Dividend imputation has been under scrutiny. The Tax Discussion Paper raises the notion that imputation does little to encourage investment in a small, open economy like Australia, where share prices and hence the cost of capital are set in international capital markets. Imputation is thus seen as a costly tax break for domestic shareholders with minimal associated benefits for the overall economy. The idea is that the removal of imputation could fund a reduction in the corporate tax rate, perhaps to as low as 20%, leading to a surge in foreign investment.

This line of argument has some merit: lowering the corporate tax rate should indeed attract additional foreign investment at the margin. However, this stance is somewhat narrow. To be fair, the Tax Discussion Paper is only airing a view for discussion, not making a policy recommendation. Nevertheless, it is worth asking what may be overlooked in adopting this line.

Mixed evidence on whether imputation is priced

The relationship between imputation and the return on investment required to satisfy the market (which might be called ‘cost of capital’) has been extensively examined in the finance literature. Unfortunately, there is no agreement.

One problem is that investors benefit from imputation to varying degrees. There are two theoretical approaches to solving this. The first involves identifying the ‘marginal investor’ – the last investor enticed to hold a stock, so that demand equals supply. The idea that share prices are determined in international capital markets implicitly assumes a marginal overseas investor who places no value on imputation credits. The second approach views share prices as reflecting some weighted average of investor demands. Here imputation credits would be partially priced, perhaps in accord with the 60-80% held by domestic investors.

Empirical analysis is no more enlightening. Four methods have been used to estimate the market value of imputation credits: analysing ex-dividend price drop-offs; comparing securities that differ in their dividend/imputation entitlements; examining if imputation credits are associated with lower market returns; and establishing whether stocks offering imputation credits trade on higher prices relative to fundamentals like earnings. Results are mixed. The majority of drop-off and comparative pricing studies find imputation to be partially priced, with a wide range of estimates. Meanwhile, footprints from imputation are hard to detect in returns and price levels. In any event, all empirical studies suffer from significant methodological issues.

Another issue is that the pricing of imputation might vary across stocks or time, perhaps due to differing marginal investors. Of particular relevance is the smaller, domestic company segment where investors are substantially local. In this case, it is reasonable to expect that imputation might be priced.

With the finance literature failing to arrive at a consensus, the assumption that imputation does not lower the cost of capital amounts to an extreme position along the spectrum. The possibility remains that imputation credits might be priced either partially, or in certain situations.

Imputation and behaviour

Of prime importance is how imputation influences behaviour, and whether these behaviours are beneficial or otherwise. This matters more than how imputation impacts ‘numbers’ like cost of capital estimates. Many decisions are not based on formal quantitative analysis; and imputation tends to be a second-order influence in any event. Analysis may be used to support decisions, but rarely drives them.

Recognition of the value of imputation credits has influence over behaviour in three notable areas, the first being the clearest and most important:

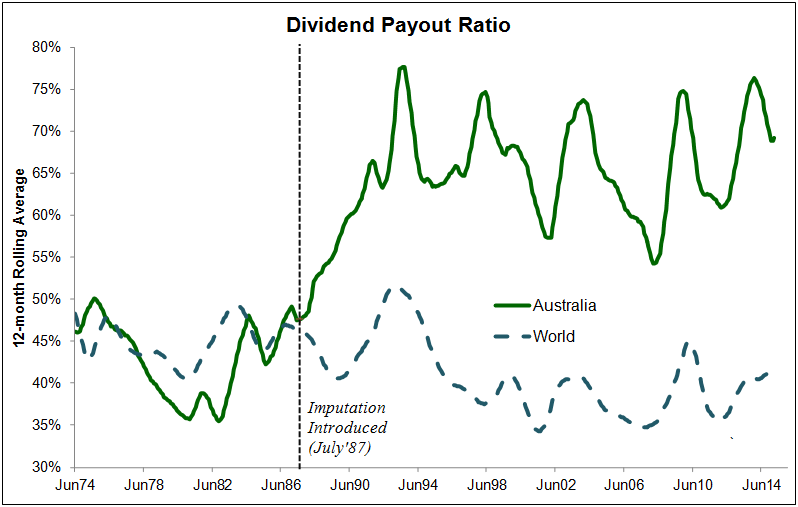

- Payout policy – Imputation has encouraged higher company payouts: the divergence in the payout ratio for Australia versus the world post imputation is stark (see chart). Actions taken by companies to distribute imputation credits clearly indicate they recognise their value to certain shareholders, e.g. off-market buy-backs.

- Where taxes are paid – Imputation encourages paying Australian company tax at the margin (referred to as ‘integrity benefits’ in the Tax Discussion Paper). If the tax rate is roughly the same in Australia and overseas, why not pay locally and generate imputation credits?

- Portfolios – Australian investors may prefer domestic companies paying high, fully-franked yields, all other things being equal. This preference is more likely to manifest as a ‘tilt’, rather than a dominating factor. There are multiple reasons for home bias, or the historical favour for bank stocks, for instance.

Would removing imputation matter?

Whether and how removing imputation would make a difference depends on what else happens, especially any concurrent corporate tax rate reduction. For instance, this could dictate the tenor of share price reactions, as effects from loss of imputation are pitted against higher earnings. Rather than delve into a multitude of possibilities, I offer two substantial comments.

First, removing imputation would do away with a major driving force for higher payouts. Higher payouts have contributed to more disciplined use of capital, through reducing the ‘cash burning a hole in company’s pockets’, and creating more situations where justification is required to secure funding. This is a MAJOR benefit of the imputation system: a view also expressed by many fund managers. Hence dismantling imputation could be detrimental to both shareholders and the Australian economy through less efficient deployment of capital.

Second, imputation probably matters most for small, domestic companies, many of which are unlisted. In this sector, it is more likely that local investors who value imputation credits are the ones setting prices and providing the funding. Any adverse impacts from removing imputation may be concentrated in this (economically important) segment.

Imputation removes the double-taxation of corporate earnings, but only for resident shareholders. The concept of reintroducing double-taxation for domestic investors in order to fund a revenue-neutral switch that provides a net benefit to overseas investors doesn’t seem quite right. The notion that the outcome will be substantially greater foreign investment with limited losses elsewhere appears questionable, especially once the implications for domestically-focused companies and potential behavioural responses are taken into account.

Geoff Warren is Research Director at the Centre for International Finance and Regulation (CIFR). This article draws on a paper titled “Do Franking Credits Matter? Exploring the Financial Implications of Dividend Imputation”, written with Andrew Ainsworth and Graham Partington from the University of Sydney. The paper can be found at: http://www.cifr.edu.au/project/F004.aspx