Older Australians might be feeling their creaky knees, stiff backs and failing eyesight, but one thing they should not feel is neglected by government departments and agencies studying their potential financial futures. The many reports and reviews issued recently are giving greater understanding about retirement and attempting to improve the outcomes for Australians living on their savings.

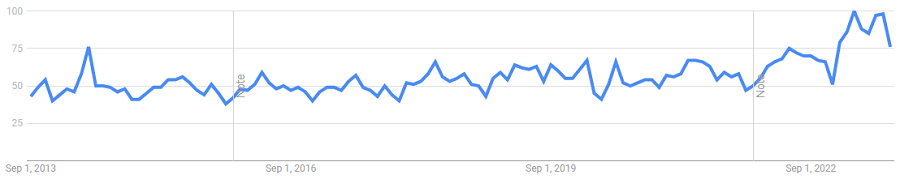

Over the next five years, according to the Australian Bureau of Statistics (ABS), 670,000 Australian intend to retire, taking the total number retired to almost five million. A check of how often the word ‘retirement’ is searched for on Google over the last 10 years shows a recent and sustained spike.

Australia is not alone in focussing on its ageing population. The World Health Organisation reports that by 2030, 1 in 6 people in the world will be aged 60 and over, a formidable 1.4 billion people or an increase of 400 million in 10 years. The number will exceed 2 billion by 2050, including 425 million aged 80 and over. We will live in a world where 100th birthdays are common.

The strong focus on retirement

For most of the time since the introduction of compulsory superannuation for more workers in 1992, and increasingly as retirement has become a major social and political issue, the focus has been on accumulation. The demographic shift underway has forced a rethink towards the retirement phase and decumulation.

In addition to the recent Intergenerational Report and Legislating the Objective of Superannuation, regulators ASIC and APRA completed a joint review of the implementation of the Retirement Income Covenant, issued in 2020. Registerable Superannuation Entities (RSE) need to develop strategies to assist their members to know how much they can spend in retirement, confirming that many people die with the bulk of the wealth they held at retirement intact. The regulators were highly critical:

“Overall, there was a lack of progress and insufficient urgency from RSE licensees in embracing the retirement income covenant to improve members’ retirement outcomes.”

So with this bombardment of insights and guidelines on how governments and the financial sector are supposed to meet the needs of retirees, we should know who they are and why they retired.

For this we turn to the ABS which has issued a new report on Retirement and Retirement Intentions, based on FY21 data.

When are Australians retiring?

The ABS estimates there are already 4.1 million retirees in Australia. In 2020, 140,000 people retired, with an average age of 64.3 years. The age pension remains the primary source of income for most retirees.

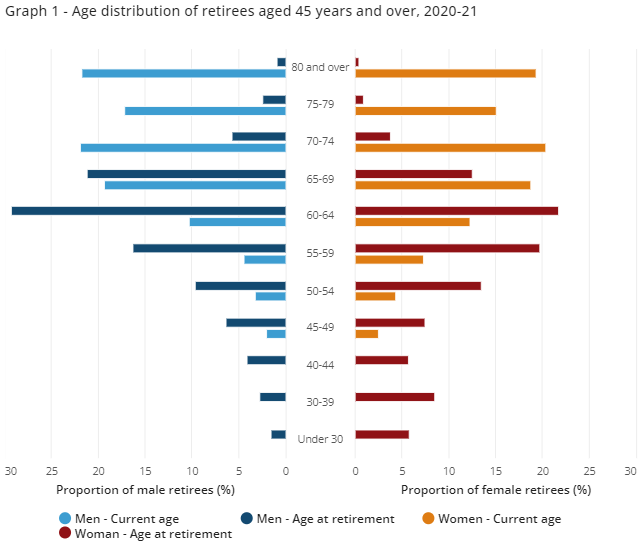

Graph 1 shows the age when people retired from the labour force (that is, ceased working or looking for work).

The chart shows the current age versus age at retirement of retirees. For example, there are far more retirees over the age of 70 than people retiring at that age. People are still alive but they retired earlier. But in the age group 60 to 64, there are far more people retiring at that age. The average age at retirement is 65.4 for men and 63.7 for women.

Why are Australians retiring?

