The following is an edited extract of a presentation from MFF Capital Investments’ Managing Director and Portfolio Manager Chris Mackay at the company’s recent annual general meeting.

Risk and Opportunity are never far apart. It would be more comfortable but imprudent to talk only of the Federal Reserve cutting interest rates, of China’s belated stimulus multiplying around the globe, of Goldilocks, of the owners of capital riding sustained increases in record market prices for most asset classes plus better interest rates on their bonds than they have had for decades.

Most importantly – and before we get distracted by risks or anything else – now is the time of greatest opportunity for many. Including calm, rational knowledge seeking investors. A few decades ago, it was impossible to access knowledge easily. Now, in an instant, we can go back centuries to first principles.

Steve Jobs famously studied Aristotle and wished to know what Aristotle might have thought about digital technologies’ ability to deliver the knowledge and learnings of modern geniuses as well as centuries of cumulative knowledge. In business, we have at our fingertips the combined experience of thousands of failures and successes, the track records of the greatest entrepreneurs, capitalists and investors.

A desire for quick validation and few questions

Concurrently, in markets, opportunity has the huge advantage that the Index has conquered the world and has been perverted even beyond what Jack Bogle feared. Market players today require immediacy of reward and validation of opinion.

Many trillions of dollars are misapplied on the basis of 140 “characters” of false opinion. On predictions of short-term unknowables. Trumped up cats and dogs of narrow ETFs. Record single day option and meme trading. Agency fallacy idiocy that higher prices for illiquidity or opaque black box lock-ups better protect capital. Active decisions that are handed to index providers, provided that they are labelled passive and fee-takers take but don’t think to question.

Beliefs are embedded into marketing, and huge incentives and institutional imperatives retard prospects of change. They reinforce the narratives and nothing exceeds like success. Bertrand Russell decided that most people fear thought as they fear nothing else on earth. This applies to 2024 markets despite the massive advantages of technology, which should unlock curiosity.

MFF’s opportunities are better and our risks of permanent capital loss smaller when most do not seek to question and understand the WHY of principles and processes, the how of business operations and valuations and refuse to accept ambiguity, to challenge shortcuts, the beliefs and truisms of appearance.

Contrary to today’s noise, and despite the Intelligent Investor being first published 75 years ago, successes in markets continue to include sensible rationalists, to outsiders willing to use old-fashioned patience and focused analysis, now aided by vast tools of new technology.

History rhymes

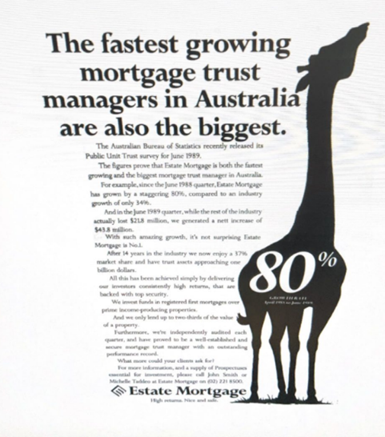

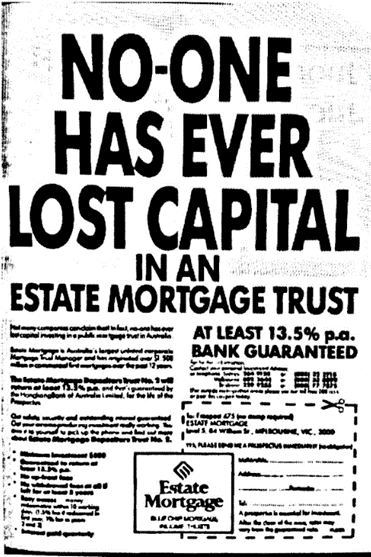

Why the Giraffe? Why the advertisements from Australia’s leading mortgage trust from before Australia’s last real recession, before many were born, before Victoria almost was bankrupted and Royal Commissions were held into economic collapse and mismanagement?

