Sharemarkets around the world, including the ASX200, fell over 30% in only three weeks in early 2020, as investors began to factor in the likely impact of Covid-19. A fall of this magnitude has historically damaged retail investors, who were often late to the party, buying in toward the peak of the bull market, and quick to realise losses as the market fell.

A different response

But 2020 was a completely different story. Retail investors flooded to the sharemarket as stock prices fell, and enthusiastically bought up shares and ETFs throughout the lows, benefitting when the market returned rapidly to former highs. This was both a global and a domestic phenomenon, although Australia punches above its weight, having more direct share investors than Germany and the second highest of any country after the US.

The incredible rise in activity by retail investors in 2020 was considered to be a negative by many commentators. The fear was Australia may also be developing a Robinhood (later Reddit) army of leveraged and inexperienced traders who were destabilising the market, driving share prices to unthinkable levels and likely to lose their shirts in a downturn.

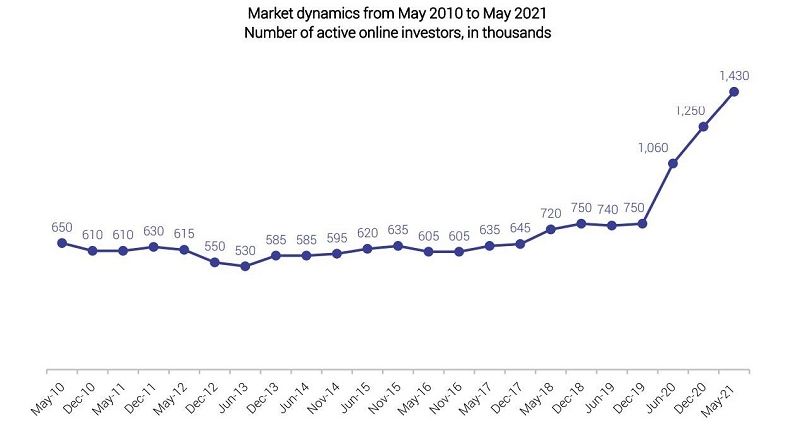

Number of retail online investors

Source: Investment Trends, May 2021 First Half Australia Online Investing Report.

Typically, though, new investors in 2020 were just like existing investors. They were keen to build wealth in the sharemarket, and sufficiently knowledgeable to ‘buy the dip’. nabtrade saw an increase of more than 30% in total investors in 2020. The average new investor was slightly younger, slightly more likely to be female and somewhat less wealthy than existing investors. These factors are usually true of new investors, as those with existing share portfolios are generally older, more likely to be male, and much more likely to have benefited from asset price appreciation.

New investors, not new speculators

Contrary to concerns about irrational behaviour, both new and existing investors saw 2020 as an opportunity to buy high quality shares at a discount. Cash balances had risen to record levels by February 2020 and were put to good use as investors bought into the falling market. The buy-sell ratio was higher than 3:1 from late February to end July.

The average investor bought less than 10 shares, the most popular of which were the big banks, Afterpay and Zip Co and three key travel stocks (Qantas, Flight Centre and Webjet). An ASX200 ETF also featured in the top 10, although if all ETF products covering the ASX200 were aggregated, they may have made the top 5. Young investors were twice as likely to buy an ETF as older investors.

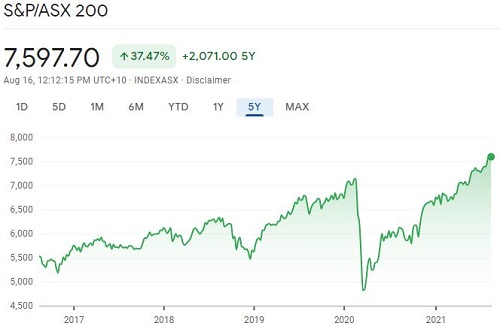

Here's a five-year chart of the ASX200 showing the rise to March 2020, the buying opportunity created by Covid-19 and the quick recovery.

Source: Google Finance

Generally, investors are sitting on profits from well-timed purchases in 2020, and even those who were fully invested prior to the crash have seen the index rise above its pre Covid highs.

What has 2021 delivered?

After such an extraordinary year, retail investor behaviour in 2021 was always going to be interesting to watch. Would investors turn to trading to eke out further gains? Would they be astonished by their good fortune, and sell to lock in profits, or hold tight to their winners? Would they continue to trade ‘reopening’ stocks and favourites from 2020, or look to other sectors for upside?

In short, investors have adapted quickly to an entirely different kind of market in mid-2021. As volatility has fallen away, so has activity. Many are clearly concerned about another fall in the market, as cash balances are now well above their pre Covid peak. In a zero interest rate environment, this is more of a reluctance to take risk than an asset allocation choice. Investors are much less likely to buy new shares than they were in 2020, with sell trades now slightly outweighing the buys. And the nature of the shares traded has also changed, with less interest in anything perceived to be ‘risky’.

Interestingly, with the exception of BHP, investors had been largely indifferent to the large cap resources companies in previous years (although small cap miners attract a specific subset of investors and traders during all periods but are not widely represented). The soaring iron ore price has changed that, with Fortescue Metals now nabtrade’s most traded stock.

Rolling border closures and lengthy lockdowns have exhausted interest in the travel sector, and none of the aforementioned travel stocks has consistently made the top 10. And while Zip is sufficiently volatile to attract active traders, Afterpay is less favoured than it once was (note, this article was written just as Square's offer was made for Afterpay). Instead, investors have looked to Telstra, CSL and Woolworths, as blue chips return to favour. One consistent buy is the ASX200 ETF, as newer investors look to build wealth through dollar cost averaging.

After the wild ride of 2020, investors appear to be settling in for the long haul.

Gemma Dale is Director of SMSF and Investor Behaviour at nabtrade, a sponsor of Firstlinks. This material has been prepared as general information only, without reference to your objectives, financial situation or needs.

For more articles and papers from nabtrade, please click here.