The performance of the US dollar and investors’ faltering optimism over China’s recovery have obscured the strong growth story of many Asian economies in the past year. But Asia’s prospects still look solid, supported by robust consumption and positive structural shifts.

Three scenarios for China’s growth

China is the big variable for the region. We see three different macro scenarios as the likeliest pathways for the country’s economy in the year ahead.

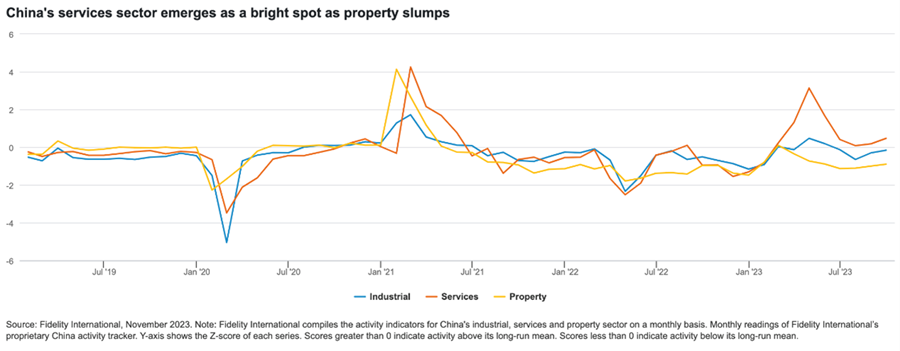

The first, our base case, outlines a continued stabilisation for China, where its recovery gradually accelerates as the property sector stabilises and consumption picks up. We assign a 65% probability to this scenario in which the economy grows around 4-5% in 2024. Policymakers will provide more fiscal and monetary support to keep growth on track, including effective measures to address deep, structural problems that help rebalance the economy away from the old investment-led model. These policy supports would, in turn, help stabilise real estate, which accounts for around two-thirds of household wealth in China, delivering a restorative boost to consumer confidence.

In the event of recession in developed countries, the stronger domestic market in China would help offset slumping overseas demand. While we believe the high growth model in previous years is not sustainable, the improving macro environment would support corporate earnings and ultimately lift investor sentiment. For property, we would expect a stabilisation of prices, not a resumption of growth, with a close eye on the debt levels.

The implications for Chinese assets under a ‘continued stabilisation’ scenario are mixed. For Chinese equities, which currently offer attractive valuations compared with most other regions, cyclical stocks like those in the shipping, industrials, and oil services sectors would stand to benefit from the rising economic output. Stronger household spending, supported by the large excess savings accumulated during the pandemic, would also benefit consumer sector stocks. In this scenario, interest rates would range from stable to a small decline. The real yield on China’s government bonds would remain compelling because of the low inflation environment, which would support demand for onshore bonds. Even so, we may see some short-term liquidity squeezes in the onshore bond market, driven by investors’ expectations on future policy support and an increasing supply of government bonds driving yields up further.

A second potential pathway for China’s economy focuses on the downside risks, such as government stimulus failing to come through quickly enough, which could result in a serious slowdown. We assign a 25% probability to this scenario. This entails the economy taking a double hit from both domestic structural challenges and an external demand slowdown. Policy support coming up short would tip the ailing property market into a more meaningful decline. In response, credit risk for local government debt would rise as land sales, a major source of local governments’ fiscal revenue, shrink further.

If the twin crises in the property and local government debt sectors were to spill over to the broader financial system, China could be heading for 'Japanification’, or years of economic stagnation characterised by heavy debt loads, disinflationary pressures, and a pullback in spending and confidence among consumers and businesses. There would still be room for increased leverage at the central government level to offset the downturn, but for equity investors, a bear-case scenario like this would call for defensive positioning. Utilities and consumer staples stocks would show more resilience in weathering the storm. This backdrop could be positive for China’s fixed income assets, and we would be more aggressive on favouring duration. At the same time, rising default risks in such a downturn argue for sticking with high-quality corporate bonds.

Our third and final scenario for China involves the economy entering a strong period of reflation. We think it’s the least probable of the three outcomes with only a 10% probability. In this case, China reverts to its old economic playbook, propping up growth by government overinvestment and rekindling a property boom. Policymakers would go beyond cyclical easing measures to bail out both property developers and cash-strapped local government financing vehicles, fuelling a renewed credit binge in the public and private sectors. Inflation accelerates. Business and consumer confidence is resurgent. Real estate’s reprise boom drives a broad-based recovery across the economy. In the short-term China would regain its rapid economic growth, but investors should be wary: this debt-fuelled expansion would not be sustainable over the long run and would eventually create even worse structural problems in the economy. In terms of asset class implications, the reflation scenario is positive for economically sensitive value stocks like the heavy machinery and financial sectors. We would also favour consumer stocks, especially discretionary names, because of the broad consumption recovery that would likely follow.

Japan

China’s trajectory is the biggest swing factor for the region, but it’s far from the only economy that will drive Asian markets in the coming year. Japan’s equities could continue to outperform as the economy transitions into a mildly inflationary state, following decades of stagnant growth and falling prices. Wage increases will have a knock-on effect of boosting consumption and supporting further price gains. Japan’s households are starting to show a shifting mentality from saving to spending and this will have broad and lasting effects. At the same time, corporate governance reforms in Japan continue to unlock equity market value. Companies are focusing more on dividends and buybacks. The Japanese market’s shareholder return profile may improve faster than most other developed markets. As policymakers gain confidence that Japan’s mild inflation has reached a sustainable level, it will be only a matter of time before the Bank of Japan further unwinds its ultra-loose monetary policy and makes a full exit from its policy of yield curve control. This policy normalisation will help attract investors to the local bond market.

India and Southeast Asia

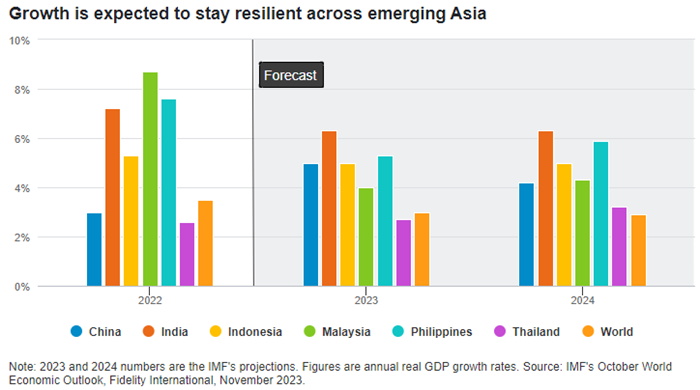

The rest of the Asian region will face challenges in the event of recession in the West or of any surprise slowdowns in China, but it also stands to benefit from some favourable structural growth tailwinds in the long-term. India is likely to be one of the world’s fastest growing economies over the coming years. With an expanding working-age population, the country will produce and consume more goods and services and drive technological innovation. Indian equities’ relatively high valuations, versus other Asian and emerging markets, can be justified by its listed companies’ consistently higher return on equity.

Meanwhile, the push to reduce supply chain reliance on China through expanding production bases in India and Southeast Asia will support manufacturing growth momentum across the region. Although it’s hard for neighbouring countries to replicate China’s manufacturing dominance, the rise of so-called ‘China plus one’ supply chain configurations will result in sizeable business and investment inflows to the rest of the region, helping boost exports and employment in both India and Southeast Asia. Of course, a recession in developed markets or a sharper slowdown in China would be a big blow to exporters across the rest of Asia, but that would only be one factor amid a much broader set of considerations, depending on which of our global macro scenarios plays out in the year ahead.

Martin Dropkin is Head of Equities, Asia Pacific at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.