Every quarter, the ATO releases an SMSF statistical report. It is usually followed by an influx of commentators, usually non-SMSF specialists, deriding the SMSF sector for asset class concentration and lack of diversification, particularly in relation to international exposure.

These claims are usually based on false assumptions that are not from the ATO but by the commentators.

The key mistakes made by some analysts are that:

1. the data is as at the quarterly publication date

2. the ATO is reporting actual asset allocation

3. all superannuation asset allocations have been reported in the same way.

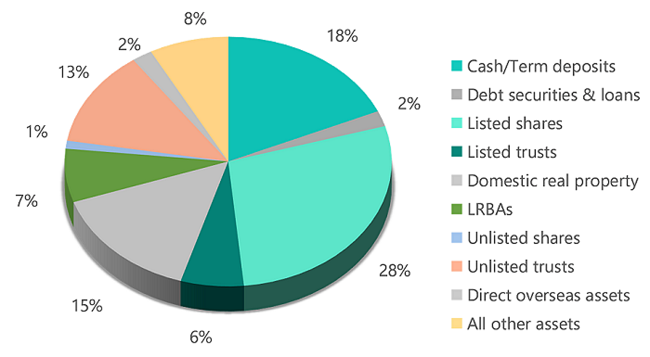

Here is the latest ATO data published in September 2021, supposedly effective for 30 June 2021.

Source: ATO SMSF statistical report 30 June 2021

So why should these assumptions be looked at more closely and why is care needed when using the data for determining how SMSFs invest?

We need to examine where the data comes from and what is its real use.

What date applies to the data?

The ATO’s source of SMSF investment data is Section H the SMSF regulatory return that is lodged each year. The timing of the actual lodgement will depend on the SMSF which may mean its return may not be lodged until May the following year.

As a consequence, the primary source of data now is still the FY2020 returns, not the 2021 returns. We also know that the ATO does take some time to analyse each year's regulatory return data as they publish an annual statistical summary and the latest was published in March 2021 based on the 2018-19 data, which suggest there is still a wait before the 2020 data will be ready.

This means the statistical report published in September 2021 is at best an extrapolation of the 30 June 2020 data. At its worst it is extrapolation of FY2019 data only which means some data is 27 months out of date by September 2021.

SMSF cash holdings overstated

The time delay in reporting means any actual investment decisions made by all SMSF trustees since 1 July 2020 are not directly reflected in the September 2021 publication. This is most obviously reflected in the cash holdings for SMSFs.

Most contributions received by the SMSF sector are NOT employer contributions, particularly Superannuation Guarantee (only 20% of all super contributions received by SMSFs) as is the case for APRA funds (80% of all contributions made to these funds) which are required to be paid quarterly throughout the year (APRA funds are the large institutional funds).

Most SMSF member contributions are made in the June quarter each financial year and often not invested by 30 June each year (but may well be invested after 30 June) resulting in an overstatement of the level of cash in SMSFs.

In addition, 45% of SMSFs are partially or fully in pension phase compared with about 15% of the amount in APRA funds. SMSFs have negative cashflow from contributions versus benefit payments compared with APRA funds and thus hold a higher amount in cash to meet their pension obligations.

The combination of accumulation funds having year-end contribution receipts and pension-paying funds holding cash to make payments results in a higher than average cash level on the 30 June reporting date.

The classifications are not even asset classes

The categories in the SMSF regulatory return are not asset classes but structures. That is, how does the SMSF hold its assets and where are the structures based.

The major classifications are Australian managed investments, Australian direct investments and overseas direct investments. While some of the direct investment classifications align with asset classes (such as real property) this is not the case for others.

For example, in the case are listed and unlisted trusts (of which managed investment schemes such as managed funds are the most common), the classification does not reflect the type of assets in the trust. Allocating these funds to a specific asset class is speculation. Managed funds can invest in a range of different asset asset classes from diversified funds (balanced or growth funds), sector or even sub sector specific (international equities, small caps, mortgage) or even specific purpose funds (income funds, absolute return etc).

Listed trusts are vehicles investing in real property, ASX-listed shares, international shares, private equity and specialist assets or business sectors. The listed share category includes Listed Investment Companies (LICs) and ETFs in this category.

This results in commentary, particularly about underexposure to international markets, based on the tiny percentage of directly-held international assets. The reality is that most international assets are held through vehicles such as managed funds and more recently, ETFs.

The ATO data is also significantly different from the categories APRA uses to collect investment data about those funds, which is not sourced from those funds' tax returns.

What is the ATO really reporting?

So, this begs the question why does the ATO classify the investments this way?

The rationale for this classification is about data matching of fund income. As anyone who has seen e-tax, the ATO can pre-populate a significant range of income sources for a taxpayer and that potentially includes an SMSF, even if the ATO does not provide this.

This is achieved as investment providers are required to collect the Tax File Number of the investor. These bodies then provide information to the ATO about the income they earn and pay to each investor.

So, if you earn interest from an investment then the bank, note or debenture issuer will advise the ATO the amount of interest you were paid along with your name and TFN. For listed securities, the registry provides the dividend details (cash dividend and franking amount) as well as your details.

If you invest in a managed fund, a wrap platform or managed account, the product provider has a similar obligation to provide an Annual Investment Income Report to the ATO. It outlines the underlying taxable transaction that gave rise to a taxable income for the investor. This includes interest, dividends (including franking credits) and realised capital gains.

Even small entities have reporting obligations that allow this data matching, and trusts must provide trustee beneficiary statements attached to the trust tax return.

It's little use for asset allocation

All this data does is enable the ATO to verify both where the SMSF holds its investments and the taxable income it declares in its tax return against information already provided to the ATO.

So next time an analyst or commentator uses this asset allocation data, think again about what it really is.

Philip La Greca is Executive Manager of SMSF Technical and Strategic Solutions at SuperConcepts, a leading provider of SMSF services.