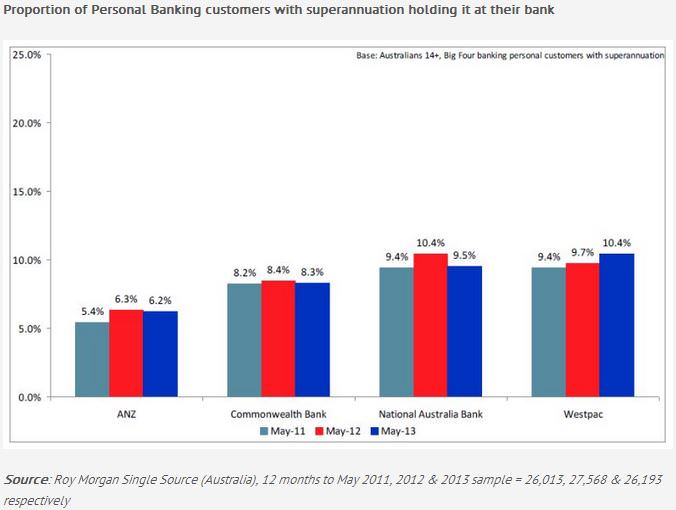

Roy Morgan Research recently reported that in the survey period of the 12 months to May 2013, no more than 10.4% of personal customers of any major bank held their super with their bank. Approximately 50% hold their super with an industry fund and 8% with AMP.

The Editor of Cuffelinks, Graham Hand, took part in a lively LinkedIn discussion after the release of this Report, some of which is extracted below:

Mark Redman: Only one in 10 bank customers has their personal super with their bank, showing that banks are missing a huge cross-selling opportunity.

Alun Stevens: Probably the most sensible thing I can say is, 'Watch this space'. The banks were all aware of the problem and all are in the process of doing something about it.

Graham Hand: Yes, Alun, they are finally focussing on it, but if you take the specific case of SMSFs, the banks have allowed the administration and most of the investments of $500 billion to be controlled elsewhere, and must now play catch up, as discussed in this article.

Alun Stevens: Graham, I agree with you as far as administration and advice are concerned. Given that some 25% of SMSF assets are invested in Cash and Term Deposits, the banks have a fairly good foothold. Another 35% to 40% of assets are invested in listed securities with the bank brokers having a significant share. The bank groups therefore already have a large presence in the assets of the SMSF market. This is quite important when one considers that the majority of these assets by value are not advised (in the sense of financial as opposed to tax advice).

The banks have also been very good at turning limited recourse borrowing into products with packaged loan and trusts. Pretty much all the debt is bank debt.

Eric Taylor: While SMSF trustees may be using bank services such as brokers and deposits, that is a long way from people investing in bank managed superannuation funds. I suspect many people see banks as high income earning corporations, more focused on selling and profit for shareholders rather that service to clients. I suspect it will be many years before banks can convince "ordinary" people that the banks want their money for the members' benefit. The conglomerates of today are vastly different from the service bodies in which I was employed many decades ago.

This can be highlighted by the offers of Limited Recourse Borrowing Arrangements (LRBA) to people who are getting close to retirement. It appears the goal in such enterprises is more related to the banks' lending money than to help people retire in say 4 to 5 years who need minimal risk.

I suspect it will be many years before the banks become significant controllers of superannuation funds, rather than a tool used by the controllers. The public confidence is not there.

Graham Hand: Alun, while it is correct that much of brokerage business of SMSFs goes through bank brokers, it is invariably the discount online offers where fees are around $20 up to a $10,000 trade, or 0.2%. This is a one-off cost to purchase, say an ETF which the SMSF may hold for 5 years or more. The annual management fee goes to the ETF provider, none of which is a major Aussie bank.

Compare this with the annual fee earned on a traditional managed fund, maybe 1% pa depending on the fund option chosen. As revenue for the bank group, the brokerage is tiny and a fraction of the managed fund recurring annuity stream. So to say the banks already have a large presence in the SMSF market underplays the fact that the revenue has fallen significantly for the banks from meeting the SMSF demand in this way.

Alun Stevens: Graham, I am not saying that the banks can't do a lot better. I am simply saying that they already take a very solid proportion of the gross margin generated from SMSFs and that this shouldn't be overlooked.

Managed funds are a furphy in the context of SMSFs because they are not greatly used. The total margin on cash and term deposits exceeds the total margin on managed funds. We will also see a fall in the use of managed funds as a percentage of assets as advisers increasingly take on the investment management role as a means of maintaining their margins whilst reducing client costs. There is a marked trend in this direction already underway.

The trend within the managed fund segment is also towards ETF type funds which can be executed and traded online like shares. The investment margins for these are much lower than for traditional managed funds.

The bank brokers do make good margins, for brokers, from their online businesses, but this is not why I was referring to them. Their major value to the banks is that these broking businesses provide a powerful client gathering and engagement function. To take Eric's point, they may not 'control' the super funds (comments below), but they do control the interface for the most significant function for trustees - investment execution, reporting and management. The comments made in the article at the start of this thread grossly underestimate the strategic value that the control of this interface delivers. Well over half of the asset value in this segment is unadvised and the primary source of market access and information for the controllers (that word again) of this money is their online brokerage provider.

I always find the word 'control' rather peculiar in the context of financial services. In my experience it is the clients who control the activities rather than advisers. Having managed an online broking business, I can attest that advisers generally overestimate the extent of their control and vastly underestimate the extent of the market. There is a very large market out there that actively avoids advisers, but they all have broking accounts. And their attitudes to their brokers (bank owned and others) are much more positive than their attitudes to advisers. In fact, attitudes overall are much more positive to brokers than to advisers.

Eric, I agree that it will be some years before bank branded superannuation funds have a significant share, but they are one of the fastest growing segments of the market despite banks like ANZ having only just started to push their product and NAB yet to launch something.

I also agree that there are problems with a good proportion of Limited Recourse Borrowing Arrangementss, but my question is why the supposedly responsible controllers of these funds (ie the advisers) are proposing these loans? It is hardly the banks' fault given that they are just sitting on the side as untrusted product providers.

Alun Stevens is Principal at Rice Warner Actuaries; Mark Redman is Manager, Wealth Management at Porterallen; and Eric Taylor is a Registered SMSF Auditor and Tax Agent.