For global equity investors, investing in growth strategies proved a wise move over the past decade, particularly with the stellar performance of many technology companies. Unsurprisingly, global growth strategies have largely overshadowed global dividend strategies.

However, the macroeconomic forces that drove these stellar equity returns are being upended. Inflation continues to reach multi-decade highs and has become more widespread than many economists ever imagined.

We are moving into a new environment – from deflation to inflation, quantitative easing to quantitative tightening, globalisation to de-globalisation, and affordability to cost of living crisis – and against that backdrop, we have seen equity market leadership change and valuations compress. Consequently, the traditional growth/value divide feels less relevant today.

With global economic growth expected to slow significantly in 2023 and beyond, the path towards policy normalisation could still mean further interest rate rises. This has given way to rising volatility and reduced earnings growth visibility, putting strain on widely held growth strategies.

As investors contemplate which equity strategies might prevail, finding a complement to growth strategies will be key to achieving long-term investment objectives – even if growth comes back. Such solutions will require resilience in uncertain markets, an ability to select from a broad range of sectors, and long-term real return generation.

The road to resilience begins with dividends

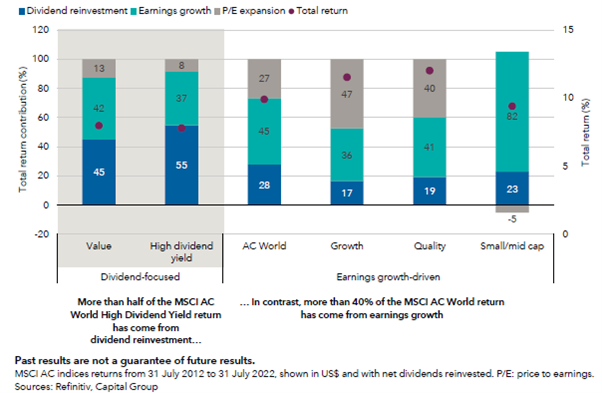

Conventional wisdom suggests that value stocks and dividend payers appear well-suited to the current environment, given their heavy reliance on dividend reinvestment for return generation.

Dividends have typically been the more stable component of equity returns over the years, relative to earnings growth and multiple expansion, comparable to the fabled tortoise against the hare.

Dividend-focused strategies can complement growth-focused strategies

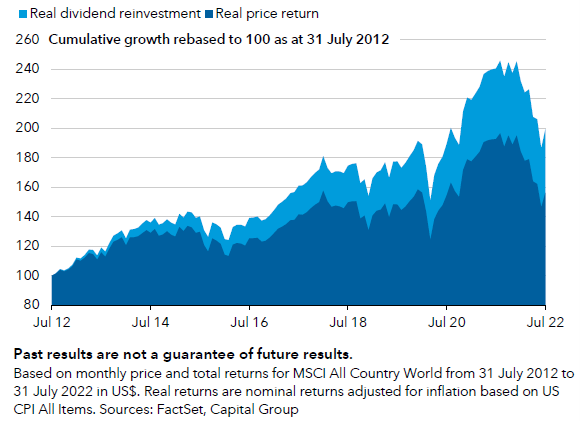

There is evidence of dividends’ steady but meaningful return profile throughout the last century; the average contribution to 10-year returns has been 40%[1], (although this decreased in recent decades as companies prioritised putting capital back into businesses and share buybacks over returning it to shareholders). Furthermore, except for the 1970s, dividend reinvestment has consistently kept pace with inflation.[2]

Dividends’ resilience are apparent in stressed markets as dividend payments have shown themselves to be less susceptible to deep cuts than earnings growth.[3]

Dividend growers: a strategy for all seasons

Dividend investing isn’t just for tough markets. It plays a powerful role in the generation of long-term returns, making it a sound strategic fit for investor portfolios.

Dividend investment has been important for long-term real returns

However, unlocking the potential rewards of dividends may require investors to consider investing beyond high yielding stocks to include dividend growers – stocks that pay and consistently grow a dividend.

These companies have historically been a compelling source of portfolio returns because of their risk-return characteristics. And as expectations for weaker economic growth and asset returns set in, dividend growers could become increasingly relevant.

The way we have characterised dividend growers over the years is by identifying companies that have typically been higher quality firms over high yielders, given their strong histories of profit and earnings growth as well as higher returns on assets, equity and invested capital.

Their solid fundamentals have enabled these companies to compound their growing income stream at levels greater than high yielders, rewarding investors with strong gains.

One of the potential benefits of focusing on dividend growth can be avoiding some of the pitfalls that come with high dividend yield investing. These pitfalls include:

Unsustainable dividend policies. A study by Wellington Management indicated that chasing the highest yield is unlikely to deliver the highest returns in the long run. The analysis ran from 1930 to 2021, looking at the behaviour of US stocks sorted by dividend yield. Over that period, the second-highest quintile outperformed the broad index 78% of the time – the highest score relative to all other dividend yield quintiles. The explanation for this was the significantly lower payout ratio. Payout ratios are a measure that help illustrate how sustainable a dividend policy is given its calculation of dividends relative to earnings. According to the study, from 1979 to 2021, the average payout ratio for the second quintile was 41% versus 74% for the top quintile.[4] A very high payout ratio can be indicative of limited growth or the dividend growth prospects of a company. What’s worse is that if the company’s earnings deteriorate, the dividend could be in jeopardy.

Higher likelihood of cutters. When it comes to dividend investing, one of the biggest threats to returns is a dividend cut. This is often a sign of financial distress. In fact, Ned Davis’ 2022 research covering the period 1973 to 2021 shows dividend cutters have endured the worst returns among dividend payers, delivering a loss of 0.5% p.a. with 25% p.a. volatility. In contrast, dividend growers and initiators have delivered a gain of 10.7% p.a. with 16.0% p.a. volatility, proving their strength.[5] Most recently, when dividend payouts fell sharply in 2020 to levels last observed in 2009, dividend cuts were almost 30% higher for high dividend yielding stocks in 2019 and 2020, according to S&P’s research on US stocks. This implies dividend growers could be less vulnerable to cuts.

Niche universe of dividend payers. High yielders have historically been confined to a narrow subset of stocks. Consequently, investors who focus only on high yield limit their investment opportunity set to a niche part of the market. Another area where investment risk is less balanced is equity factors, given the MSCI World High Dividend Yield index’s significantly higher exposure to value and large cap.

For investors, ongoing macroeconomic uncertainty and volatile markets continue to divide many on future equity leadership. But regardless of whether growth stocks return, or value stocks persist, we believe current conditions present an opportunity to build resilience through dedicated dividend strategies.

Even when economic conditions improve, we believe that dividends deserve to stay in a portfolio. By adopting a fundamental approach to identifying companies that can consistently pay and grow their dividends, investors can achieve long-term real return generation through the investment cycle.

Matt Reynolds is an Investment Director for Capital Group Australia, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.

[1] Based on S&P 500 total returns in US$ from 1930 to 2021. Source: Ned Davis Research

[2] Based on returns from 31 January 1938 to 28 February 2022 in US$ for S&P 500. Sources: Capital Group, Standard & Poor’s, Robert Shiller, Morningstar Direct, FactSet

[3] Based on MSCI World dividends-per-share and earnings-per-share drawdowns in US$. Sources: FactSet, Capital Group

[4] Based on research by Wellington Management, 2022.

[5] Based on US$ returns of S&P 500 stocks sorted by dividend policies from 1973 to 2021. Source: Ned Davis Research, 2022