While Australian major bank hybrids (sometimes called T1s reflecting their position in the capital structure) are rightly held in high regard, their USD-issued equivalents now trade at a substantial premium and offer much higher risk-adjusted returns. Investors able to access Australian credit in offshore markets remain at a distinct advantage to those constrained to local shores.

(Editor's note: access to these securities is generally available via fixed interest brokers for investors who qualify as 'wholesale' - which is not a difficult test - or through funds which invest in them. In Australia, we commonly refer to T1 securities as 'hybrids' and T2 as 'subordinated' and T1 ranks below T2 in the capital structure. That is, T1 carries more risk because it would be paid out after T2 in an event of default).

Small yield gain for lesser credit quality

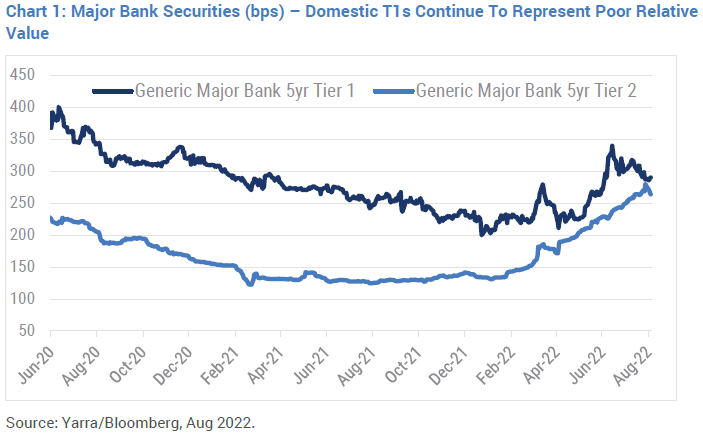

In May 2022, we were surprised when major bank BBB-rated Tier 1 (T1) hybrid securities in Australia were trading just ~40bps (0.4%) higher in yield than the lower risk major bank BBB+ rated Tier 2s (T2) despite being two notches lower in credit quality. Incredibly, that gap has narrowed further to just ~20bps following the recent T2 (subordinated) issuance from NAB and ANZ which priced at very attractive margins of BBSW+280bps and BBSW+270bps respectively (refer Chart 1).

Based on historical averages, T1s currently look incredibly expensive and should be trading ~200bps wider of current valuations.

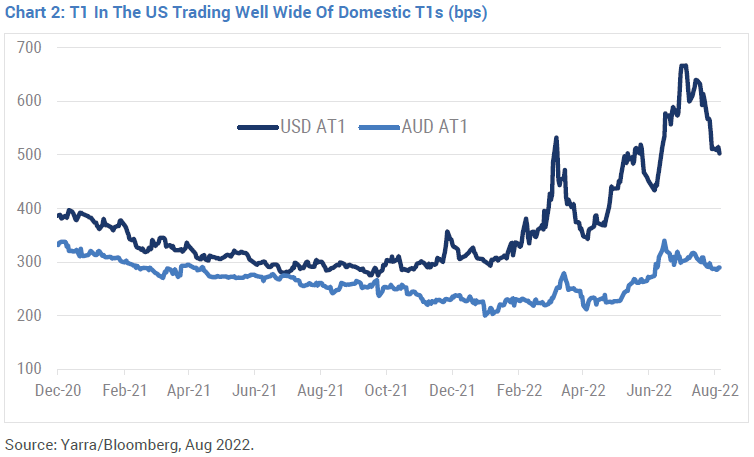

Moreover, based on offshore hybrid pricing, it seems this disconnect in bank hybrid capital pricing is more of an Australian phenomenon.

After diverging in late 2021, there is now a dramatic gap between the two, with US T1s now trading ~200bps wider than their Australian comparatives (refer Chart 2).

