Many investors wonder how Exchange Traded Products (ETPs), including Exchange Traded Funds (ETFs), that track international markets are priced on the ASX when the underlying offshore markets are closed. Australians often find out how the US market has performed overnight by listening to the news whilst heading to work or reading the paper with their morning coffee. This can lead to some confusion, as although a news report might say the S&P 500 or the NASDAQ has moved by a certain percentage overnight, this price change is often not exactly reflected in the opening price of funds (which aim to track these indices) when the ASX starts trading from 10.00am.

A typical question we receive is “The S&P 500/NASDAQ etc. did +% or -% last night – why isn’t my fund doing the same?”

Futures markets continue to trade when stock exchanges are closed

There is a ready answer. These differences are explained by the differing time zones in which the international exchanges around the globe operate, and the fact that futures markets operate continuously around the clock even when certain exchanges are closed.

We’ll use the BetaShares NASDAQ 100 ETF (ASX Ticker: NDQ) as an example (and ignore the effect of currency fluctuations).

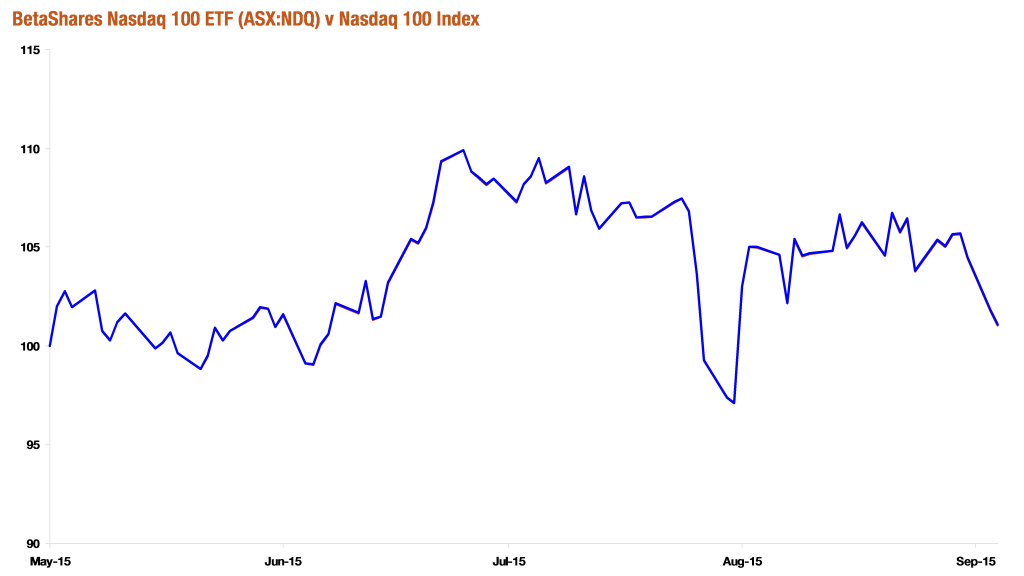

When tracking its benchmark index (the NASDAQ 100 Index), NDQ has performed well since inception. The chart below shows NDQ vs. the NASDAQ 100 Index. Although you can’t see it, there are actually two lines being plotted here (the two lines are virtually indistinguishable from each other).

Period 26 May 2015 to 30 September 2015.

Source: BetaShares. Past performance is not an indicator of future performance.

Time zones and fund pricing

The charts below show the respective returns of the NASDAQ 100 Index and the Nasdaq 100 Futures Market on 1 September 2015 (NYC Time) and examine how these reconcile with the pricing of the BetaShares NASDAQ 100 ETF when it opened on the ASX on 2 September 2015.

At the close of the US ‘cash’ equities markets at 4pm (New York time) 1 September 2015, the value of NASDAQ 100 Index – based on shares trading on this market – was down 3.08% on its closing value of the previous day. This is the figure typically quoted in news reports in Australia over morning coffee. These reports will say, for example, “the Nasdaq closed down 3.08% today.”

Yet it should be noted that the ASX market won’t open until 10am Sydney time, or around 4 hours (depending on daylight savings) after US equity markets have closed. Will the 3% decline in the market still be relevant? After all, market sensitive news is still being released. Indeed, it is often the case that companies release important new information after the US cash equities markets (like the New York Stock Exchange) have closed for the day.

New information is in the price when ASX opens

This new information is reflected in the NASDAQ 100 Futures Market, which continues to trade even after the US equity market has closed. The chart below shows the price of the NASDAQ 100 Futures. As might be evident, the futures price tracks the actual Nasdaq 100 cash index quite closely when US equity markets are open.

The gap between the second red line and the green line, however, shows the performance of the NASDAQ 100 Futures prices between the time of the US equity market’s close and the ASX open. As seen, on this day, the NASDAQ 100 Futures price rallied by 1.16% in this period, perhaps reflecting the release of some positive market news.

Here’s the important point: the market makers involved in the Australian-listed NDQ ETF will set opening prices for the Fund with reference to the NASDAQ-100 Futures market as at ASX’s market open. It is the best indicator of fair value while the US equity market is closed.

The opening bid-offer prices of NDQ ETF will reflect the higher NASDAQ-100 Futures price at the time the ASX opens. What’s more, the closing bid-offer prices of NDQ ETF will reflect the price of Nasdaq-100 Futures at around the ASX close at 4pm Sydney time.

It follows that the overnight percentage changes will reflect the percentage changes in the NASDAQ-100 Futures price at the time of the ASX close the day before and at ASX open the following morning. Due to the timing gaps with the opening and closing times of the NYC, these movements will often not mirror those of the actual NASDAQ physical index.

To be precise, the actual opening and closing recorded prices of NDQ ETF will depend on the time at which the first and last trades take place on that day, which should be close to 10am and 4pm respectively though not necessarily exactly at those times. That means that if, for example, the last trade of NDQ ETF takes place at 3.45pm then the closing prices will be reflective of the Nasdaq-100 Futures price at 3.45pm.

Matthew Leung is a Business Development Associate at BetaShares Capital, a leading provider of Exchange-Traded Products.