Back in March I was chatting with a fellow parent at a school social event. After the prolonged lockdowns and enforced social distancing of 2020, we both agreed that it was great to be out and about. An obstetrician, this parent also happened to mention how unusually busy he had been in the prior months and this got me thinking more deeply on the topic of babies.

Looking further into all things baby related, it became evident that in strong contrast to other parts of the world, Australia is set to enjoy a coming baby boom. While it would be easy to flippantly attribute this great baby news to lock-downs and the thought that one can only watch so much streamed TV, in reality it means so much more.

The coming baby surge speaks volumes to the great levels of shared optimism we should have in our ongoing prosperity. Australians have both the confidence to commit to baby plans and the knowledge that a strong birth rate delivers long-term structural benefits.

This population growth is also good news for the long-term success of Real Assets. Quite simply, the more the Australian population grows, the higher demand for Real Assets serving our everyday needs.

Forecasting baby showers ahead for Australia

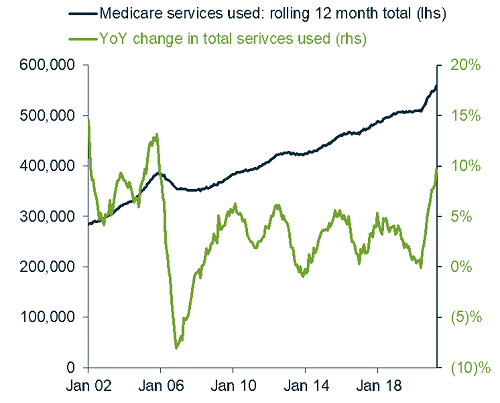

Unlike behaviours that saw a sharp drop in births during the GFC, Government Medicare data on early-stage pregnancy ultrasounds is signalling a mini baby boom on the horizon.

Early-stage (<16 week) pregnancy ultrasound referrals

Source: Australian Government Medicare statistics; as of 31 March 2021, item reports for Medicare Benefits Schedule – Items: 55700, 55703, 55704, 55705.

In a world troubled by the COVID-19 pandemic, the outlook in Australia is reassuring both for our Real Asset investments that rely on population growth, and for the broader economic backdrop. The baby confidence most certainly can equate to a healthy consumer.

Australia is bucking a global COVID-19 trend

While myths of a spike in birth rates nine months after blizzards or major electricity blackouts have been debunked in the past, Australia’s expanding families are looking markedly different to other parts of the globe where baby birth rates are steadily falling. COVID-19 impacts look to only have exacerbated these downward trends.

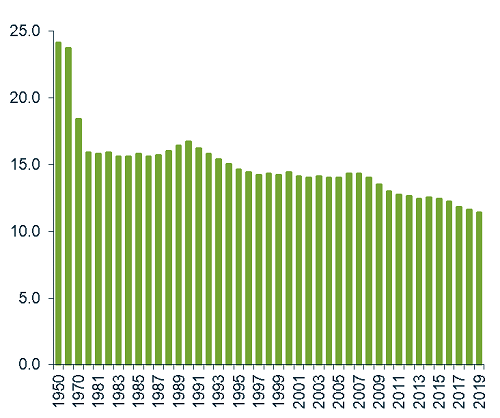

Data coming out of the US is particularly bleak. The US Centers for Disease Control and Prevention (CDC) reported that in a year not yet affected by COVID-19, 2019 already delivered the lowest birth rate for 35 years (sourced here and here). Provisional data for 2020 indicates an ongoing downward trend.

US: Crude birth rate (Live births per 1,000 population)

COVID-19 impacts are expected to see even less babies arrive this year with an estimated 300,000 fewer US babies expected in 2021, according to a study by the Brookings Institution think-tank.

Using real time Google search data, Germany’s Max Planck Institute for Demographic Research has also anticipated these declines for 2021. Their research focussed on Google search terms like "Clearblue" (the US pregnancy test) or "morning sickness" and has flagged greater decline in US birth rate than what followed the GFC in 2008-2009. This would be a similar magnitude to the declines following the Spanish Flu of 1918-1919 and the Great Depression in 1929.

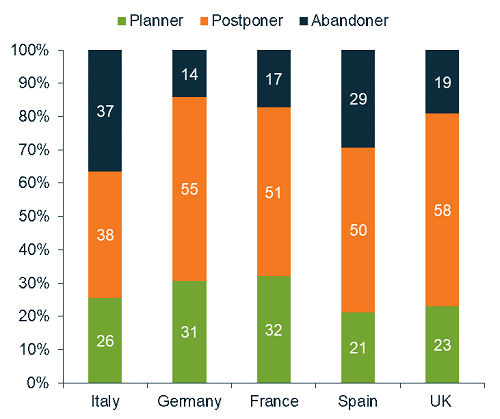

Europe paints a similarly sobering picture. A survey of fertility plans in Europe showed that 50% of people in Germany and France who had originally intended to have a child in January 2020 were going to postpone baby plans, while in Italy, 37% of respondents have abandoned the idea altogether.

European fertility plans

These slowing overseas birth rates are likely to have been exacerbated by the impacts of economic slowdown, as the pandemic has disproportionately hurt working women.

Australia’s natural population growth partially offsetting immigration losses

Australia’s world leading population growth that has historically been bolstered by net migration will of course slow, given border closures and negative net migration. Based on our observation of all these trends, we would expect that Australia’s total population growth will stay positive, but most probably slow to around +0.5% in 2021. This is down from the +1.5% p.a. pre-COVID-19 levels of 2019.

We do expect an upward acceleration from those lower rates into 2022, and conservatively assuming a 10% year on year increase in Australian child births in 2021, population growth will likely then rise back to levels of around +0.7% over 2022. For reference, the latest monthly March 2021 ultrasounds in the earlier chart are up +20% on pre-COVID-19 March 2019 levels.

Immigration will also rebound

Australia is also in the enviable position of having both an accelerating birth rate from already high levels and a solid handle on the spread of COVID-19.

Solving quarantine logistics for a re-commencement of our controlled migration programme will be much easier than trying to kickstart the declining organic birth rates we are seeing offshore.

Strong local employment data will also facilitate a re-introduction of our migration, and the poor global COVID-19 experience will likely have only increased net migration demand for Australia. Immigrants have also traditionally had a higher birth rate than Australian-born citizens.

Finally, the natural motivation to re-invigorate our key export market of education is strong, with offshore students historically providing a key pool of prospective new Australians.

Both births and immigration a key part of Australia’s population story

Population growth from both the natural birth rate and immigration are key driver of the Real Assets we invest in for our income clients, and we remain very confident in the long-term Australian population story.

In a troubled world we should be optimistic about the future, I certainly am.

Ashton Reid is a Portfolio Manager at Martin Currie Australia for the Legg Mason Martin Currie Real Income Fund. Also available as an Active ETF (Managed Fund) ASX:RINC. Martin Currie is a Franklin Templeton specialist investment manager, and Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.