Managing assets in retirement presents a significantly different challenge from the accumulation of wealth phase. Retirees generally have less capacity for risk together with a reduced ability to rebuild wealth once they’ve started depleting assets by drawing off income and selling assets for living expenses.

Unfortunately, there aren’t many retirees who’ve built the necessary wealth to live solely on investment income. Assuming a 4% yield on an Australian equity portfolio – which for retirees can be further buoyed by a generous dividend imputation credit system – nearly $700,000 is required to be invested to maintain a modest level of income (defined by ASFA as $34,687 per annum for a couple).

This figure is far above current average super fund member balances and yet still does not allow for the necessary growth required to maintain purchasing power. For a comfortable level of income in retirement (defined by ASFA as $59,808 per annum for a couple), the balance needed is $1.2 million, which is only a dream for many.

Disadvantages in the decumulation phase

In accumulation, monies are regularly invested via employee and employer contributions and investors can harness the power of ‘dollar cost averaging’. In a volatile world, if the market falls, the investor ‘averages down’ and buys more assets when prices are low, thereby enhancing overall returns. But, these advantages are reversed in the decumulation stage of retirement. On average, monies are removed when prices are low but cannot be replaced as fresh contributions are no longer applied. For markets that remain broadly static, the impact of a regular withdrawal pattern can lead to a 50% worse overall return than one without cash inflows.

Both the sequencing of returns and the withdrawal pattern matter significantly in retirement. To partly mitigate this disadvantage, retirement balances are generally invested in growth assets for as long as possible while income requirements are met separately from a pool of more liquid, low return assets.

Managing downside risk in volatile times for retirement is best approached by combining two inherent advantages of investing:

- the investment ‘free lunch’ effect of diversification

- a long-term investing approach utilising alternative assets.

This approach manages downside risk by opportunistically diversifying monies away from listed assets (listed equities, REITs and listed bonds) into alternative assets and strategies. If carefully managed, this switch can preserve capital, reduce volatility, and still provide reasonable returns.

Diversification is the 'free lunch' of investing

The extraordinary power of diversification is demonstrated by a simple two stock investment portfolio example: an umbrella manufacturer and a sunscreen manufacturer. Both do well in entirely different weather environments and have low correlation with each other, moving differently in price according to weather conditions.

Assume both expect to return 7% per annum, have identical risks (defined by standard deviation) of 12% per annum, and zero correlation. From an investment perspective, you can choose to own either:

Surprisingly, the risk of a 50/50 portfolio is lower than either company singularly. The portfolio risk for the equally-weighted blend is 8.5% and the risk-adjusted return rises to 0.82 (i.e. 7/8.5), that’s 0.82 units of return for each unit of risk. This is a more than 40% improvement in the risk-adjusted return of the portfolio.

The benefit of diversification is the proverbial ‘free lunch’ of investing – you either have the same return for less risk or match the risk number and have a higher return. Magic indeed! Providing the correlation between these two investments is less than 1.0, then combining them in your portfolio will provide a better risk-adjusted return and make your portfolio more efficient (on a risk-adjusted return basis).

When investing for retirement, taking maximum advantage of this diversification benefit will move the investing odds in your favour. Since retirement involves a long time horizon, you can adopt a long-term view and consider investing a portion of the portfolio in alternative assets, defined as anything that is not listed equities, bonds or REITS.

A diverse range of alternative investments can enhance returns and reduce risk

There are plenty of alternative asset classes as shown below, from direct lending and macro to reinsurance and infrastructure.

Source: Edgehaven Pty Ltd

These require expert navigation but there is a broad opportunity set to produce diversifying returns, taking an opportunistic approach and finding alternatives that complement existing exposures. Diversification into alternatives is certainly not a ‘fill the buckets’ task, nor should it be a simple bolt-on to an existing portfolio. Instead, it’s more akin to searching for excellent quality standalone investments in areas which are not easily accessible via listed markets.