In Australia in the early 1990s, it was not about equity speculation as euphoria had not returned after the heavily borrowed paper entrepreneurs evaporated with the 1987 market crash aftermath. Early 1990s risks were disguised by the success of yield chasers which encouraged greed and envy and of course fraud and total devastation.

In the 2020s, the ‘everything’ rally amazes, with direct and second order risk effects building over time. Yield chasing has become rampant with myriad promotions providing everyone with extra percentages and basis points, except in Omaha where US treasuries are rolled over month after month.

As many companies report reduced revenues, profits and forecasts, their share prices gloriously uncouple from the drudgery, whilst cost of living pressures bite hardest on non-asset owners. Anti-business, anti-growth regulations, decisions, commissions and enquiries, fines, taxes and tariffs are becoming more popular as many voters favour populists and socialists, rejecting responsible, prudent societal growth policies.

However, unlike the early 1990s there are massive booms going on in all things digital and in financialisation. Massive efficiency benefits of the internet, mobile data and communication and digitization is followed by general artificial intelligence. The profits of digital businesses and networks have exploded, and equities have followed - as have alternative investments. Real technology benefits accrue to some businesses on revenue and to more on costs. Alphabet technologists already use AI with leading health insurance companies to cut half hour human tasks to mere seconds for each of many thousands of claims.

Of course, euphoria loves technological success and breakthroughs to amplify rather than replace market economic cycles. Alphabet’s Google easily finds credible research that a small minority of equities represent total sustained above inflation returns over decades and very few animals sustain the heights of giraffes.

Benefitting from irrational markets

We sometimes benefit when markets are irrational. In early August, the Japanese equity markets fell more in a short period than they had in over 30 years: 20% in less than 2 days. Other markets collapsed in sympathy. We dropped everything, assessed causes and anticipated effects, and swapped our steady selling for some buying. The rebound happened within days, which was not to our favour as we are investors who can hold high quality businesses for decades.

Despite equity markets generally being high by historical standards and volatility modest over recent years, we have found a few opportunities where high-quality companies within our focus areas have been underpriced. Even very large companies have periodically been materially underpriced, sometimes because of disillusioned, panicked forced sellers.

Although these recent opportunities have been okay, low risk and high probability opportunities with massive margins of safety are rare and we have not seen them recently. Our process is to be prepared but, in the meantime, to earn from more moderate mismatches and from compounding gains in the high quality businesses we hold.

Currently it is fashionable to rebalance towards lesser quality businesses and demonstrably less attractive market jurisdictions as most market participants chase short term rewards and overweight lower probabilities with perceived higher potential payoffs. But history indicates lower aggregate results. Better to instead read Benjamin Graham’s warnings about lower quality and late cycles.

Keep the focus on individual companies and industries

In assessing risks, the primary focus is upon individual companies and industries within the context of the portfolio. If we were required to invest directly in so-called emerging markets, so-called macro considerations would loom larger than simply saying “no thank you”.

Many will have seen the charts for share price returns for the greatest emerging market which net out to about zero over 20 years. Specificity also applies to opportunities; for example, markets underestimating the potential for profitable growth for a small number of extraordinary companies which can comprise significant holdings in the portfolio.

Broader risk assessments currently include high levels of government and consumer debts (with unconstrained, unfunded election promises currently not dissuaded by the recent UK Truss crisis), geopolitical issues, ageing demographics, immigration, competing deflationary and inflationary pressures, which mean that margins of safety (or margins of error) should be wider than in recent decades of digitization and globalization benefits plus low inflation and interest rates.

For those interested in the very short term and overall markets, our views are of limited value. It is best to ignore much of the Noise that derogates from core fundamental processes and risk controls must consider alternatives. Less time is wasted if we do not predict but focus upon understanding businesses, their cycles and current details in comparison with market prices. The best bargains are when outlooks are bleakest.

Chris Mackay is Managing Director and Portfolio Manager MFF Capital Investments.