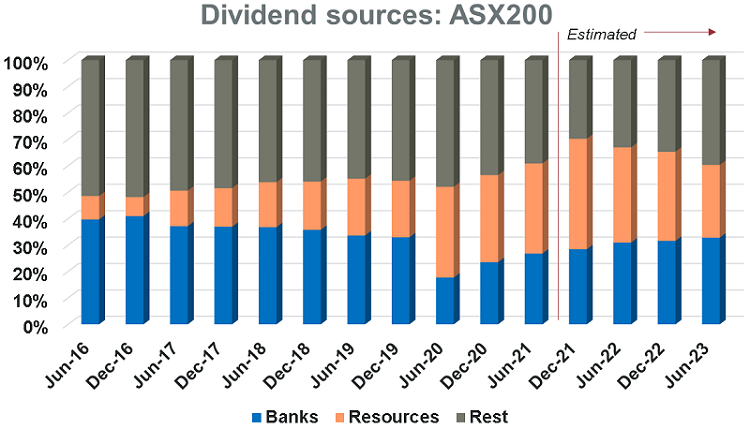

The upcoming reporting season will affirm how the global COVID-19 pandemic has impacted businesses and sectors in different ways. Aggregate dividend payments over the next 12 months will likely be back in line with that paid in calendar 2019 pre-COVID. However, the sources of these dividends will be different to previous years.

Dividend conservatism

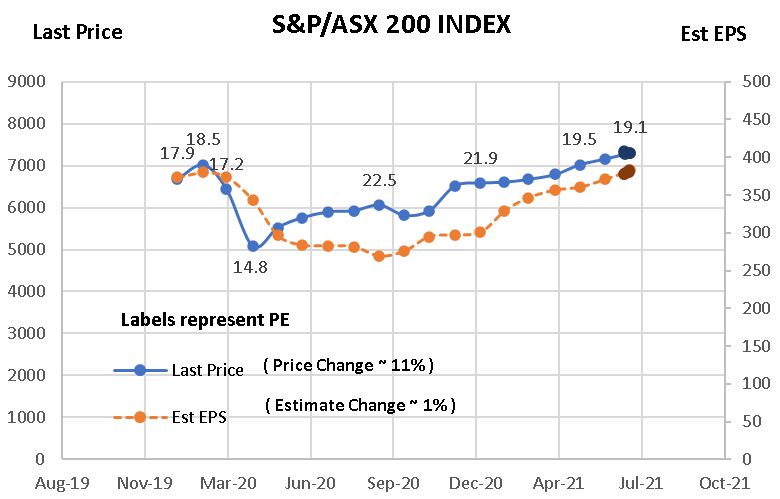

The Australian equity market has now returned to its pre-February 2020 highs, at least in price terms. For the S&P/ASX200 Index, forward earnings estimates have returned to pre-COVID levels while share prices are, on average, 11% above pre-COVID highs.

Source: Redpoint, Bloomberg

But while the unprecedented fiscal and monetary policy settings are reflected in share prices, corporates have so far been more conservative and held back on dividend payments.

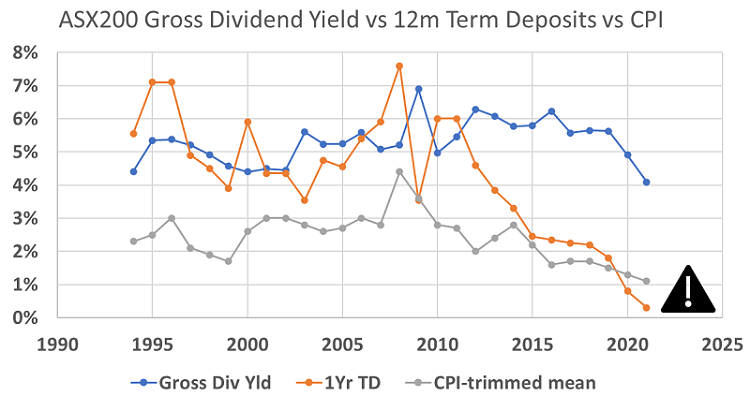

This conservatism in payout ratios has been a double hit for self-funded retirees who have also seen interest payments on cash deposits cut at the same time.

Source: Redpoint, Reserve Bank of Australia

Inclusive of franking credits the ASX200 has delivered an attractive yield relative to term deposits over the long term and especially over the past decade. Driven by underlying economic growth, the resilience and rise in share prices is also a characteristic of dividend payments through time.

Furthermore, Australian corporates continue to favour higher payout ratios due to the Australia’s policy of tax credits associated with company dividends.

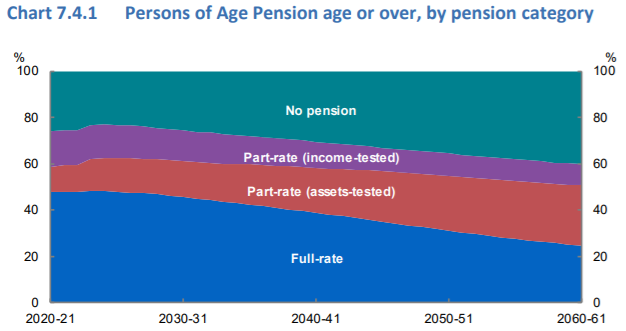

This important policy pillar supports the retirement savings system and will enable appropriately constructed equity portfolios to play their part in an effective retirement income strategy. The Australian Government’s 2021 Intergenerational Report is forecasting that over 40% of retirees will be self-funded by 2060, and less than 25% will be drawing a full government pension (versus 50% today).

