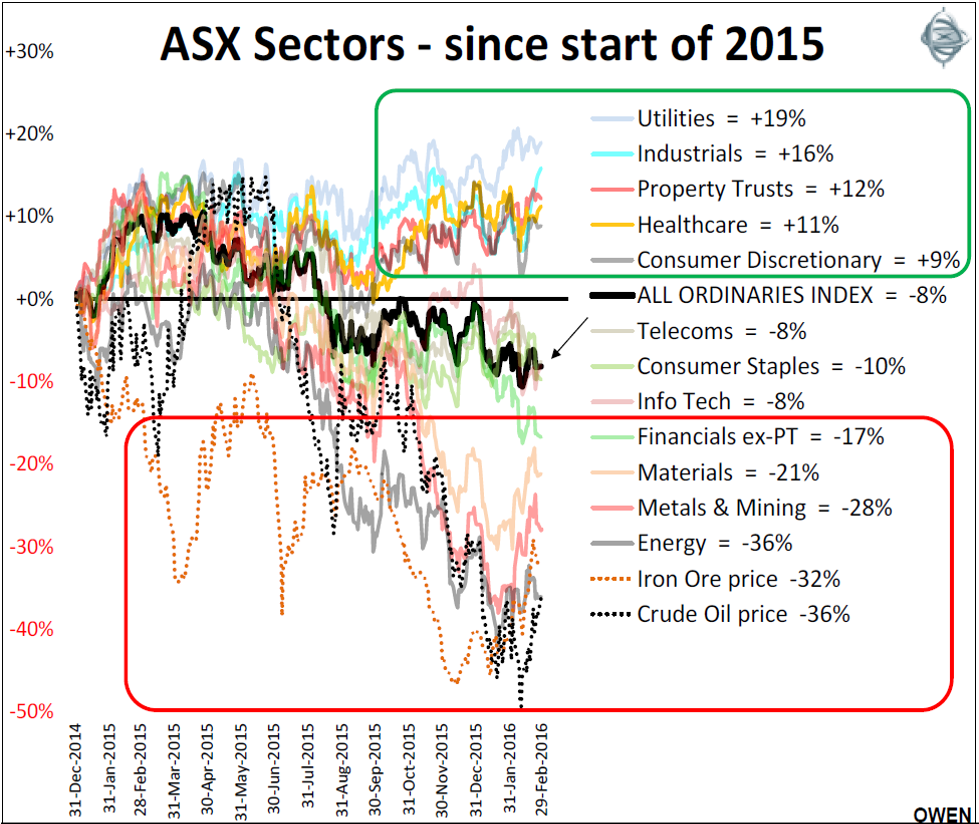

Many people see the Australian stock market as little more than banks and miners. They dominate the market index, even more so before both sectors were sold off over the past year. The chart shows ASX share price indexes by sector since the start of 2015 (excluding dividends). The overall market has been dragged down by mining and energy sectors and banks (‘financials ex-property trusts’) languishing at the bottom of the chart while several other sectors are doing well at the top.

Mining and energy stocks have been hit heavily by the collapse in commodities prices. The problem is not lack of demand - the world economy and demand for energy and resources are still growing. The problem is over-supply and excess production from all of the new mines developed during the mining boom. Many are now being closed or written off.

Banks have been hit by rising funding costs as investors demand higher risk premiums when lending to banks. There are fears of a blow-out in bad debts from bank exposures to mining and energy companies as they contract, and also bad debt blowouts from a possible bursting of the local housing bubble which is inflated by bank debt. Higher equity capital requirements also reduce future returns on equity from banks.

But outside the two problem sectors other stocks are doing rather well. Traditional ‘defensive’ sectors of utilities and healthcare are up strongly. Industrials and consumer discretionary stocks are benefiting from lower energy and input prices and the lower dollar, and consumers are spending more as fuel prices fall.

Update on February 2016

The local stock market ended down a couple of per cent in February but there was a lot going on behind the broad index result. Banks reported respectable rises in profits but their shares fell 10%. Miners reported billion dollar losses but their share prices rose thanks to the seasonal min-recovery in metals prices. The half yearly reporting season was reasonably strong, apart from the big losses from the resources sector. Most of the losses were write-offs of the over-priced purchases and developments at the top of the mining boom years ago. The overall market is fair value on long term fundamental measures at current levels.

Ashley Owen (BA, LLB, LLM, Grad. Dip. App. Fin, CFA) has been an active investor since the mid-1980s, a senior executive of major global banking and finance groups, and currently advises and High New Worth investors and advisory groups in Australia and Asia. This article does not consider the circumstances of any individual investor.