Retirement is a major change, giving up or losing regular income from work and relying on savings or a pension, but about 2,700 Australians a week take this step. The top three reasons for ceasing work are:

- Reached retirement age or eligible for superannuation (28%)

- Own sickness, injury or disability (13%)

- Retrenched, dismissed or no work available (7%).

Women were more likely to retire to care for a person than men (4% versus 2%).

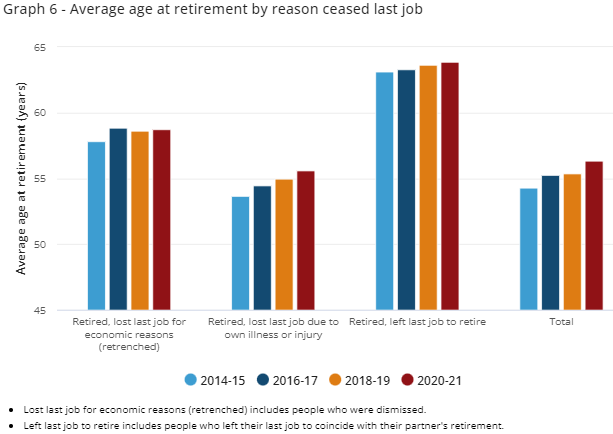

Not surprisingly, the age of retirement of people retrenched, dismissed or injured is much lower than people who voluntarily retire. It shows thousands of people in their 50s ‘retire’ each year against their own choice. One-third of retired women rely on their partner’s income after retirement, compared with only 7% of men.

Investment risk by generation

Turning to another recent report, the Australian Securities Exchange (ASX) releases an annual Australian Investor Study. The 2023 Report says that 10.2 million people or 51% of the adult population hold investments outside their home and superannuation. Over the years, the ASX has increasingly focussed on generational differences, especially as more younger investors start their journey with listed securities.

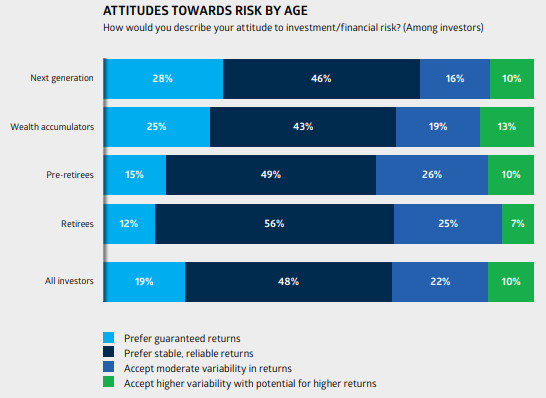

As should be expected, the 2023 Report shows retirees are highest for seeking ‘stable, reliable returns’ and lowest for ‘higher variability with potential for higher returns’. Retirees are also more likely than younger generations to hold a diversified portfolio.

SMSF members by age

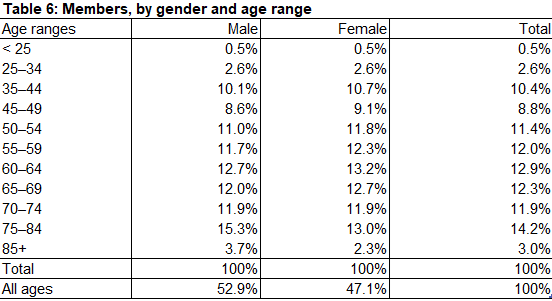

A final check on SMSF usage by age from the latest ATO statistics (data for March 2023 is extrapolated from FY21). There were 606,000 SMSFs with 1,136,000 members, holding $890 billion.

Although there is much media coverage about younger generations opening SMSFs, only 3.1% of members are 34 years and under, although a strong 19.2% are aged 35 to 49. Which leaves 77.7% aged 50 and over, with high representation in all older age groups including 17.2% over the age of 75 and 11.9% between 70 and 74. It’s clear that SMSFs are a popular superannuation vehicle for older Australians.

The policy implications of these changes are profound, from the impact on government revenues, the demand for housing, the impending wealth transfer from baby boomers to their children, and the design of financial products for decumulation. Investors should factor demographic changes into assessing the future of any company.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information.