The Australian office sector has shown its resilience through various economic shocks and cycles and continues to play an important role in providing physical workplaces for organisations to collaborate, innovate and socialise. Workplace is a visual element of corporate culture and workplace design has a role in supporting the values and basic assumptions (how employees behave) of the organisation.

JLL’s report ‘Outlook for the Australian office sector’ was prepared for Charter Hall and here are the major conclusions:

Office sector recovery (post COVID): The Australian office sector has rebounded from the COVID-19 pandemic. JLL tracks 19 office markets across Australia and 15 of them recorded positive net tenant demand over the 12-months to 1Q22.

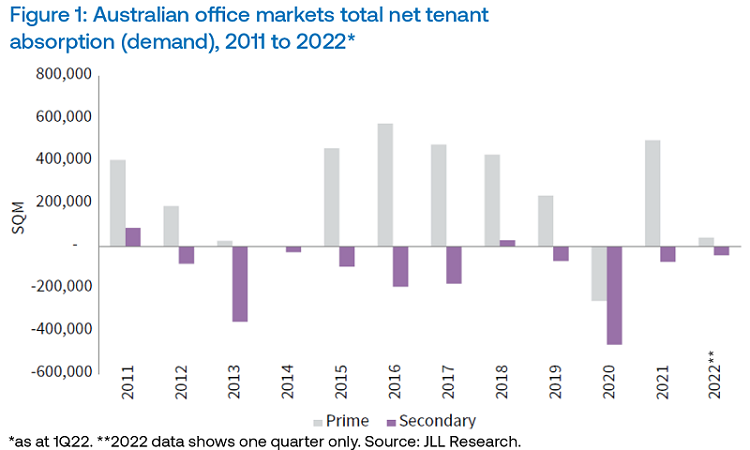

Flight to quality: Organisations are gravitating towards prime grade (higher quality) office assets. JLL recorded net absorption of +489,200 sqm in prime grade higher quality buildings and -110,100 sqm in secondary grade lower quality assets over the 12-months to 1Q22 (see Figure 1).

Employment growth and leasing activity positive: The economic rebound has flowed through to employment growth and a sharp increase in office leasing enquiry and activity. Based on Deloitte Access Economics forecasts, the number of office workers is projected to increase by 637,400 to 5.1 million people through to 2026. Growth is projected to be broad based and include solid growth in the professional services, public administration, technology, and healthcare sectors.

Positive market fundamentals: The outlook for future rent growth is positive. An improvement in physical market conditions will exert upward pressure on rents and JLL forecasts average Australian CBD prime gross effective rents will increase by 3.8% per annum between 2022 and 2026.

Capital value growth: Positive income growth will be supportive of an uplift in prime capital values. JLL is projecting weighted average CBD capital values to grow +1.8% per annum between 2022 and 2026.

Increased transactional activity: Liquidity in the Australian office sector improved substantially over 2021 totalling $15.8 billion, which was an increase of 70% from transaction activity in 2020 of $9.3 billion. Investment activity came from a broad buyer pool which highlights Australia’s attractiveness as a global investment destination.

Five key themes shaping the office sector

The trends influencing the office sector are broad and diverse. JLL has distilled these observations into five key trends that will influence the office sector over the next decade.

1. Return to work rates will increase towards 70% to 80% of pre-pandemic levels (currently averaging 60% across Australian CBD markets)

Australia was viewed as a global leader in the management of the health crisis and has a vaccination rate which is amongst the highest in the world. Australia is transitioning from pandemic to endemic with minimal COVID-19 related restrictions. The easing of restrictions through 2022 has led to return to work rates increasing across all Australian geographies. Several large organisations have announced they will allow greater employee working flexibility and adopt a hybrid work model. JLL’s Workforce Preferences Barometer (2021) revealed that 63% of the workforce wants to keep the flexibility of being able to alternate between the office and working from home.

Early evidence shows a high proportion of workers are committed to coming into their primary place of work three days per week. Organisations are generally allowing employees to select their own flexible working schedule and office occupancy is higher from Tuesday through Thursday. Most organisations are finding that headcount growth is offsetting the potential reduction they could make from a flexible work policy.

