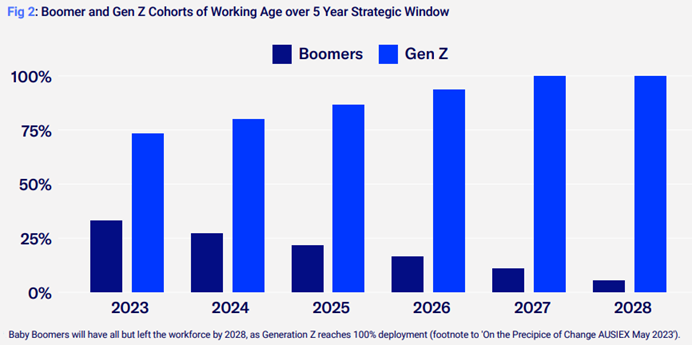

Within five years, all Baby Boomers will be eligible for retirement and the Boomer ‘bubble’ will have all but deflated out of the workforce by 2028. This demographic shift will have profound consequences for the financial industry and advisers.

A Productivity Commission paper, released in 2021, estimated that the transfer of inherited assets at about A$120 billion per year, and this figure is expected to grow to almost A$500 billion per year over the next 25 years.

The same research also found that the average age of inheritors is 50 years old, close to the mid-point of the age bracket corresponding with Gen X, which makes them an important part of the answer to the question about who will inherit the bulk of the baby boomer wealth.

Likely beneficiaries

Research suggests where money may be directed. The Future of Legacy Giving: Boomers and Beyond – Australia (November 2023), found that Baby Boomers and Gen X felt strongly that it was important to help others in need as well as your own family (55% and 61% respectively) and had a higher expectation that their family will need financial support from them (19% and 38% respectively).

Of arguably greater consequence, there also appears to be evidence that females will be the primary beneficiaries of financial flows from the transfer.

The report cites research commissioned by Schroders and McKinsey (UK and US respectively) suggests females will be the primary beneficiaries of the wealth transfer, inheriting 60% to 70% of the wealth transferred, this decade. As women statistically live longer than men on average, it’s not inconceivable they will have full control of their family wealth at some point.

All in all, it seems females are set to play a significant role in how the intergenerational wealth transfer will play out and this will likely have a profound impact on the adviser-client relationship and the advice industry overall. Whether the industry has adapted or is ready to is a different question.

Implications for financial advisers

According to The Value Gap, a report from Effortless Engagement, over 70% of clients would like their adviser to advise their children, though it may not be a fait accompli that children will use their parents’ preferred adviser. Overseas research suggests that many inheritors change their advisers.

Accordingly, working with clients to extend conversations about transfers to beneficiaries and including them in conversations, should be a key priority for the industry.

For advisers, Australian Ethical found in its 2023 Opportunity Next report, conducted with CoreData, that an overwhelming majority (77%) of advisers who engaged children in wealth transfer conversation, saw an increase in client satisfaction.

Education directly addresses a general need across generations but particularly for younger beneficiaries. Advisers are increasingly leveraging digital channels to help beneficiaries better understand the transfer and investment process and how decisions will impact them.

Advisers can also take advantage of new client portal and reporting technologies to be better informed as to the composition and performance of their portfolios and help strengthen communication and trust between transfer stakeholders.

Technology key

While the intergenerational transfer of wealth presents a substantial opportunity for advisers to engage clients and beneficiaries to establish resilient, long-term revenue streams, success is predicated heavily on their ability to add value as well as serve them profitably.

Naturally, technology is part of the answer. Modern and fully-featured trading platforms provide advisers access to the wide range of markets and asset classes required to build bespoke client portfolios in precise alignment with their objectives and risk profiles.

The net effect and arguably a key role of technology through the wealth transfer is to help address the challenges of communication and trust as root causes of transfer, ensuring there is a common and mutually agreed fact-base for stakeholders in order to deliver transfer plans their best chance of success.

At the same time, technology can help deliver significant operational efficiencies to a practice, allowing them to navigate the challenges and take advantage of the opportunities from the intergenerational wealth transfer.

Adapting to change

Investors and the wealth management industry has always adapted quickly to new technologies to improve products and services.

Our industry has, and will continue to be able to, deal with change. It is just happening faster and with higher impact than many realise.

With the older generations about to leave the system, the younger generations face different challenges than those that came before them, and the transition to innovation in the digital world is continuing apace.

The wealth management industry and equity capital markets are proven at adapting to help the economy find new ways to create capital and increase wealth. It is essential that industry participants become more active in understanding and discussing the changes that are now taking place and engage across the value chain to plan and execute change.

Industry participants need to accelerate their preparations for intergenerational transfer, as the Baby Boomer boom is over.

The full research paper on this topic can be found at: https://www.ausiex.com.au/media/202227/2024-ausiex-intergenerational-wealth-transfer-rgb.pdf.

Te Okeroa is Head of Sales, Trading and Customer Relationships at AUSIEX. This information contains general information only and has been prepared without taking into account your objectives, financial situation or needs.