The financial year-end performance data of industry super funds was met with suspicion from investors, advisers, and even between super funds. The regulator's recent commitment to update its practice guide (APRA's SPG531) on valuation methods cannot come soon enough.

However, the reality is the industry has come a long way in recent years. Many funds have clear valuation policies that involve external expert reports, asset revaluations are conducted during heightened periods of volatility to support member equity and board valuation sub-committees have been established. But the debate over superannuation fund valuations of unlisted assets continues to rage.

Growth in allocations to unlisted assets

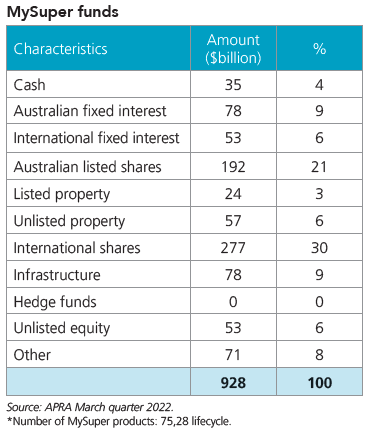

Many superannuation funds have embraced more use of unlisted assets recently. According to ASFA’s Superannuation Statistics, on average MySuper fund holds over 20% of assets in unlisted property, infrastructure, and private equity. Given the inflow profile and investment time horizon of some super funds, these large allocations to illiquid assets have remained manageable.

MySuper Funds’ Aggregate Asset Allocations

Source: ASFA Superannuation Statistics – May 2022

From the due diligence data Morningstar receives, the results for members have been impressive. Both AustralianSuper and Australian Retirement Trust's Private Equity programmes have generated returns in excess of 16% per annum over the last five years (as of 31 March 2022).

But APRA didn’t undertake their recent Unlisted Asset Valuation thematic review for nothing. The review highlighted:

“the need for considerable improvement in industry approaches to valuations and the need to conduct valuations proactively and regularly.''

Following the review and update of SPS530 – Investment Governance, APRA now intends to update SPG531 – Valuation. It is expected that the update will address valuation governance, valuation methodology (including independent assurances), frequency and monitoring of valuations and types of valuation risk.

Canva illustrates transparency need

Australia’s own start-up success story, Canva, is the subject of the most recent unlisted asset valuation controversy. According to U.S. SEC 'Statement of Investments' filing, Franklin Templeton Growth Opportunities Fund has written down the value of their Canva investment by over 58% already this year.

This write-down calls into question the valuation responses of the Australian superannuation funds that also hold this investment through their private equity programmes.

The answer became obvious in a recent Morningstar discussion with a large super fund about how private equity managers need to be more transparent in a world of heightened standards around environmental, social and governance (ESG) considerations, with a focus on transparent disclosure.

Whether the write-down taken by Franklin Templeton is precisely right isn’t the point. The point is it was transparently disclosed. But under SEC regulations, Franklin Templeton didn’t have a choice. Revealing the holdings and valuations isn’t just good governance - it’s the law.

Here in Australia, Portfolio Holdings Disclosure at the security level for unlisted assets isn’t required. Instead, the industry and media are trying to back-solve based on the inadequate disclosure currently required.

For example, Aware Super has publicly stated they own Canva, but based on the Portfolio Holdings Disclosures posted on its own website, the best guess is that the investment is held through a Blackbird Ventures position. As to the carrying value of the investment, it is impossible to say, although to be clear, Aware Super’s disclosure is compliant and more than adequate under the current regulations.

Resistance to transparency of valuations

There are lots of arguments against increasing levels of transparency. After all, the Portfolio Holdings Disclosure regulations were watered down following significant industry criticism of the draft regulations. But wouldn’t sunlight solve the ongoing suspicion in relation to unlisted asset valuations?

It's good enough for many of the large listed real estate investment trusts. For example, Scentre Group clearly publishes Westfield Bondi Junction’s valuation. It’s good enough for our offshore counterparts, as Franklin Templeton publishes Canva’s valuation along with DataBricks and its other listed and unlisted assets.

Obviously, no valuation is perfect, whether listed or unlisted, daily or otherwise. We all know that the listed equity market in the short run is a voting machine. But it is a transparent voting machine and one that applies the same price consistently across market participants.

Funds need to disclose their unlisted valuations

It’s doubtful many super fund members would be venturing in to check valuations, but regardless, better disclosure would create enough industry scrutiny around who was taking what write-downs, when, and using what methodology that it would put to bed the cloud of doubt and suspicion that currently exists.

If we are really going to resolve this once and for all, funds need to be regulated to disclose their holdings at the security level and associated valuations following quarter end. I’m not suggesting that this is a 10-business day post-quarter end proposition. But following an appropriate lag, this information should be made available to investors and the broader industry.

This will be the only way to quell the doubt that exists. Instead, the industry remains under a cloud of suspicion as to who really was the best performing fund of the year.

Annika Bradley is Morningstar Australasia's Director of Manager Research ratings. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published in Morningstar on 16 August 2022.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free, four week trial below:

Try Morningstar Investor for free