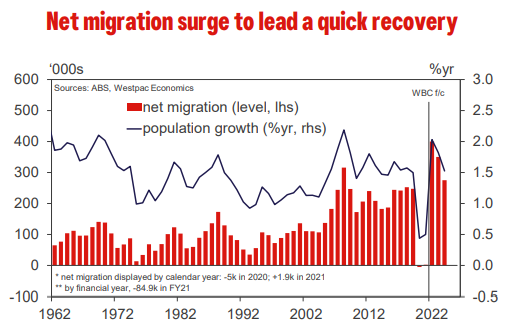

Westpac estimates net migration totalled more than 400,000 people in 2022, reflecting a temporary ‘catch-up’ in migration flows. A gradual easing is then expected to emerge over the course of 2023 and 2024, to +350,000 and +275,000 respectively.

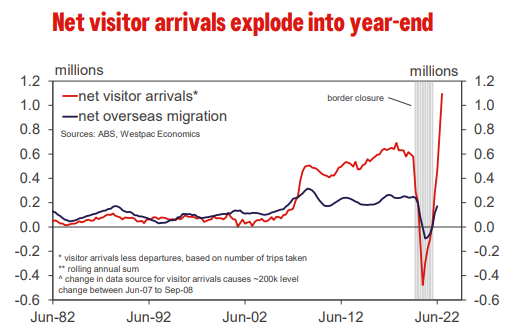

In the days after the first reported case of COVID-19 in Australia in late January 2020, the government began implementing a staggered closure of the international border. On March 20, the border was officially closed to all non-residents and non-citizens, and Australians were banned from travelling overseas.

The general border closure – which remained in place for nearly two full years – saw annual net migration turn negative (i.e. net emigration) for the first time since 1946 and Australia’s population growth plummet to its lowest level in over 100 years.

To determine whether a migrant adds to the population size, the ABS uses the 12/16 framework, meaning a migrant must stay in Australia for a period of 12 out of 16 consecutive months.

The ABS estimates that over the 2020-21 financial year, there was a net emigration of 84,900 people, the bulk of this being concentrated in H2 2020. That loss is in addition to the opportunity cost of the net migration that would have materialised had the pandemic not occurred, which according to the four-year pre-pandemic average, would have been 235,000.

Over this period, many temporary visa holders were forced to return to their country of citizenship or move onto a bridging visa, some of which have limited work rights.

Indeed, data from the Department of Home Affairs suggests that between March 2020 and December 2021, the ‘stock’ of temporary visa holders among key visa classes in Australia (including working holiday makers, skilled employment, and students) collapsed by 400,000. Over that same period there was a significant take-up of bridging visas, totalling 77,000.

The pandemic caused a sudden and extreme shift in population dynamics in Australia. That is reversing quickly given the major threats from the pandemic have now passed.

2022: the boom

On 21 February 2022, Australia’s borders reopened to fully vaccinated individuals across the world. Since then, it has become increasingly evident that a net migration surge is well underway, stronger than what was initially expected coming out of the pandemic.

According to the official quarterly population estimates from the ABS, net migration has totalled 156,000 over H1 2022. Despite having closed borders to most of the world for nearly two months, net migration in H1 2022 was just 3,000 under the H1 record of 159,000 in 2008.

Although we have not yet received any official data regarding net migration beyond H1 2022, limited but timely indicators are pointing to a further strengthening over H2 2022.

Monthly data on overseas arrivals and departures (recording number of trips taken) indicates that net visitor arrivals have lifted from 419,000 in H1 to 676,000 in H2. Given that the border reopening began in late February, the recovery in visitor travel only started to pick up around mid-year, with this strength being sustained through to the end of 2022.

A similar theme is also found within net visa arrivals (distinct from ‘net visitor arrivals’). H1 2022 was characterised by a substantial backlog of visa applications and extreme delays in visa processing. As these issues began to resolve, net arrivals surged in the ‘temporary work’ group of visas (including skilled, working and other temporary visas), and the strength in net student arrivals was largely sustained too.

In our view, the surge in net migration is beginning to have a material impact on the labour market too, with growth in the working age population rising to be well above pre-pandemic levels at an elevated 2.1% per year.

Data from the Department of Home Affairs on visa applications and grants are also positive for the outlook. Across the key working visas such as working holiday makers, temporary skill shortage and temporary graduates, grant volumes have all lifted above their respective pre-pandemic levels and are continuing to rise. There has also been an appreciable lift in student visa applications and grants through to end-2022, coinciding with the relaxation of work-hour and industry conditions in order to alleviate extreme labour supply pressures in Australia.

Also, with the removal of COVID-zero restrictions in China now freeing up travel and the Chinese Government’s mandate for students to return to in-person learning, arrivals from China are set to jump this year, complementing the strength already being seen in arrivals from India, which has been the key support in Asia since the border reopening.

It is important to note that the precise relationships between these data sources are not direct and there is uncertainty about how the strength of these indicators are reflected in the official estimates of net migration from the ABS.

2023 and 2024: the recovery

Given the severity of the collapse in net migration over the course of the pandemic and evidence emerging on the ‘surge’ to date, we believe that the recovery in net migration will be much stronger and more sustained than the government’s forecasts, which assumes a return to the pre-pandemic trend level of 235,000 in FY23.

By calendar year, Westpac estimates net overseas migration to print +400,000 for 2022. This historic high – well above the +316,000 print in 2008 – represents a temporary ‘catch-up’ from the substantial loss of net migration flows over the pandemic

This will be followed by a gradual easing over the course of 2023 and 2024 as migration targets are likely to be pared back in response to the boom over 2022.

There is a great deal of uncertainty around what the near-term net impact of a historic surge in net overseas migration will be on inflation, especially during a period of rising interest rates and slowing growth.

On the one hand, sudden growth in the population represents an expansion in the aggregate spending capacity of households, materialising as stronger demand-side inflationary pressures. While small at the margin, the effects of this may be larger in markets with an extremely tight supply-demand balance, such as rental markets in major capital cities.

Simultaneously though, a surge in net migration will expand the size of the labour force. Given the current strength of labour demand as evinced by business and household surveys, more job vacancies would be filled, leading to an increase in employment growth. If this were to be large enough to see increases in unemployment or underemployment (unemployed and those who want to work more hours), then on balance, the labour supply effects would be enough to outweigh the demand-side impacts.

Ryan Wells is an Economist at Westpac Banking Corporation. This information is for general information and has been prepared without taking into account your objectives, financial situation or needs. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it.