Source: 2021 Intergenerational Report: Treasury, Australian Government

Dividends returning but slightly different to before

Australia’s mining sector is set to be the star of the upcoming corporate reporting season in Australia. Record profits are expected from companies involved in iron ore mining thanks to record high prices. Companies such as Fortescue, Rio Tinto and Mineral Resources should deliver record dividends in the coming weeks.

Government financial support has ensured that retail spending has remained robust. Retailers such as JB Hi-Fi and Kogan have been beneficiaries and have rewarded investors with growing dividends. Supermarkets have also benefited from the ‘stay-at-home’ thematic, with Coles and Metcash paying a growing dividend stream over the past two years.

Healthcare has also delivered on dividends with plasma giant CSL, protective-wear specialists, Ansell, and equipment manufacturer Fisher and Paykel Health all growing their dividends (albeit this growth has not translated to share price growth for CSL, which currently trades at 20% below its pre-COVID highs).

The IT sector has been a standout winner in the past year driven by the fall in interest rates and the perceived stability in their revenues regardless of whether workers are in the office or at home. Global logistics software specialists Wisetech is on track in 2021 to almost double the 2020 dividend. Similarly, global security specialists Codan has grown dividends by 50% in 2021 versus 2019 levels. Both companies pay fully franked dividends, albeit they are a low yield.

This highlights that income-focused investors need to ensure their income generation also provides some exposure to earnings and dividend growth and not simply focus on high yield alone. Wisetech remains slightly below its pre-COVID highs while Codan trades at $17, more than double its pre-COVID high of $8.

For the banking sector, Australia’s banking regulator, the Australian Prudential Regulation Authority, dropped restrictions that banks limit dividends to 50% of profits in mid-December. This enabled an increased dividend from all four of Australia’s largest banks in the first half of this year. CBA is likely to further increase its dividend in August after being more cautious in February, with the remaining three seeing economic conditions improve in early 2021 before paying increased dividends in May. The rollout of product innovations and divestments in the sector could be a catalyst for earnings growth moving forward.

On the other side of the ledger, COVID-19 has been devastating for industries such as tourism and travel. After promising signs through the start of 2021, new lockdowns mean it is unlikely that operating conditions will improve soon but investors need to be aware of the potential for mergers and acquisitions as conditions improve.

Just like driving: look forward, not back

Being distracted by a high historic yield can be detrimental to investment outcomes. High yields can often hide low growth, business stress or a failure to properly reinvest to support future growth.

Source: Redpoint, ASX, IHSMarkIt

Research indicates that a focus on historical yield has consistently underperformed the ASX200, and by taking a forward-looking approach to dividend yields, opportunities can be found.

Don't focus only on high yields

The market goes through phases where dividends and companies that pay dividends are in demand, and other periods when they are not. The past 15 months are a brutal reminder of investor appetite for growth and risk versus cashflow and dividends.

Some income-focused strategies commence with defining an investible universe based on higher dividend yielding stocks. Some strategies start with a specific income style and then seek to identify the highest yielding stocks within that sub-group. This can be rewarding at times when dividend-paying companies are in greater demand but can be harmful to overall returns at other times.

Being constrained to invest in just a subset of the market can also lead to less consistent dividend capture if particular sectors of the market are impacted by a change in business conditions while others are not. This is where risk management and a diversity of stock selection views can deliver an investment edge versus a singular focus on high yield alone.

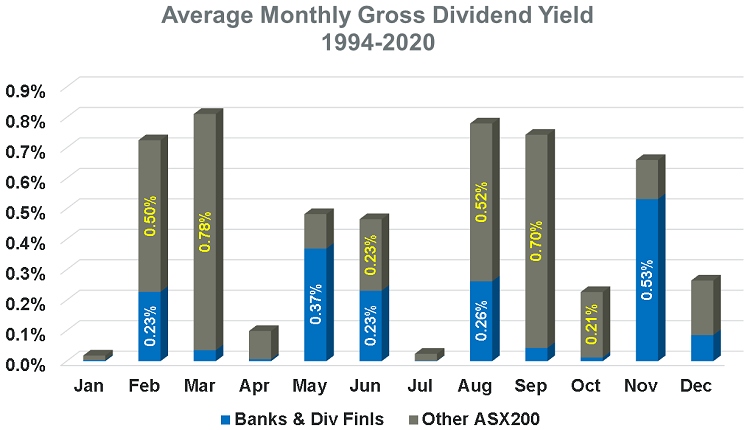

Different companies pay dividends at different times during the year. There is an opportunity for a dynamic approach to trade across these different times to capture an overall above-average income yield while retaining exposure to higher growth stocks. Of course, investors need to abide by holding period rules to ensure they not only capture the cash dividend but also any tax credits attached.

Source: Redpoint, ASX

Capturing a consistent dividend yield from equities cannot be a set and forget endeavour. Building a portfolio from last year’s best-yielding stocks has delivered above average dividend income but has consistently underperformed the index overall.

The goal for most income-seeking equity investors should be to earn a consistent and above average yield on their capital, including an appreciation of the calendar and industry profit cycles can assist with this goal. While the last year has been one of the most challenging in history, it has also highlighted the opportunities for a more dynamic perspective into how investors should seek to capture income from equities.

Max Cappetta is Chief Executive Officer and Senior Portfolio Manager at Redpoint Investment Management, a specialist investment manager partner of GSFM, a sponsor of Firstlinks. This information is of a general nature only and is not financial product advice. Opinions constitute our judgement at the time of issue and are subject to change, and do not consider the circumstances of any investor.

For more articles and papers from GSFM and its partners, click here.