This time last year, it would have been brave to have predicted that 2020 would be the best year for the global Initial Public Offerings (IPO) market since 2007, as the World Health Organisation declared COVID-19 a pandemic in March and the negative economic impacts played out.

Yet global IPOs were up 62% year-on-year by capital raised – at US$333 billion – and up 21% by number of listings at 1,615 (Source: Dealogic).

However, it was a tale of two halves: the fiscal and monetary stimulus bolstered market sentiment in the second half of the year and many companies, particularly in the technology and healthcare sectors, benefited from a quickly-transformed world.

This boosted IPOs globally, as market volatility reduced from extreme levels. Three quarters of the year’s IPO proceeds were raised in the second half, equating to more than the total raised in all of 2019.

The world’s two largest economies hosted the largest IPOs of the year with the top five companies raising around US$4 billion each:

- Beijing-Shanghai High Speed Railway and JD Health in China

- Snowflake, Airbnb, and Pershing Square Tontine in the US. The latter was the largest-ever listing of a special-purpose acquisition company (SPAC).

Strong year for new listings across multiple sectors

[Upcoming Floats and Listings has information on latest IPO and recently-listed companies.]

ASX experienced a similar pattern to the global trend. The number of new listings increased 23% year-on-year to 113, three quarters of which arrived in the second half.

IPO capital raised was down 23% at $5.3 billion, but the market value of new listings, including IPOs, spin-offs, direct and dual listings, was up 148% year-on-year at $35.7 billion.

Four of the largest new listings of 2020 were not IPOs, but important additions to the menu of investment opportunities available on ASX, including:

- TPG Telecom’s (ASX:TPG) $16 billion merger with Vodafone Hutchison Australia and the listing of TPG Telecom as the combined group.

- Iluka Resources’ (ASX:ILU) $2.3 billion demerger of its iron-ore royalties business, Deterra Royalties.

- Magellan Global Fund’s (ASX:MGF) $2.3 billion listing of closed class units.

- GrainCorp’s (ASX:GNC) billion-dollar spin-off of United Malt Group (ASX:UMG).

There were IPOs in a broad range of sectors; 10 out of 11 sectors in the Global Industry Classification Standard (GICS) were represented.

The top three by number were materials (31), technology (19) and healthcare (13).

Price performance of ASX IPOs (+33.4%) significantly outperformed the broader S&P/ASX 200 index (-1.45%) in 2020, with metals & mining IPOs achieving average gains of over 50%.

Top 10 IPOs in 2020 by capital raised

|

Ticker

|

Company

|

GICS Industry

|

Capital raised $m

|

Market cap at

Listing $m

|

|

DBI

|

Dalrymple Bay Infrastructure Ltd

|

Transportation Infrastructure

|

1,286

|

1,286

|

|

NXL

|

Nuix Ltd

|

Software

|

953

|

1,685

|

|

LFG

|

Liberty Financial Group

|

Diversified Financial Services

|

321

|

1,822

|

|

HDN

|

HomeCo Daily Needs REIT

|

Real Estate Investment Trusts

|

301

|

644

|

|

ABY

|

Adore Beauty Group Ltd

|

Internet & Direct Marketing Retail

|

269

|

635

|

|

UNI

|

Universal Store Holdings Ltd

|

Specialty Retail

|

148

|

278

|

|

MGH

|

MAAS Group Holdings Ltd

|

Construction & Engineering

|

146

|

530

|

|

CSX

|

CleanSpace Holdings Ltd

|

Health Care Equipment & Supplies

|

131

|

340

|

|

DOC

|

Doctor Care Anywhere Group Plc

|

Health Care Technology

|

102

|

255

|

|

HPG

|

HiPages Group Holdings Ltd

|

Interactive Media & Services

|

100

|

319

|

Source: ASX

Metals and mining

A strong upward price trend in several commodities led to a flurry of IPOs by mining explorers, including those with gold, silver and copper assets. Gold and silver prices were driven by demand from investors seeking a store of wealth and a hedge against inflation risk, with interest rates falling to record lows and a weakening US dollar.

Traditionally, copper prices move in the opposite direction to gold given 'Doctor Copper' is driven by industrial activity and economic growth, whereas gold tends to be a safe haven in times of uncertainty.

However, in 2020, copper prices also increased, driven by demand from China as economic activity normalised faster than expected, an anticipated increase in the production of electric vehicles and renewable energy, and supply disruptions.

In mergers and acquisitions activity, SSR Mining (ASX:SSR) – a TSX and Nasdaq listed Canadian gold, silver, zinc and tin producer – listed on ASX through its $470 million merger with Alacer Gold.

Australian Strategic Materials (ASX:ASM), a materials technology company focused on producing high-tech metals and oxides, listed following a demerger from Alkane Resources.

Technology

The technology sector benefited from, and adapted well to, a global population in lockdowns or working from home. The COVID-19 crisis brought forward years of change in the way consumers and businesses use technology, from accounting and e-commerce to online communications and entertainment.

