Dear friends, colleagues, and fellow rockers

The quest for stable and inflation protected investment ideas grows as the era of market uncertainty ingrains itself for what looks to be a long and bumpy roller coaster ride. Such tumultuous and volatile market conditions, coupled with capital inadequacy, threatens to impact when baby boomers can retire, if and when they do, and how comfortably they can do so. Increasingly, the luxury and ability to retire at the age of 65 is looking more and more like a distant dream.

Pete Townshend may have once said never to trust anyone over 35, but today at 68 years himself, no doubt he's changed his tune. Actually, it's the rock and roll stars we baby boomers grew up on who are the best examples of working WELL beyond 65. The Rolling Stones, for one, are touring North America this northern hemisphere summer. Not bad given that Mick Jagger himself turns 70 in just one month's time. But for rock lovin' baby boomers wanting to retire in comfort, however, perhaps we're immunizing against the wrong CPI target.

No, am not referring to health care inflation, which is near twice the rate of CPI. Nor am I referring to food inflation, which here too dwarfs the official CPI levels. Rock and roll may never die, but the cost of seeing it is killing us.

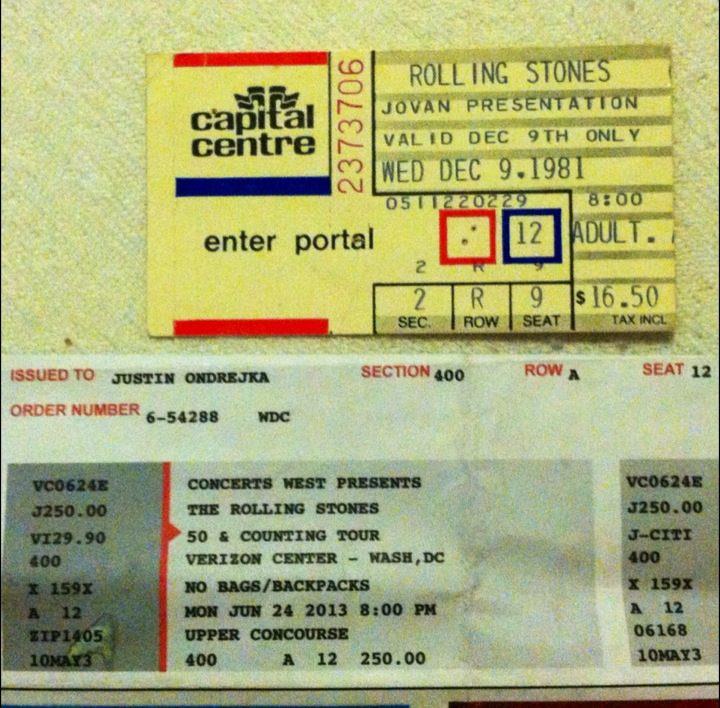

Courtesy of a high school friend, who I've happened to share many a rock concert WAY back when with, I received a photo which speaks in volumes to the aforementioned. My friend sent me two ticket stubs: one of last night's Rolling Stones concert in Washington DC; and another of a Rolling Stones concert we both attended was back in 1981. Same rock band, same city, same venue, and very near same seats. Way back in 1981, to see the Rolling Stones would set you back a whole US$16.50. Today, to see these now septuagenarians rock on stage would set you back US$250! In 32 years, the price of a Rolling Stones ticket has risen by 15X! I tell you, baby boomers have no chance immunizing their retirement portfolios towards such luxuries.

Consider the following stats. Back in 1981 the average US household weekly gross salary was US$340, compared to today's gross weekly salary of US$930. From 1981 through to 2013, the average weekly gross household salary rose by a nominal 1.74% annually. During this same time period, the price of a movie ticket rose nominally by 1.9%, whilst the price of a gallon of petrol rose by 1.5%. The cost of a Rolling Stones ticket, however, rose nominally by 8.6% pa. I wonder what impact this would have if the statisticians would dare to include the price of Rolling Stones in their CPI calculations?

Perhaps this increase has more to do with demographics than just CPI calculations? Well consider this. The affordability of seeing a movie, or cost of driving to the movie theatre, has not changed much over this 32 year period. But the same cannot be said for Rolling Stones. Back in 1981, seeing the Rolling Stones would only deplete 5% from one's weekly gross salary. Today? Seeing these aging, diamond-stoned rockers deplete a whopping 27% of the average US household income.

Either way you look at it, and to paraphrase the Stones, what a drag it is getting old.

Rob Prugue is Senior Managing Director and Head of Asia Pacific at Lazard Asset Management.