Real assets are tangible assets like property, infrastructure and utilities and they are different from financial assets (cash, bonds and shares) as they mainly rely on you, and the rest of the population, to help them generate investment returns.

A day in the life - you use real assets every day

We all use real assets in numerous ways – probably multiple times - every day. The alarm goes off and you turn on the light courtesy of electricity providers like AGL Energy. You take a shower using water that is heated with gas, perhaps also supplied by AGL, and travels down utility-owned water pipes. The electrical wires that power the appliances that toast your bread or blend your smoothie are owned by companies like Ausnet Services or Spark Infrastructure. Driving your car to work means you may travel down one of Transurban Group’s toll roads and then spend your day in an office that is owned by a commercial real estate investment trust (REIT) like Dexus. On the way home, you need groceries for dinner, so you drop into a shopping centre that is owned by a retail REIT, think Scentre Group or Vicinity Centres. Going on holidays? You may be flying from Sydney Airport.

Use of real assets is typically non-discretionary. You have to use them, and you don’t really think about the decision.

Real assets - population growth more important than the business cycle

If everyone uses real assets and you can’t really avoid them, it follows that the more people you have, the more demand there will be for their services. A key point of leverage of real assets is to population growth rather than the ups and downs of the business cycle. Shopping centres, ports, toll roads and airports are all well positioned to grow their businesses as the population increases.

Consider the aviation industry, with a particular focus on the Asia Pacific region.

Two important demographic trends are highly favourable in our region - strong population growth and rising income levels. What is less widely discussed is how these positive trends could ultimately lead to increased demand for the region’s real assets, including in Australia. Airports in particular, are expected to be a significant beneficiary, with more than half of all new air passengers expected to originate from within the region over the next 20 years.

Asia already seeing strong growth

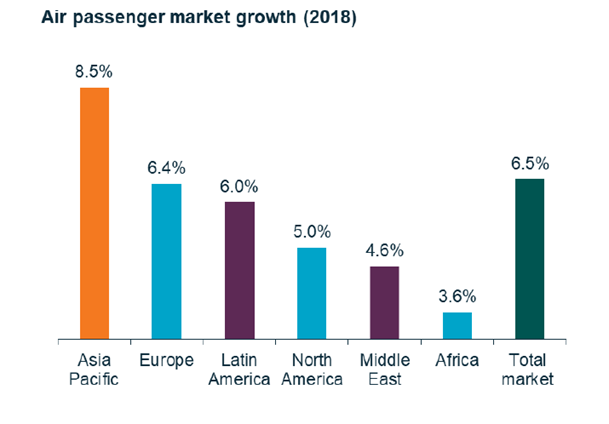

The Asia Pacific region has already seen the highest growth rates for air passengers of any region globally in 2018. Outbound travel from China is particularly significant. For example, China had the strongest growth for short-term arrivals to Australia for the year to June 2018 and was the largest source of visitors. Similarly, China is New Zealand's second-largest international tourism market, and Malaysia’s third (after Singapore and Indonesia).

Source: IATA; as at 12 December 2018: “Economic Performance of the Airline Industry” report; passenger growth denotes Revenue Passenger Kilometers for 2018.

Asia has some of the fastest country and city-based population growth rates globally. According to UN estimates, the region is second only to Africa. The number of ‘megacities’ in the Asian region (settlements with more than 10 million people) is set to increase by around 50% by 2030.

Not only is Asia already home to almost half the world’s middle class, but by 2030, the middle- class population is set to almost double again. Equating to an incremental 1 billion people (more than the combined middle-class populations of North America and Europe), this will lead to a significant increase in spending power for the region.

Centre of gravity to move east

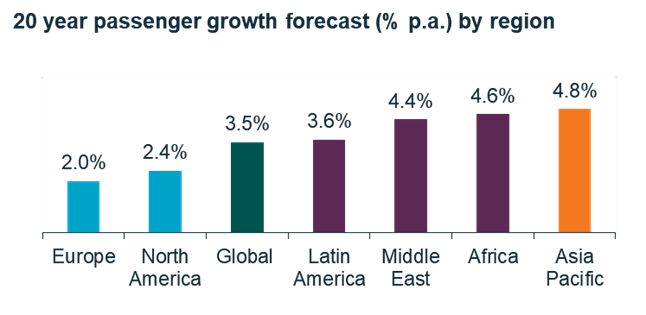

The latest forecasts from IATA show that Asia Pacific’s strong passenger growth will continue in the long term.

