It’s believed that the first gold coins were minted in the ancient Kingdom of Lydia, located in what is now part of western Turkey, around 550 B.C. These coins were stamped as a guarantee of their purity and weight and since then almost every government has minted gold coins for currency.

Over the past 2,000 years, gold has continued its upward trajectory in terms of value and is still regarded as an item of wonder and beauty, whether that be as jewellery, collector coins or on the stock exchange as an exchange-traded product (ETP).

Investors and advisers struggle to justify buying gold

In 2012, reforms were introduced to the Corporations Act 2001 which included prospective bans on conflicted remuneration structures. This included commissions and volume-based payments, relating to the sharing of and advice about a range of retail investment products. This was due to the unregulated and somewhat unethical financial guidance given by advisers who only recommended commission-earning products.

The Financial Planners and Advisers Code of Ethics 2019 (FASEA, 2019a) states the following:

“Collectively, financial planners and advisers are members of Australia’s newest profession. As such, while they formerly provided a commercial service, they should be committed to offering a professional service -informed by a code of ethics intended to shape every aspect of their professional conduct.”

Prior to 2012, many advisers simply wouldn’t recommend gold as there was no incentive for them to offer it. Even after these regulations were introduced, the hangover still exists, especially with the notion that gold pays no dividends.

However, the idea that gold should be disregarded because of lack of return is perhaps an oversight. During uncertain periods like the ongoing Covid-19 pandemic or as the Russian/Ukraine war rumbles on, diversifying portfolios has never been more important. The idea that gold will not help mitigate risk in portfolios is a misconception.

Five common misconceptions about gold

We’ve pulled together the five most common misconceptions held about investing in gold.

1. Gold is too risky to be included in portfolios

There may be short-term volatility, but long term, it’s a different matter. Gold can be used to diversify portfolios to help risk-adjusted returns (risk adjusted returns are a calculation of an investment's return by looking at how much risk is taken to obtain that return).

The table below illustrates that from 1970 to 2020, gold’s volatility was in line with equities. If investors had a 50/50 blend of gold and equities, the generally-negative correlation of gold to other traditional asset classes (stocks, bonds, cash and real estate) could significantly reduce portfolio volatilities.

AUSTRALIAN EQUITIES AND GOLD 1970 TO 2020

According to the World Gold Council:

“Gold is a clear complement to stocks, bonds and alternative assets for well-balanced … investor portfolios. As a store of wealth and a multi-faceted hedge, gold has outperformed many major asset classes while providing robust performance in both rising and falling markets.”

2. Investing in gold is only effective when inflation is high

Often, gold is only seen as beneficial during periods of high inflation. The 1970s oil crisis was one such time that hit the global economy hard, triggering a stock market crash and sending inflation rates climbing. With markets in turmoil, gold rose from a low of USD35 per ounce in 1971 (set during the gold standard) to a peak of USD180 in late 1974. By 1976, however, the gold price fell nearly 40% to USD110 before gaining again in 1978 and then hitting an incredible USD850 in January 1980.

The World Gold Council, covering market data since the 1970s, found that gold has on average delivered gains of 15.1% (in nominal terms) and 8.3% in real terms in the years US CPI has averaged 3% or more.

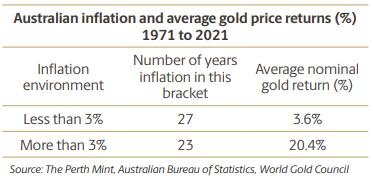

For local investors, analysis conducted by The Perth Mint suggests the gold price in Australian dollars has on average risen by just over 20% in nominal terms in years when the local CPI was 3% or higher. But even in the years where CPI was below 3%, gold has still returned a nominal average of 3.6%.

3. Gold does not provide long-term portfolio returns

Although gold has not outperformed stocks and bonds during various market patterns, it has provided positive returns over a longer term, comparative to many other asset classes.

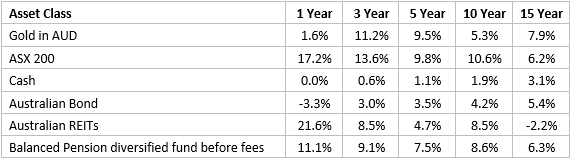

Adding gold to a hypothetical Australian portfolio over the last 15 years would have increased risk-adjusted returns.

LONG TERM ANNUALISED RETURN UNTIL END OF 2021

4. Without paying interest or dividends, gold has no value

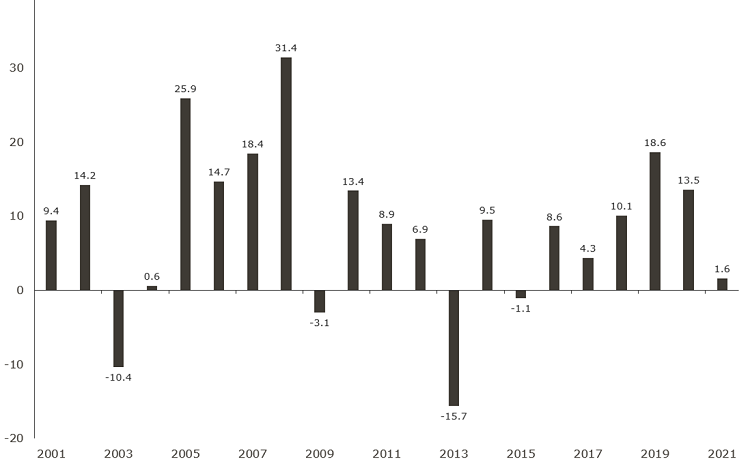

It is indeed true that gold doesn’t provide income like some stocks and bonds. Instead, investors in gold are compensated solely by price appreciation, driven by economic and market trends. The chart below shows gold returns in AUD over the last 20 years.

GOLD’S ANNUAL RETURN IN AUD

Source: World Gold Council, The Perth Mint

5. Only when the US dollar declines does gold appreciate

Although the US dollar and gold have had a long economic tie, when the gold standard was abolished by US President Nixon in 1971, central banks were no longer entitled to on-demand conversion of their dollars into gold. Officially delinking gold’s price from the US dollar allowed the price of gold to be influenced by open market demand.

Factors such as demand, interest rates, inflation, central bank reserves, production and market volatility can all influence the return on gold, pushing the price of the precious metal up as well as down. In January and February 2020, when the COVID pandemic was taking grip, the US dollar and gold actually rose in price, having a positive correlation.

But it’s not all about the US dollar. Gold also offers a de facto foreign currency exposure in an Australian investor’s portfolio, with declines in the value of the Australian dollar typically magnifying the gains gold delivers to local investors. In periods of financial market stress, not only does gold tend to go up, but the AUD often falls. GFC is a prime example of this; in 2008, when USD gold price was +4%, AUD gold was +28%.

By complementing investments in bonds, stocks and broad-based portfolios, gold can hedge against currency depreciation and inflation, and has historically provided positive returns as well as offering liquidity in periods of market turbulence.

Sawan Tanna is the Treasurer of The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.