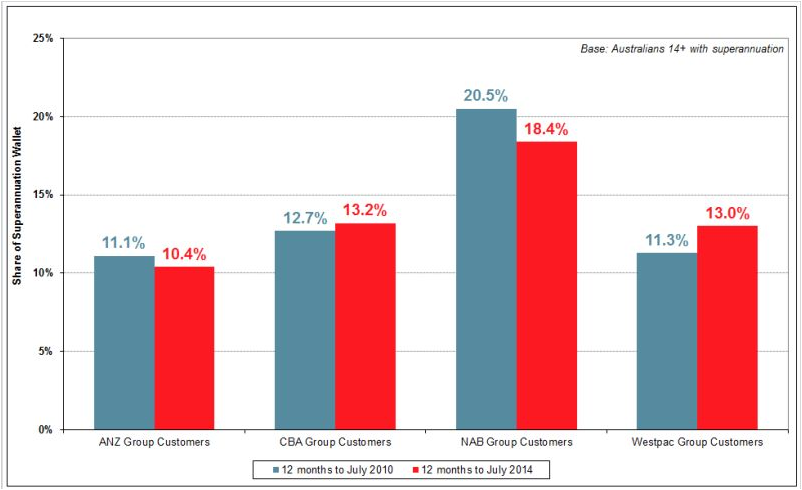

The latest research report by Roy Morgan shows banks have a poor track record in selling superannuation services to their existing retail banking customer base and it may represent a significant opportunity. Australian banks only hold between 13% and 18% of their customers' total superannuation wallet.

Share of customers' superannuation wallet

Source: Roy Morgan Research , 12 months to July 2010 (n=33,901) and 12 months to July 2014 (n=33,812) NB: Groups include subsidiaries.

There are a number of key barriers to overcome if the banks are going to woo their existing retail customers better. Firstly, retail super customers don’t change superannuation providers easily. Secondly, their biggest competitors are the industry superannuation funds which have arguably performed better (even if the overall range of services is not as broad) and advertise very aggressively. Lastly, superannuants with their own SMSF, rightly or wrongly, are generally happy with their decision to 'go it alone'.

So while winning new customers is generally considered harder than cross selling services to existing ones, that might not be the case for superannuation. Most Australian retail superannuation holders remain disengaged from their superannuation and do not even bother to make an active choice about which fund (or which product) their contributions should be paid into. The speculated reasons for this are many and varied and include the lack of availability of independent, comparable superannuation fund performance and fee data.

But given the low penetration levels of banks into their customers superannuation wallet, the size of the prize might be worth it.

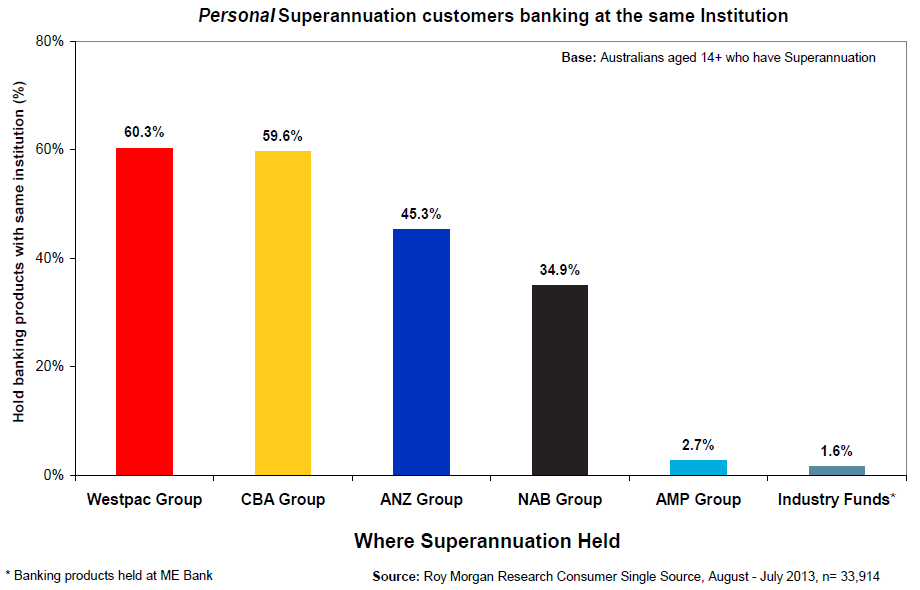

Interestingly, previous research by Roy Morgan (click here) showed banks hold a better track record the other way around, in providing banking services to their existing superannuation customers.

For example Westpac holds the lowest percentage at 13% of its customer’s total superannuation wallet, of the big four banks. But of the superannuation wallet that it does hold, around 60% of these superannuation customers have a banking product with Westpac.

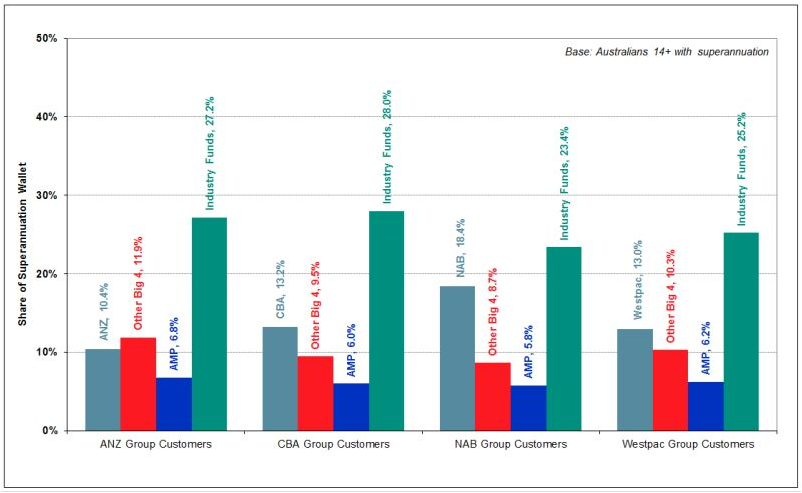

The research report also shows industry super funds hold the single biggest share of banks customers’ superannuation wallet averaging around 25%.

Source: Roy Morgan Research Consumer Single Source, 12 months to July 2014, n=33,812. NB: Groups include subsidiaries

The banking sector in general is often criticised for its lack of competition, with the big four banks estimated to own around 80% of the deposits and lending to private households. But the banks have recently engaged in hard-fought customer convenience battles, mainly through their investment in information technology, in order to stay in the game and hold onto their market share. This success in banking services has yet to spill over into the provision of super to bank customers.

Les Goldmann has over 20 years experience as a Chartered Accountant. His other roles have included journalism, working as the policy and research manager for the Australian Shareholders Association and senior positions in the commercial and non profit sectors.