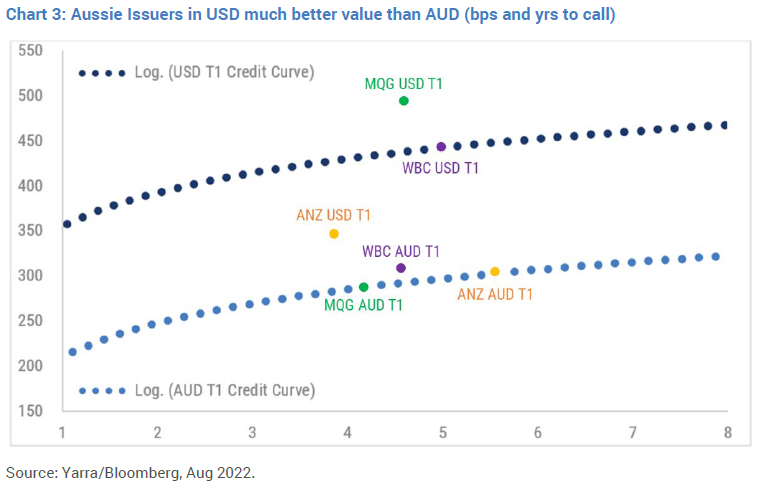

Looking at T1 curves in Chart 3 - the US (dark blue line) and Australia (light blue line) - there are several opportunities for domestic investors to extract a significant premia by choosing the US dollar denominated Australian T1s. Australian investors either need to accept the foreign currency exposure or hedging out the currency and interest rate risk.

We recently purchased the 2027 Westpac USD T1s. The security swapped back to a credit margin of BBSW+480bps, ~200bps wider than the equivalent ASX-listed security, with all currency and interest rate risk hedged throughout the life of the security.

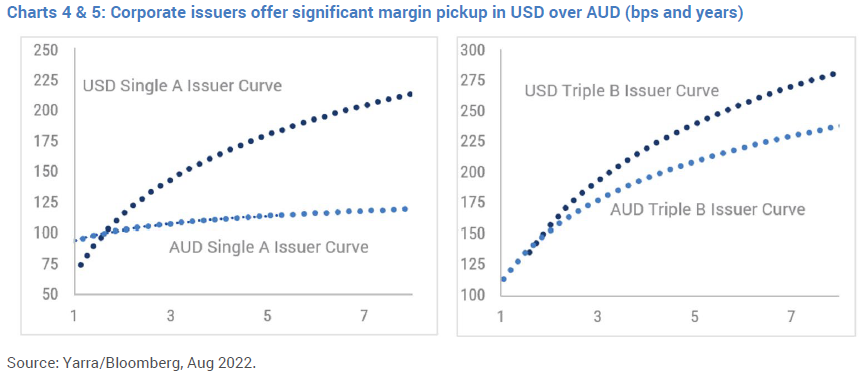

By comparison, given their more attractive pricing domestically compared to T1, the same pick-ups in credit margins offshore are not currently available in bank senior or T2 segments. However, there are similar opportunities in Australian corporate credit with both the single A and triple B rated curves for Australian issuers significantly wider in USD than in AUD (refer Chart 4 and 5).

Benefits of taking a global perspective

This approach is enabling us to harvest higher risk adjusted returns across most sectors of Australian credit, while maintaining diversity across the spectrum of household Australian names which are a mainstay of most equity portfolios but typically do not issue debt in AUD. This long list includes major corporates such as BHP, Rio Tinto, Brambles, Bluescope and CSL, to name only a few.

Where it makes sense to do so, the Yarra Higher Income Fund is investing in Australian issuers across major currencies and hedging out currency and interest rate risk to optimise risk adjusted returns. With a current yield at ~5% which we expect will increase alongside rising interest rates, the Fund remains well placed to continue delivering consistent monthly income to its investors.

Phil Strano is a Portfolio Manager, Higher Income Fund at Yarra Capital Management. The information provided contains general financial product advice only. The advice has been prepared without taking into account your personal objectives, financial situation or particular needs.