This is an edited transcript of an interview that Firstlinks’ James Gruber did with Francisco de Juan, CIO of Alantra’s EQMC Fund, and Jacobo Llanza, Chairman of Alantra Asset Management, on 14 March in Sydney.

James Gruber: One of the fascinating aspects of this year has been the turnaround in European equities. Have you been surprised by this, and do you think it can continue?

Francisco de Juan: Two things. A lot of pessimism was built into Europe. It was built because of the subdued growth that Europe had been delivering, the geopolitical issues around Ukraine, and the tariff situation. And there was even more pessimism in small caps, which we can expand on later.

Are we surprised? Well, Trump is creating a situation where Europe needs to react. I was reading an article the other day that asked, Is Trump making Europe great again? That is a nice question, in the sense that Europe understands that, in different moments in history, it needs to react.

Now, Europe is talking about joint defence, using its balance sheets, and we are seeing the UK and Europe talking again more than ever.

You could claim that what is going now could fundamentally be a step forward for Europe. It's not only just [investor] flows, looking for where to park money outside of the US, but it could be that there's a fundamental change within Europe.

With Trump, the uncertainty he's creating with tariffs is bad for everybody. We think it is temporary. But some of the things he's doing, like ending the war in Ukraine, that could also entail some very positive news for Europe.

JG: Are opportunities opening up for you that maybe weren't there six months ago due to some of these changes?

FDJ: Over the last two or three years in the small cap space, we've seen the opportunity improve for the wrong reasons, in the sense that the [valuation] discounts of the small caps have been expanding. We've seen a period where the uncertainty and rates going up have stopped M&A (mergers and acquisitions). What that has created in Europe, and particularly in small caps, is that the price to value gap has widened.

We've been running our fund for 15 years, and today we are flooded with opportunities. The next thing is our business model in this environment has to move also, not only to spot ideas and execute ideas, but to make sure that we spot assets where you might find sort of crystallization of value. We've seen M&A activity subdued in the course of the last few years. As long as we see inflation under control, geopolitics steady or improving, we might also see M&A picking up. The opportunity will then get even more attractive.

JG: Forgive my ignorance, but larger caps in Europe have turned quickly, but have the small caps followed suit yet?

FDJ: Over the last 40 months, there has been strong relative underperformance in Europe of small caps to large caps. Small caps used to trade at a 15% premium to large caps on a price-to-earnings (PE) basis – historically they traded for 15-16x PE, but now they are around 12x. And today, we have one of the biggest spreads of small cap to large cap discounts: 10%. In the last 25 to 30 years, we have not seen such an extreme period of underperformance.

JG: Can you describe your approach? I know that you also take an activist role in your investing.

FDJ: You know we get very upset when people call us activist [laughter]. We think we are a gentle, and constructive, active owner. Our approach is about being engaged in a positive way with companies. We seek to own 20% ownership in a given company. We seek to eventually join the board or have an influence with that board. We don't control companies, but we try to help companies. And what we try to achieve is help a small cap company typically with a billion, one-and-a-half billion Euros market cap, and we try to help them to become a mid-cap. We typically underwrite five-to-seven-year investment cycles, and we try to be a constructive, positive accelerator of value creation. And this is typically something that the boards like.

The companies need to expand earnings growth and compound and sometimes for that, you need to refocus parts of the business. And if you get that right, the company can turn into a two or three billion market cap company, and then it can get included in indices, ETFs, and liquidity improves.

JG: Can you give an example of a company that you guided and turned into a mid-cap?

Jacobo Llanza: CIE Automotive (CIE:MCE) is a business we underwrote 13 years ago. It was a 625 million euro market cap company. Now it's 2.7 billion. It’s in a very basic industry, making components for cars.

It was a very good and profitable company, a low-cost operator, but quite exposed to the European market at the time. It had around €1.3bn revenues and €200m EBITDA in 2012. A good business and the management team had been very successful in building it up.

We backed them to do a successful international build out. They become very strong in Latin America - Brazil and Mexico – and then they entered Asia (mainly India).

Long-story short, in 2024, the company reported 4 billion Euros in sales, and more than 720 million euro in EBITDA with margins and ROCE at the top of the industry.

