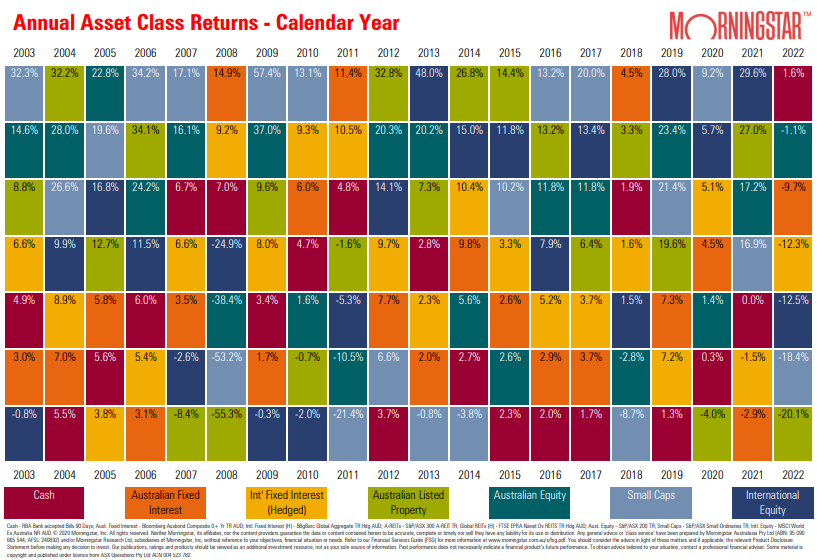

It’s an annual highlight when Morningstar releases its Asset Class Gameboard, showing the winners and losers across seven major asset classes over the last 20 years. A glance at the chart immediately tells investors that the leading and lagging asset classes change most years, and it is almost impossible to pick which class will be the 2023 winner. At the start of 2022, how many experts would have nominated cash as the 2022 best performer?

What else does the Gameboard tell investors?

While the chart will not identify future winners, it gives some useful lessons over the years (the chart shows global returns hedged into Australian dollars):

- Good-to-bad-to-good is common. Many fund managers who shot the lights out in 2020 and 2021 became media darlings, regularly interviewed for their remarkable insights into the future, until the shocks of 2022 made them look like mere mortals. It’s the same with asset classes, suggesting there’s more to luck and randomness than analysts like to acknowledge.

- Defensive cash won in 2022 but it was at the bottom in four of the five years from 2015 to 2019, and near the bottom until 2021. Cash also did relatively well in 2007 and 2008 during the GFC, but interest rates were noticeably higher. These better returns (in nominal terms) will continue in future putting cash back into the asset allocation game.

- Australian listed property was bottom in 2020, near the top in 2021 and bottom again in 2022. Good luck picking those wild swings over only three years, suggesting the market’s ability to pick the trends and value real estate cash flows leaves a lot to be desired. Does it also mean that super funds which do not regularly revalue their unlisted property assets are right not to react to market prices every month?

- Small caps topped 2020 as the pandemic favoured particular niches and growth companies, but they slipped rapidly down the chart in 2021 and 2022 as business models were tested, funding costs rose and some traditional consumer habits returned.

- There’s a temptation to think returns from Australian and international equities should be approximately the same, as similar factors affect companies around the world. In fact, performance is often remarkably different, with 2022 as a stark example, especially as the currency impact of hedging into Australian dollars is in the numbers.

- 2022 was the first time only one asset class delivered positive returns (although Australian equities rose when dividends are included) and the lowest return from the winner. This is on the back of exceptionally good returns in 2021.

- Bond losses, both local and global, were the worse in 2022 over this entire series.

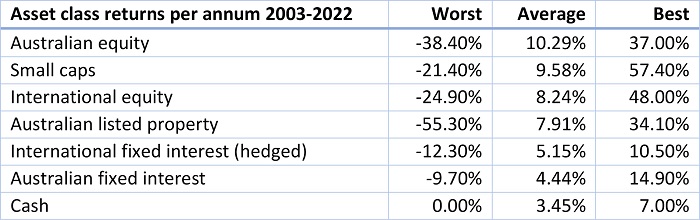

The average per annum performance of each asset class over this sample as in the table below, listed from highest to lowest. As with most long-term series, equities win.

The overarching lesson for most investors looking for consistent returns and balanced risk is that diversification will reduce heavy annual losses that come from concentration, although the best long-term returns are derived from exposure to equities if the risk is not outside the comfort zone.

Any comments on other information in the charts are welcome.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any other investor.