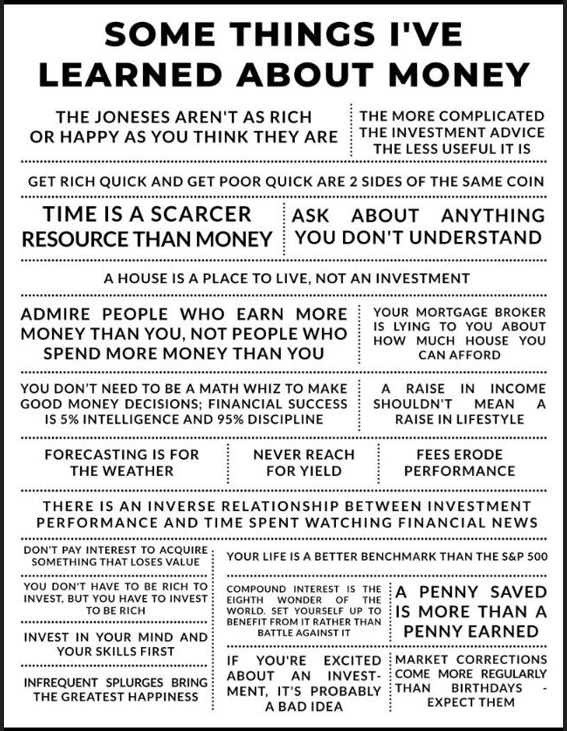

In his book, The Laws of Wealth, behavioural finance expert Daniel Crosby offers this one-page summary of the most important lessons on money:

There are good lessons here as well as some that may be best ignored. Let’s go through them one-by-one:

1. The Jones’ aren’t as rich or happy as you think they are.

This lesson reminds me of a story by finance author Morgan Housel about his days as a hotel valet:

“In college, I worked as a valet at a fancy hotel in Los Angeles. When an expensive car drove in, I used to always think, “Wow, he’s rich!” But as I got to know these “rich” people, I saw a different side. A few opened up about their finances (people love talking to valets), and I couldn’t believe their stories. Some of them weren’t that successful. Certainly not like I imagined. Instead, they made modest incomes and spent most of it on a car. It’s amazing how fast you can go from admiring someone to feeling bad for them.

I learned something from that. When you meet someone who owns a $100,000 car, you only know one thing about their wealth: That they have $100,000 less in the bank, or $100,000 more in debt, than they did before they bought the car. That’s the only information you have.

We rarely think of it that way. So much of our perception of wealth is driven by what we see other people buying. Since we can’t see their bank accounts, that’s all we have to go on. But it gives us a distorted view of wealth. Some people we think are wealthy really aren’t; they just spend most of their income. Others we think of as less well-off are actually the rich ones. They’re rich not despite driving the old car, but because of it.

Financial wealth isn’t what you see. It’s what you don’t see.”[bold type added]

Comparing yourself to others creates envy. And envy is a shortcut to despair. As Warren Buffett’s business partner, Charlie Munger, says: “Envy is a really stupid sin because it’s the only one you could never possibly have any fun at. There’s a lot of pain and no fun. Why would you want to get on that trolley?”

Maybe that’s why the Stoic philosopher Seneca described a wise man as “Content with his lot, whatever it be, without wishing for what he has not …”

2. The more complicated the investment advice, the less useful it is.

Complex financial advice often comes with more risk or more fees going to an adviser. Simple advice and strategies are less profitable for advisers yet can be the best options for individual investors to follow.

3. Get rich quick and get poor quick are two sides of the same coin.

Making a fast buck will inevitably involve taking large risks. Put another way, the greater the returns on offer, the greater the risks.

When you hear of a hedge fund making 600% in a year, or a friend who punted big on a small cap and made a lot of money, it likely means they took on large risks, perhaps with leverage. And it could have easily turned out poorly for them.

4. Time is a scarcer resource than money.

This is a lesson that gets repeated by financial authors who write more about self-help than investments (how did self-help infiltrate finance?), but it’s one I disagree with. Time isn’t a scarce resource, it’s just that we’re experts at wasting it.

I can think of many examples where the lesson doesn’t match with reality. For instance, I speak to my retired parents and their friends, and they have all the time in the world to fritter away. Yet I’m sure they’d all love more money, no matter what their circumstances.

5. Ask about anything you don’t understand.

A ‘hard agree’ on this one. There’s no such thing as a dumb question.

6. A house is a place to live, not an investment.

You can tell this is an American author, not an Australian one! In Australia, it might read: “Every Australian has the right to have a house as an investment.”