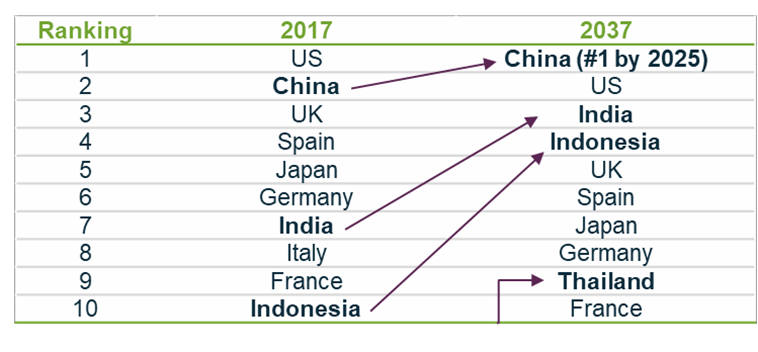

By analysing the same population and income trends that we believe drive broader real asset demand, IATA’s data shows that the ‘centre of gravity will move eastwards’ in the global aviation industry, with more than half of new passengers over the next 20 years to originate from the region.

Source: IATA; as at 24 October 2018: “IATA Forecast Predicts 8.2 billion Air Travelers in 2037”.

This growth profile positions Asia Pacific as the largest-growing aviation market globally.

Source: IATA; as at 24 October 2018: “IATA Forecast Predicts 8.2 billion Air Travelers in 2037”.

Airline commercial market outlooks, such as those provided by Boeing, also have China as the largest domestic-travel market by the end of the decade.

New assets needed to handle demand

The Chinese airport regulator (CAAC) also has positive projections on future growth. They forecast strong passenger growth for the Beijing region, with passenger numbers expected to grow around 6% per annum to 2025 (to 154 million).

Indeed, based on our recent discussions with a Chinese aviation expert, even higher passenger numbers are possible in the longer term (around 200 million) based on Beijing’s population growth and higher disposable income. A new airport, Beijing Daxing, is under construction and is expected to open this year.

Other airports across the Asian region are also looking at expansion plans as well as possible stock exchange listings, providing further investment opportunities.

Trade tensions shouldn’t displace growth

Increased protectionism could pose a risk to these growth forecasts, and current US-China trade tensions point to these real possibilities.

That said, tourism-related aviation has thus far been excluded from any trade discussion, and recent industry statistics show no material deceleration in passenger growth in line with any slowing pace of economic growth within China. Air cargo could still be impacted, but most tariffs have been placed on bulky goods that do not use air freight, such as steel or aluminium.

If we did see a reverse in globalisation, and more protectionist policies arise, we still believe that passenger growth for the region will be positive due to demographics trends, albeit at a more modest pace.

Portfolio implications - investing in both the outbound and inbound growth

We believe the main investment opportunity within this theme is in the region’s airports, rather than airlines themselves [we do not classify airlines as a real asset sector, as they are inherently volatile, with high competition, modest barriers to entry and exposure to fluctuating fuel costs], especially for Real Income strategies that only invest in low-risk listed real asset companies that have large sunk capital bases with high barriers to entry, such as airports.

Domestic Real Income strategies can potentially capture the benefits of rising Asian air travel to Australia by holding stocks such as Sydney Airport. Similarly, Real Income strategies that have a broader (eg regional) investment universe could also hold selected regional airports, enabling them to capture the strong growth in both outbound and inbound passengers.

Daniel Fitzgerald is a Portfolio Manager with Martin Currie Australia, a Legg Mason affiliate. Legg Mason is a sponsor of Cuffelinks. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable. Please consider the appropriateness of this information, in light of your own objectives, financial situation or needs before making any decision.

For more articles and papers from Legg Mason, please click here. The BetaShares Legg Mason Real Income Fund (managed fund) (RINC) is managed by Martin Currie Australia and can be bought and sold like any share using the ASX code: RINC.