It followed that investors backed business models with high scalability, compared to more traditional companies that generate profits from fixed assets, demonstrated by software, fintech, and e-commerce IPOs on ASX.

Investigative analytics and intelligence software company Nuix (ASX:NXL) was ASX’s largest-ever software IPO, raising nearly $1 billion and trading up 55% following its December listing. Macquarie Group’s venture-capital arm had backed the business since 2011.

PlaySide Studios (ASX:PLY) was the first Australian games developer to list on ASX; it achieved aftermarket price performance of 130% within two weeks of listing.

Three non-bank lenders came to market, the latest to challenge incumbent institutions, including Liberty Financial Group (ASX:LFG), Plenti Group (ASX:PLT) and NZ-based Harmoney (ASX:HMY)

Companies with variations on the BNPL (buy-now, pay-later) business model hit the boards, including Payright (ASX:PYR), NZ-based Laybuy (ASX:LBY), and US-based Zebit Inc. (ASX:ZBT).

Associated with these companies was the dramatic movement of consumers towards online channels, reflected in IPOs of e-commerce companies Adore Beauty Group (ASX:ABY), MyDeal.com.au (ASX:MYD), Cettire (ASX:CTT), Booktopia Group (ASX: BKG) and Cashrewards (ASX:CRW), as well as online tradie marketplace Hipages Group Holdings (ASX:HPG).

The S&P/ASX All Technology index, launched in 2020, was up 45.3% on a calendar-year basis. Now with a market capitalisation of over $170 billion and 69 constituents, expect the index to expand further as more technology IPOs come to market and existing listings grow in size to meet eligibility criteria.

Healthcare

The COVID-19 crisis broadly raised awareness of the importance of healthcare, benefiting the sector from an investment perspective, but also benefiting some healthcare companies directly.

This was borne out in the IPOs of CleanSpace Holdings (ASX:CSX) , a manufacturer of respiratory protection equipment; and Global Health Investment Fund-backed Atomo Diagnostics (ASX:AT1), which offers diagnostic test solutions including for COVID-19 screening. Both companies gained around 50% in the aftermarket (from their issue price).

Other IPO highlights included: NZ-based soft-tissue regeneration business Aroa Biosurgery (ASX:ARX), backed by venture-capital firm Movac; and UK-based telehealth company Doctor Care Anywhere (ASX:DOC), with the telehealth industry expected to expand rapidly over the coming years.

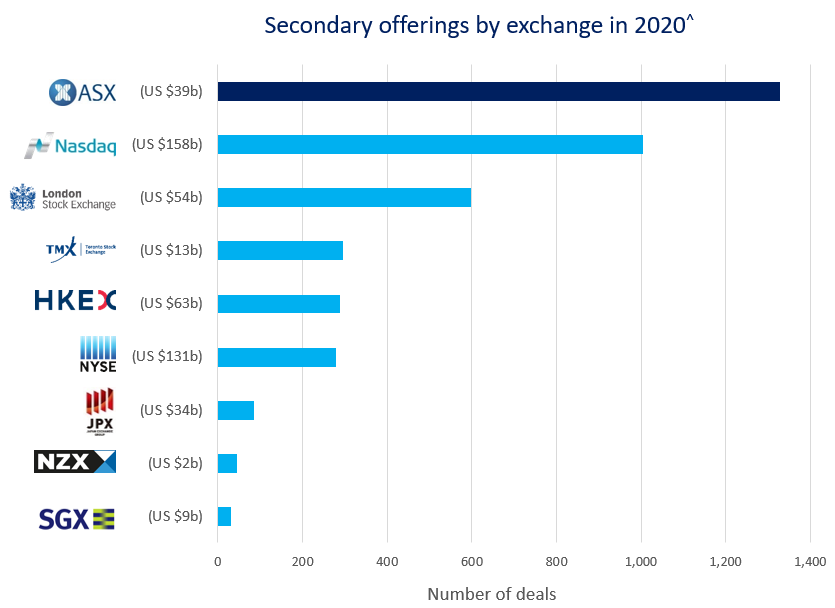

Secondary offerings at highest level in a decade

In the five years prior to 2020, the ASX averaged around $40 billion a year in secondary offerings. That is, the sale of new shares by a company that has already had an IPO.

Incredibly, $66 billion was raised in 2020 – the largest amount in over a decade – as many companies shored up balance sheets during the crisis and companies in higher-growth sectors, like technology, raised capital to accelerate growth initiatives.

In global terms, ASX ranked fifth by secondary capital raised and first by number of deals out of over 90 exchanges (Dealogic).

Source: Dealogic, 1 January to 31 December 2020; values in brackets show capital raised in US dollars. ^Includes placements, SPPs, rights issues. Excludes block trades, convertibles, DRPs, employee share schemes; value apportioned by exchange where applicable.

James Posnett is Senior Manager, Listings, at the ASX. This article is general information and does not consider the circumstances of any investor. This article will also appear in the ‘ASX Investor Update’ on Friday.