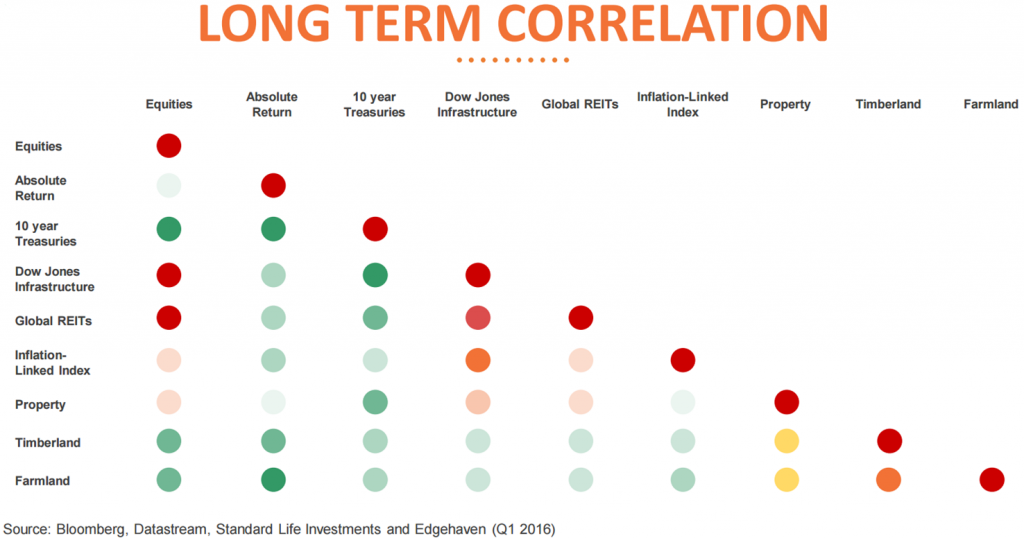

Long term correlations between asset classes

The diagram below highlights diversification benefits of three alternative asset classes – timber, farmland and absolute return – with listed asset classes including equities, global REITs and listed infrastructure. The traffic light scheme shows the effects of diversification with green being good, red bad, etc. The ‘farmland’ row is nearly all green, demonstrating the asset’s good, long-term diversification effect. It’s also noteworthy that direct property is not shown here to be a particularly good diversifier on this measure, nor is Dow Jones infrastructure (representing listed infrastructure), which many use as an infrastructure proxy.

The challenge lies in accessing these alternatives in smaller parcels. Institutional investors and super funds have relatively easy access but they generally don’t make these available to investors except within large, diversified portfolios. Individuals and SMSF trustees struggle to invest the minimum amounts required for each investment, typically $5-$10 million.

The good news is there are possible solutions available. Super funds can create choice options containing broad alternative asset exposures, although the investment would need to be locked up for a minimum investment period. This may be a novel concept right now. But given equities are a long-term investment (minimum seven years) we should not confuse the daily pricing of asset classes with the minimum exposure time required for successful investing.

Future retirement investing will include more alternative assets

Long-term investment principles and locking up monies via minimum investment periods will allow retirees to reap the diversification ‘free lunch’. Opportunistic alternative asset investing also prevents ‘silo’ asset class thinking and the ‘fill the bucket’ style of investing which dominates accumulation schemes. Plus, it allows investors to take advantage of the longer-term horizon of retirement investing and harvest illiquid premia in assets that can be selectively chosen for explicit downside protection.

The market is changing and some more liquid forms of alternative assets are now available to 'retail' sized investors, often in listed form, although many are not best suited to a liquid version. Investors should expect to invest via a lock up structure which matches the investment to the illiquidity of these asset types.

Bev Durston is the Founder of Edgehaven and is one of Australia’s leading experts in alternatives investing. She works with long-term investors including pension and superannuation schemes, foundations, family offices and sovereign wealth funds. She provides alternative assets advice for asset class strategy, sourcing managers and funds, portfolio construction and risk management.