2. Organisations will gravitate towards office assets with strong environmental, health and wellness attributes

Organisations increasingly understand that workplace has a role in the attraction and retention of knowledge workers. Nurturing talent through human-centric workspaces and workforce strategies will become more prevalent in real estate decisions. JLL’s Workforce Preferences Barometer (2021) highlighted the importance of this approach with 73% of respondents aspiring to work in places that support healthy lifestyles, safety and wellbeing. Furthermore, 58% of the workforce consider that health and wellbeing programs will make the employer unique in the long-term. The evolution of employee health and wellbeing expectations is positive for prime grade assets. The trend towards prime grade office assets will accelerate through 2022 and lead to higher structural vacancy within secondary grade accommodation.

3. Rising labour, material and financing costs will reduce new development activity

Australian office sector development is typically precipitated by healthy levels of tenant pre-commitment. Lending criteria for commercial development is stringent with conservative loan-to-cost ratios and tenant pre-commitment hurdles to de-risk projects. A higher current inflationary environment for labour and raw material costs is exerting upward pressure on construction costs and pushing the economic rent required for new development well above existing office rental levels. As a result, JLL expects new development will be lower across Australian office markets over the next five years. Supply additions across CBD office markets are projected to average 216,500 sqm per annum between 2022 and 2026, which is below the 20-year historical average of 248,200 sqm.

4. The technology, healthcare and education sectors will become important sources of tenant demand

Public administration (government), professional services and finance & insurance have historically been the three most relevant industry sectors for office tenant demand. The professional services industry sector has broadened to include technology and the ABS reported that the technology sub-sector has represented 57% of professional services employment growth over the past two years. Financial services has also broadened to include Fintech and Australia now ranks sixth in the world in the Global Fintech Ranking 2021.

The increasing relevance of the healthcare and education sectors will lead to new sources of occupier demand. Deloitte Access Economics estimates healthcare’s share of white collar employment was 15.3% in 2011, 18.4% in 2021 and is projected to reach 21.2% by 2031. Healthcare industry sector employment is becoming more diverse and the expansion of health-tech, life sciences and telehealth jobs will flow through to a new source of office sector tenant demand.

5. The next generation of workplace design will have a greater focus on collaborative and social space

The workplace will be a destination for collaboration, ideas generation and knowledge transfer. It is estimated that over 70% of learning occurs on the job* and face-to-face interaction with colleagues allows younger professionals access and the opportunity to learn through osmosis. The regenerative workplace will accommodate all of these features and fuel workforce resilience.

JLL’s Regenerative Workplace Survey (2021) showed that relaxation spaces and social spaces were ranked highly on employee expectations of services and amenities within the building or individual workspace. Future workplace design will lead to fewer workstations relative to the number of employees. However, greater collaboration, social and wellness space are all factored into the workspace ratio and will largely offset the reduction in individual or focus work areas.

Conclusion

Solid economic growth projections and strong levels of employment growth are a positive for the outlook of the Australian office sector. A number of key industry sectors are also projected to support solid levels of office demand over the medium term. This includes the public, professional services, healthcare and educations sectors.

The office sector will be shaped by key trends including:

- Improving occupancy rates in office towers over 2022 as employees come back into the workplace which will help reinvigorate CBD and metropolitan markets.

- Organisations showing a greater interest in the environmental, health and wellness attributes of an asset when considering relocating which will be beneficial for prime grade assets.

- The next generation of workplace design having a greater focus on collaborative and social space in order to attract the best talent to an organisation.

Although JLL is projecting property yields to soften over the medium term (2022-2026), this will be counterbalanced by solid forecast income growth supporting capital growth, with projected capital values increasing by 1.8% per annum over this period.

*Source: How To Leverage The 70 20 10 Model For High Performing Employees.

Andrew Ballantyne is Head of Research – Australia, JLL and Steven Bennett is Direct CEO at Charter Hall Group, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.