We helped them in that process. We helped them simplify the shareholder structure, then with maximizing cash flow and reducing debt.

We bought an initial 5% and then we grew to 10%. When the stock hit a record, we decided to reduce part of it, getting close to 10x on that specific investment, and we still own 3% of the company.

JG: What’s a stock that you are excited about now?

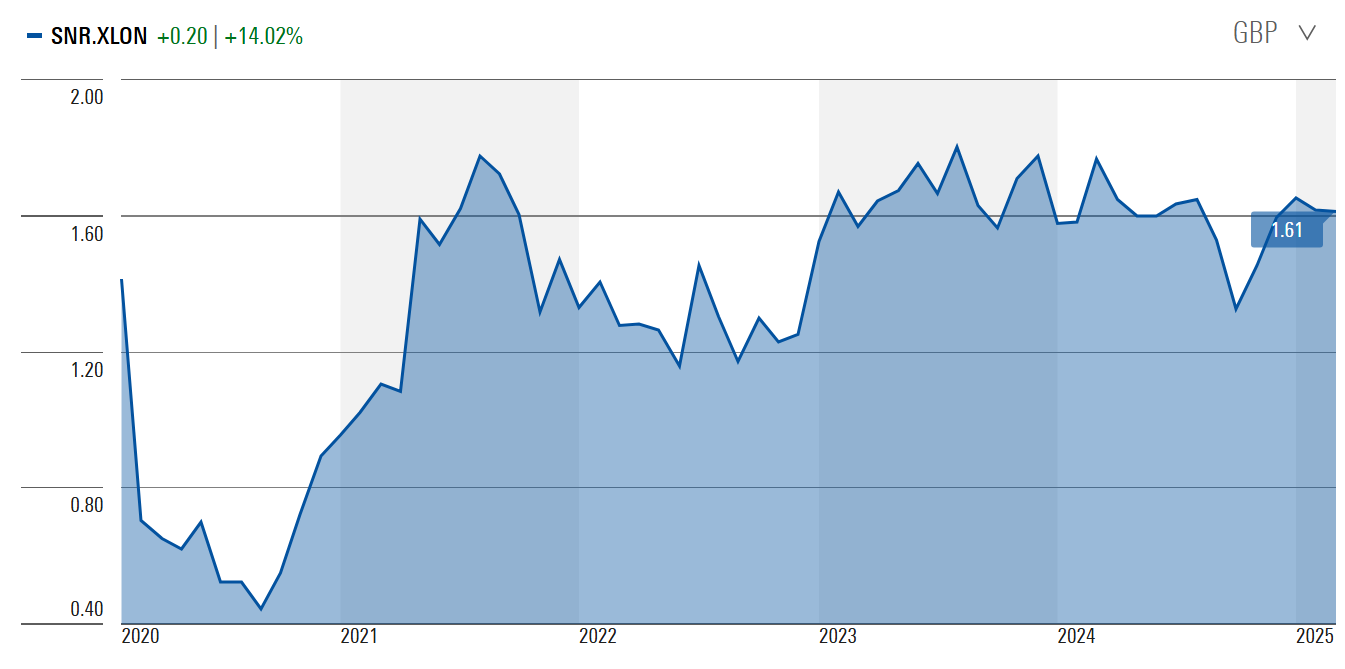

FDJ: One is Senior PLC (SNR:GBX). It's an aerospace supplier. We believe in the industry, with demand for planes being high, and the number of planes produced being low. In addition, the company is in the process of a strategically selling a non-core asset. That will leave the business as a pure play, fluid system business, which is a high IP [intellectual property], high margin business. So, this is a beautiful business at an inflection point in an industry that has multi-year growth.

The outcome of that may be a natural re-rating of the business, and if it doesn't re-rate, the company may be a very interesting asset for other industry players.

It's a good combination of limited downside and multiple possibilities of upside.

Alantra Asset Management is an affiliate of GSFM, a sponsor of Firstlinks. Francisco de Juan is CIO of Alantra’s EQMC Fund and Jacobo Llanza is Executive Chairman of Alantra Asset Management. The information included in this article is provided for informational purposes only.

For more articles and papers from GSFM and partners, click here