There's a mind-numbing multitude of changes taking place around the world today. Focusing solely on new technologies is more than sufficient to back up that opening statement. I am not even including climate change, refugees, social inequality, demographics or the many side-effects from ultra-low interest rates and bond yields.

Viewed through an economic lens, most changes are still in early days of development. Their true impact will only be felt in 5-10 years' time. But societies have started to pay attention. It's why buzzwords like ‘sharing economy’, ‘fintech’ and ‘disruptors’ are common in the vocabulary of investors and economists, and even of politicians.

My eBook published last year, 'Change. Investing in a Low Growth World', draws a comparison with the roaring and fabulous 1920s, the last time such a whirlwind of innovations and technological breakthroughs re-shaped global society. If my comparison proves accurate, we haven't even seen the full tip of the iceberg of future transformations yet.

ASX transformation

Collectively, new technologies and ‘disruptors’ are already making their presence felt. By opening up monopolies, breaking down market barriers, lifting transparency for consumers and commoditising popular goods and services, there's already a good argument that all this partially explains today's lack of economic growth. It may also be causing a lack of inflation, low growth in wages and poor genuine, sustainable corporate profit growth across developed economies.

In Australia, where a relatively small population in a vast geographic space has facilitated duopolies dominating markets, the arrival of new business models and challengers has been an important co-contributor to why the ASX20 has significantly underperformed the broader share market since late 2012.

So far not so good for Australian share market investors. It's easy to feel excluded with companies including Facebook, Alphabet, Tesla, Apple and Alibaba contributing to the feel-good factor in US equity markets. Unbeknownst to many, the Australian share market is going through major transformation, and modern day explosions in innovation and capital-light business models sit at the coal face of it.

Raging bull market downstairs

The ASX20 price index is close to the same level it was in February 2013. This means no net returns from holding a basket of shares with Wesfarmers, Telstra, BHP Billiton and the banks in it, other than dividend payouts and franking, over a period extending more than 3.5 years.

Over that same period, the All Ordinaries index, comprising of 500 mostly mid and small cap stocks in addition to the Top 20, appreciated by nearly 12%. Still not a fabulous result, given the S&P500 in the US added 43%, but nevertheless a world away from the moribund and sorry state at the top of the Australian stock market.

No double guessing as to why many a focus has descended outside the Top 20 in Australia, including from funds managers previously specialised in large cap blue chips. This looks like the ideal environment to introduce new ASX-listings.

According to data from OnMarket Bookbuilds, not only are fresh IPO numbers on the rise, so is their average size and their popularity among investors. The average first day-of-trading performance for all 24 IPOs on the ASX in Q3 this year was +28.2% (average gain at 4pm on the first day of trading on the ASX). There's a trend to IPO more foreign companies on the ASX, as well as more new listings originating from private equiteers. Note to us all: private equity IPOs do not all turn into mud by default, as long as the owners remain on board with a substantial stake in the equity.

Technology rules among IPOs

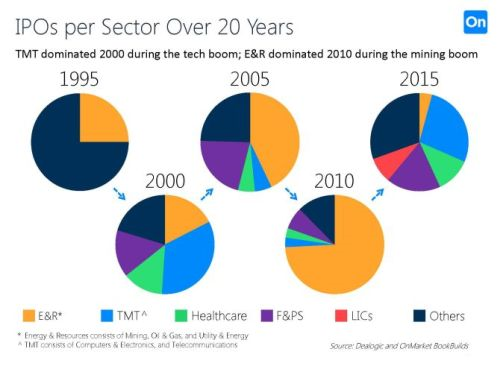

The transformation of the ASX, as shown in the 20-year overview below, has expanded the exchange with many new technology, healthcare and finance & professional services companies. In 2016 to date, half of all IPOs consisted of technology and finance companies with many of the latter carrying the label ‘fintech’. Gone are the days when the majority of new listings comprised of mining, energy and mining services providers. That is so 2005-2010!

Australian investors do not only see the ugly side from today's technological transformation disrupting or challenging the corporate heavyweights. They do not by default have to venture overseas to seek exposure to new challengers and innovators; they can stay here at home, at the ASX.

It goes without saying, irrespective of current popularity and average past performances, new ASX listings are not a risk-free, guaranteed money printing option. Some IPOs cause shareholders severe headaches, if not significant capital losses. Once the initial euphoria post public listing ebbs away, there is no guarantee investors stay on board or join in. Most of these freshly minted ASX-additions are young, unknown and they still have a lot to prove.

Don't ignore the future

As a daily observer of financial markets and of global macro-economic developments, I believe new IPOs over the past two years have enriched the local stock exchange, and investors should pay attention because in between the many newbies of today might be the next REA, ResMed or Carsales.

Below are ten newbies from the 2014-2016 harvest which, on my assessment, have shown enough substance to suggest a future success story might be in the making. Investors should always conduct their own research and consider their risk appetite.

Ten ASX-Newbies worth investors’ attention

Brief introduction to these names:

- iSentia: media intelligence offered as Software as a Service (SaaS), expanding into Asia

- Speedcast International: network and satellite communications services worldwide, headquartered in Hong Kong

- Catapult Group: wearable athlete tracking and analytics solutions

- oOh!media: out-of-home advertising services, increasingly digital

- Appen: speech technology and search services for international technology customers

- Link Administration: back office administration services to companies and financial services providers in Australia

- MYOB: desktop accountancy software, migrating into the cloud

- Class: cloud-based services for SMSF trustees, their accountants and their advisors

- WiseTech Global: cloud-based software solutions for the logistics industry, worldwide

If you do intend to look into some of the potential new stars of the future, the list above could be a good starting point.

Rudi Filapek-Vandyck is Editor of FNArena. His book, "Change. Investing in a Low Growth World", is available via Amazon or any online book platform. This article is general information and does not consider the circumstances of any individual.