Here's an example of reader feedback

"Graham – I wonder whether you might do something about the benefits of off-market buybacks. For small retail investors, especially those of us who can’t afford financial advice, it’s a bit of a mystery.

For example, Westpac is offering to buy back shares at between 8-14% (discount) to their value. I mean, why is this so? I’m sure I could read the hundreds of pages accompanying it, but I’m told to get financial advice. Well, if you’ve only got a few hundred shares…

So I wonder whether you might be able to explain in retail investor language what this is all about – at least in principle."

Firstlinks does not offer personal financial advice but here are the general principles.

-----

Westpac has announced an off-market buy-back, with the size at $3.5 billion.

Off-market buy-backs are a tax-effective mechanism for returning franking credits to shareholders who most value them. The buy-back will have a $11.34 capital component, with the balance being a fully franked dividend.

The buy-back will be based on a tender, with investors tendering to sell shares at a discount of between 10% to 14% below market price. Shareholders who don’t participate will still benefit from the buy-back, to the extent that shares are effectively bought back at a cash discount to market price. This compares with on-market buybacks, where companies buy-back stock at market price.

For tax-exempt investors such as pension phase super

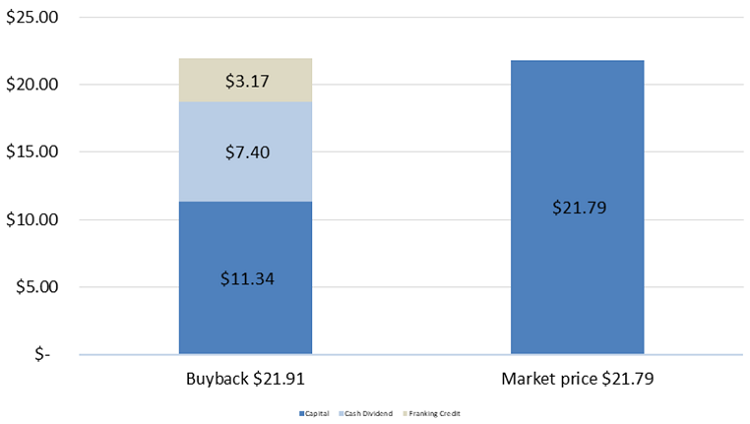

We have analysed the value of the buy-back for tax-exempt investors such as charities, foundations, pension phase superannuation and individuals below the income tax threshold using the market price of Westpac on 22 November of $21.79, as shown in Chart 1 below.

Using $21.79 as a guide (the actual price used for the buy-back will be the volume weighted average price (VWAP) of Westpac shares in the five trading days up to and including 17 December 2021) the maximum 14% discount would equate to a $18.74 buy-back price. With the capital component being $11.34, the other $7.40 would represent a fully franked dividend, which would have a $3.17 franking credit attached.

For a tax-exempt Australian investor, we estimate the buy-back at a 14% discount would be worth approximately $21.91 (disregarding the time value of money), representing an after-tax profit of just $0.12 or 0.6% compared to the market price of Westpac.

Please note that the buy-back is expected to be completed on 20 December 2021 based on volume weighted prices from the previous week.

Chart 1. Estimated value of the Westpac buyback for tax exempt investors

Source: Plato, Westpac buy-back announcement 1 November 2021.

The value of the buy-back for other investors will depend on the tax situation of each investor. At current prices, we would expect the buy-back to be of marginal if not negative value for 15% tax rate Australian investors.

The precise value will be determined by investor circumstances, the deemed capital value that the ATO will issue after the close of the buyback and the final buy-back price relative to the closing market price.

Potential for price set at lower discount

Given that we estimate the buy-back is only just valuable for tax-exempt Australian investors at the maximum discount rate, we expect the final buy-back price could be possibly set at below the maximum 14% discount to market price. This price will not be known until after investors make a commitment to sell.

For example if the buyback went off at an 11% discount, then the after-tax value for tax-exempt Australian investors would rise to 4.8% for every share successfully tendered. The scale-back may also be not as high as it has been for other recent buy-backs.

So whilst we expect the buy-back to not be as valuable for tax-exempt Australian investors as previous buy-backs (which have often been worth 20% for every share successfully tendered), a lower scale-back will potentially increase the overall value of the buy-back at the portfolio level.

We believe opportunities such as this Westpac buy-back highlight the importance of tax-exempt investors like pension phase superannuants having their investments managed from their tax perspective.

Dr Peter Gardner is a Senior Portfolio Manager at Plato Investment Management. Plato is an affiliate of Pinnacle Investment Management, a sponsor of Firstlinks. Please note that this analysis depends very much on the particular tax status of the investor. We would suggest individual investors should seek professional tax advice based on their individual tax circumstances.

For more articles and papers from Pinnacle and its affiliates, click here.