In a world of low-yielding investment returns, finding solid investments by wading through various measures, metrics and methods can seem an onerous task. Free cash flow is one of the more reliable indicators for return on your investment. This is especially true when companies focus on allocating cash efficiently among internal reinvestment opportunities, acquisitions, dividends, share repurchases and debt repayments.

Cash flow basics

First, it is important to define what cash flows actually are. Cash flows, the income statement and the balance sheet are the three financial statements needed to assess a business.

A company’s cash flow comes in through sales or cash receipts, for example, and out due to operational expenditures. Cash flows in and out are shown through the quarterly cash flow statements. If the cash outflows are greater than the cash coming in, then it is a cash-losing business.

The cash flow statements also represent how much cash in the bank a business has for that quarter. If the business only has a couple of quarters' worth of cash in the bank, then it may not be a viable business worth investing in.

The income statement, by contrast, represents how much income a business has made through deducting total expenses from total revenues. Meanwhile, the balance sheet represents what assets (land, cash, buildings, machine, equipment, intellectual property, etc.) and liabilities (debt, wages, taxes, etc.) a company might have.

The free cash flow of a business is the cash left over for all financial stakeholders, including investors.

Why is this important?

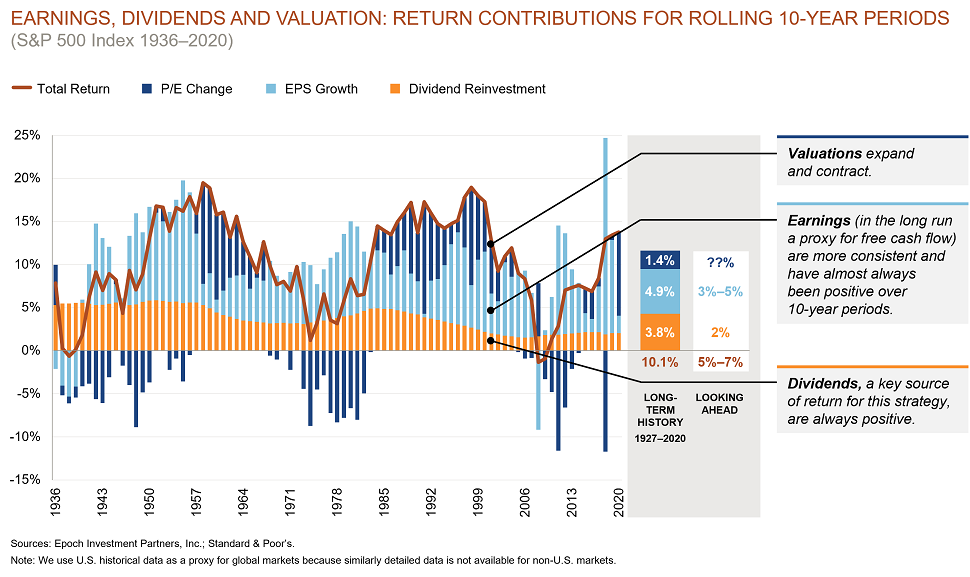

Take a look at the chart below which is foundational to our investing. It’s the guiding philosophy when looking for companies based on cash flow. It shows the S&P500 index since 1936 with total returns broken into three components: earnings growth, Price/Earnings changes (expansion and contraction) and dividends.

In any period of time, P/E multiples can drive total market returns but their impact fades over time. Investors are left with earnings growth and dividends as the fundamental drivers of long-term equity returns.

Check the long-term numbers on the right of the chart below. The total return from the index over this long time period has been around 10% a year (nominal) on average, of which 3.8% is due to dividends and 4.9% is due to earnings, but only 1.4% is due to multiple expansion and contraction. That is why we focus on the cash flow the business is able to generate.

Free cash flow as an investment value determinant

Investors can use free cash flow to determine the true value of a business for investment and what returns it may generate in the future. The higher the cash flow in any given year, along with the growth rate of further cash flow, usually means a higher value for the company.