More seriously, it’s amazing how this simple lesson has been ignored over the past 30 years.

7. Admire people who earn more money than you, not people who spend more money than you.

Not sure I agree with this one. Why admire people who earn more money than you? It seems to me that there are far more admirable human traits than earning more money. Wisdom, kindness, compassion, happiness, leadership, intellect, creativity, to name a few.

8. Your mortgage broker is lying to you about how much house you can afford.

This shouldn’t be a lesson though it aligns with Warren Buffett’s famous saying that you shouldn’t ask a hairdresser if you need a haircut.

9. You don’t need to be a maths whiz to make good money decisions: finance success is 5% intelligence and 95% discipline.

If you want to get really wealthy from investing, you will need to be a maths whiz. Warren Buffett, Jim Simons, George Soros – all are maths geniuses. For the rest of us though, discipline is key.

10. A raise in income shouldn’t mean a raise in lifestyle.

This is a good one. British entrepreneur James Caan once said that upon selling his company, he was advised to hold off spending any of the proceeds for 12 months. It was a cooling-off period before he decided on how to spend the money.

A cooling-off period is a good idea for anyone getting a raise or a bonus or any other windfall.

11. Forecasting is for the weather.

Mostly true, though not totally true. Wharton Professor Philip Tetlock suggests there are ‘super forecasters’ out there yet they’re rare, niche experts who focus on forecasts of less than 12 months. Any forecasts beyond 12 months are largely worthless, he says.

If you aren’t a rare, niche expert, the lesson is worth following.

12. Never reach for yield.

Yes! It’s critical to remember that dividends rely on earnings. Dividends can’t continually grow if earnings don’t. And earnings growth depends on the quality of the company. That’s why Morningstar advocates buying stocks with ‘moats’, or sustainable competitive advantages.

13. Fees erode performance.

Wherever John Bogle is, he’ll be nodding. Bogle founded Vanguard on the premise that low-cost index funds would outperform most investment funds, largely because of the latter’s fees. The premise has revolutionized the investment industry over the past 40 years.

14. There is an inverse relationship between investment performance and time spent watching financial news.

This is cute, though not entirely accurate. I think the point it’s trying to make is that if you spend all day watching Bloomberg news, you’ll be more inclined to trade stocks, and the constant trading of stocks will lead to subpar investment performance.

The flip side is that being better informed about finance issues is a good thing. Watching and reading about investments can make you a better investor.

As with life, being selective about what you consume is important too.

15. Don’t pay interest to acquire something that loses value.

Crosby likely had cars in mind and it’s a good rule.

16. You don’t have to be rich to invest, but you have to invest to be rich.

This reminds me of a quote from Robert Allen: "How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case."

17. Invest in your mind and your skills first.

Investing your money and time in other things such as your health as well as your family and friends are also important.

18. Infrequent splurges bring the greatest happiness.

I’m not sure what science says about this, though it rings true in my life.

19. Your life is a better benchmark than the S&P 500.

Or the ASX 200. Money is just one component to living a good life and should never become your whole life.

20. Compound interest is the eighth wonder of the world, set yourself up to benefit from it rather than battle against it.

Warren Buffett started his investment firm, the Buffett Partnerships, in his 20s, and had a net worth of US$1 million (US$9 million in today’s money) by the time he was 30. Since that time, till now at the ripe age of 92, Buffett has compounded his money at 22% annually to be the world’s sixth richest person, worth around US$113 billion.

Yet his net worth could’ve end up very differently if he’d started his investing career later and retired earlier. If he’d saved US$25,000 by the time that he was 30 and retired at the age of 60, yet still compounded his money at same rate of 22% p.a., then Buffett today would be worth closer to US$12 million or just 1/10,000th of his current fortune.

That’s the power of compounding, and it’s a lesson that should be drilled into children and adults alike.

21. A penny saved is a penny earned.

Thomas Stanley writes of seven common traits among those who’ve accumulated wealth in his best-selling book, The Millionaire Next Door. One of the key traits is frugality –the wealthy live well below their means and save more than they earn: “They became millionaires by budgeting and controlling expenses, and they maintain their affluent status the same way.”

22. If you’re excited about an investment, it’s probably a bad idea.

Recently, my brother-in-law contacted me and suggested that electric vehicles were the future and key suppliers such as lithium miners would make good investments. My response was that a lot of investors were thinking along similar lines, and that means it’s probably a bad idea.

23. Market corrections come more regularly than birthdays – expect them.

If you define a market correction as a market decline of 20%, then this lesson is false. However, the point is valid. Markets go up and they go down, and you need to be able to handle both with equanimity.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information.