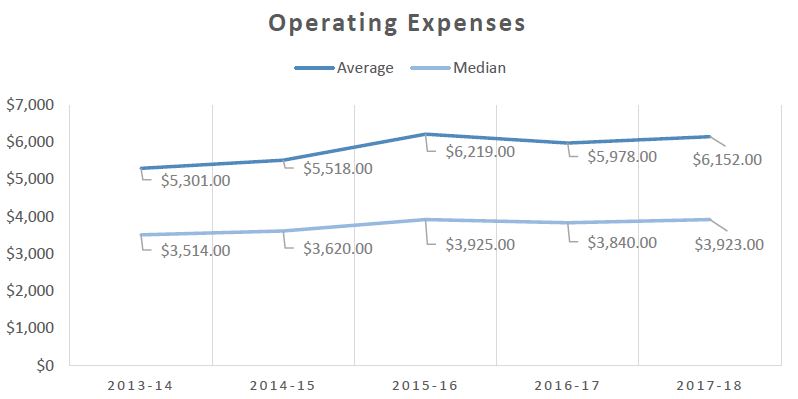

Previous analysis has relied on the use of averages, which ignores distortions from very large SMSFs and included SMSFs that have chosen to use extensive administration, insurance and investment services.

The SMSF Association has been encouraging the ATO to publish more granular expense data and we are extremely supportive of the updated data that has now been released.

So, what is new?

- New tables that break down median and average expenses by type and asset size.

- ‘Administrative and operating expense' has been renamed 'Operating expense'. Its components of approved auditor fee, management and administration expenses, other amounts and SMSF supervisory levy remain unchanged.

- ‘Management and administrative expenses’ therefore now only refer to amounts entered into management and administrative expenses in the SMSF annual return.

- ‘Investment expense' now only refers to amounts entered into investment expenses in the SMSF annual return.

With this new breakdown, the median ‘operating expense’ of an SMSF is $3,923. As highlighted above at point 2, this includes the typical expenses an SMSF would need to incur.

The breakdowns also allow us to determine how much the average and median expenses have been affected by those funds which undertake optional services or incur less common expenses.

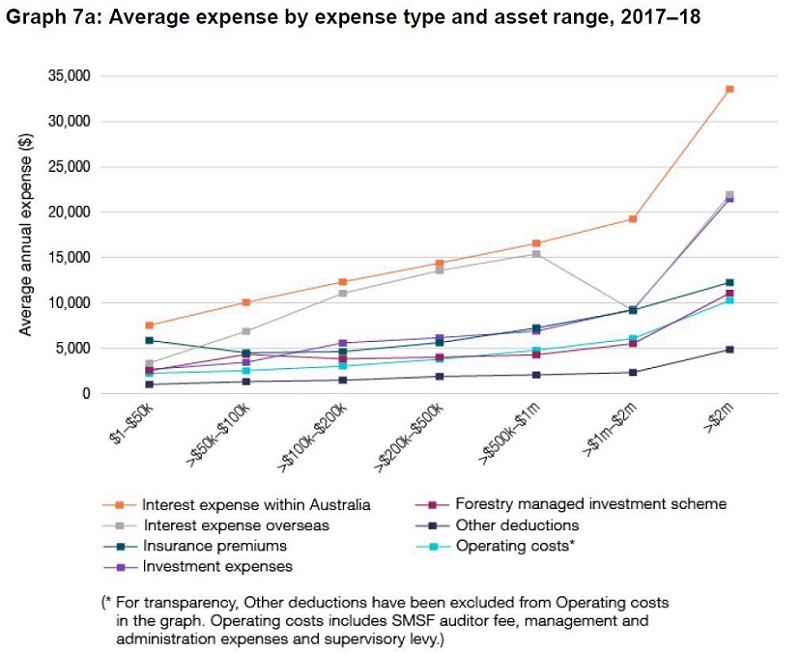

The SMSF sector may be wondering how the total average expense cost of $14,879 was calculated for the 2017-18 financial year. Graph 7a below supplied by the ATO provides a visual determination.

Funds with over $2 million had a significant impact on the weighting of the costs allocated to an average figure. In addition, expenses such as investment expenses, insurance and interest were attributed to the average when many SMSFs did not use these services. The spike in these amounts is also quite evident for funds on the higher end of the scale. In particular, interest expense relating to borrowings is an expense aimed at achieving higher investment returns and not an operating expense.

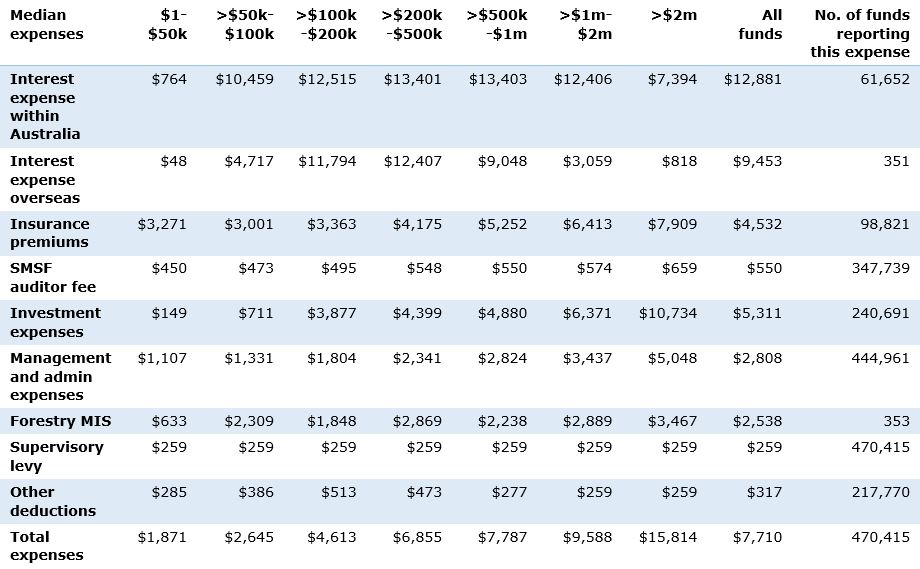

Greater information can be taken from the following table on median expenses. It details the number of funds which are reporting an expense, as well as a clear breakdown for asset sizes.

If we take a fund with a typical establishment balance of between $200,000 and $500,000, only including the typical operating expenses, removing those with investment expenses, insurance, interest, and forestry MIS we can roughly estimate the median operating expense as $3400 for these SMSFs.

The updated expense data shines a light on the many optional expenses an SMSF could incur. With these breakdowns, it is clear that previous analysis included expenses such as insurance premiums and interest expenses that were not operational expenses.

We are now able to see a clearer picture of where SMSFs choose to voluntarily incur expenses that members believe provide value to their fund.

Franco Morelli is Policy Manager at the SMSF Association.

Part 2 of the analysis of the new data will be published next week.