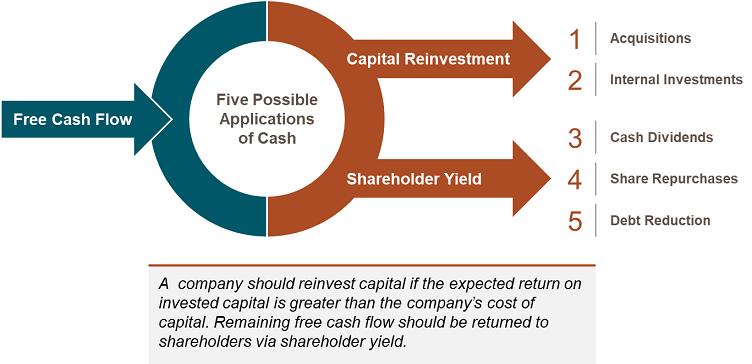

Yet, there are trade-offs in this equation as cash must be invested in the business for growth to happen. The management of any business with free cash flow must determine how much it will pay out to investors today and how much it will invest back into the business to create future growth.

Companies Maximise Returns Through Disciplined Capital Allocation

Source: Epoch; GSFM.

The free cash flow difference

In many respects, free cash flow investors follow the same process as value investors. They use a valuation metric to narrow the investable universe down to a manageable list of candidates. In essence, free cash flow investors uncover value by determining which companies are efficient allocators of capital.

The focus is on the capital allocation decisions instead of the traditional accounting-based financial metrics such as P/E ratios, earnings before interest, taxes, depreciation, and amortisation (EBITDA), and enterprise value (EV). These traditional financial metrics do not tell the full picture of potential returns due to their myriad accruals and assumptions.

Some investors seek companies that have paid out high dividends recently, but such dividends may not be a consistent feature of the investment. In fact, a high dividend payment can often be a sign of distress within a company and its stock price will fall. It is best to view company dividends in line with the consistency of free cash flow.

Every good company needs a sound capital allocation policy. Reinvestment of cash into the business should only happen when the return on capital is greater than the company’s average cost of capital. If not, then the cash should be used to buy back shares, pay dividends and pay down debt.

Company cash flow examples

Most technology companies were able to maintain or increase their dividends and share repurchase programs throughout the pandemic. Microsoft is a good example as the company continues to generate strong levels of free cash flow and increased its dividend in September 2020 and September 2021. The company also maintained its share repurchase programme through the pandemic. Microsoft has been transitioning to an enterprise software-as-a-service company with a strong adoption of its Office 365 platform and it is pushing this model into more of its offerings. The focus on perpetual subscriptions rather than one-time licensing sales will improve the consistency and growth trajectory of cash generation which has been strong in the work-from-home environment.

Another example to highlight is MetLife, a U.S. based global life insurance company. MetLife raised its dividend in April 2020 at the start of the pandemic and again in April of this year. While the company temporarily paused share repurchases during the early part of the pandemic, they did reinstate the buyback programme in Q3 of 2020 which has continued into this year. The company has a strong regulatory capital position, pays an attractive dividend, and has a policy to use excess free cash flow for debt reduction and share repurchases. Growth for the company will reflect the rate of market expansion in the U.S. as well as the more dynamic opportunities to offer insurance and financial products in developing regions outside the U.S.

On the other hand, movie theater operator Cinemark is an example of a company we exited after determining that the business impact from the pandemic was very material which clouded the outlook for dividend sustainability. We sold the position over concerns that the US could experience theatre shutdowns of an indeterminable length which would put pressure on the cash flows of the business.

When assessing any investment, it’s important to remember that cash is still king.

Damien McIntyre is CEO of GSFM, a sponsor of Firstlinks and distributor of the Payden Global Income Opportunities Fund in Australia and New Zealand. This article contains general information only. Please consider financial advice for your personal circumstances.

For more papers and articles from GSFM and partners, click here.