Going global gives you choice. Just like buying online you get more items at cheaper prices. Your portfolio will benefit from trends and industries that are not available in Australia. The local market is heavily weighted to banks and resources, otherwise known as the two options of debt or dirt. With the mining boom winding down, investors have to look offshore for growth.

The majority of the disruption we see every day is benefitting companies overseas at the expense of our past market darlings. We can see what has been happening in stocks like Fairfax and Channel Ten. New media like Facebook and YouTube are taking eyeballs and attention away from old media. The rivers of gold from print advertising can now be found online. There are some disruptive stocks in Australia that are benefitting, like realestate.com.au and Domino’s Pizza. But they trade on expensive multiples because of the scarcity of these investments in Australia and the weight of superannuation money. The amount of money in superannuation is larger than our domestic stock market. If we look overseas these same trends can be accessed at much cheaper prices.

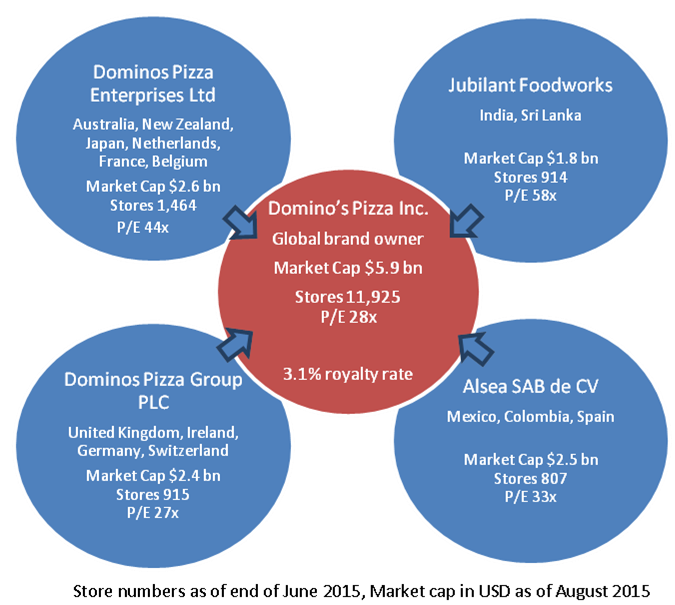

Which pizza would you choose?

Domino’s Australia (ASX:DMP) has been a great outperformer in the local market but there are four other listed Domino’s companies around the world. All four pay a royalty of 3.1% to the US company which owns the brand, yet Dominos in America (NYSE:DPZ) trades at a one-third Price/Earnings multiple discount to the Australian-listed Dominos. Investors get access to the brand owner at a cheaper price because it’s listed overseas where the choices are greater which makes for cheaper valuations.

Digital ordering

Going global gives you options. We have seen how popular Domino’s has become with digital ordering. Large restaurant chains have benefited tremendously as smart phones allow ordering on the go. Domino’s mobile application even tracks the driver so customers can watch real time as the driver decides which street he is going to take!

Being global you can apply this trend elsewhere. I personally see a similar opportunity in Starbucks as they roll out digital ordering this year in their 13,000 US stores. It’s great ordering coffee ahead – there’s no waiting in line. The app will ask whether the customer is driving or walking to better estimate when the coffee should be ready at the closest store. The introduction of drive-through at Starbucks grew revenue incrementally by 50%. Digital ordering will have a significant impact decreasing lines while increasing sales at peak hour. Like Dominos, once the Starbucks app is downloaded, orders are customised and saved on the phone.

Access to trends

Going global gives exposure to other trends like electronic payments. Customer purchase behaviour has changed every day at stores. How often do you see customers use tap and go with their Visa and MasterCard debit cards? I hardly carry any cash around anymore. I’ve even forgotten my password a number of times as I’m so used to tap and go.

When we purchase on the internet we don’t use cash we use PayPal and our credit cards. They are great businesses clipping the ticket on every transaction. Electronic payments is such an important trend that Monopoly has produced a version of its game without cash, just debit and credit cards. Though I have to admit holding the cash in the original version is a lot more fun.

Access to brands

Many of the brands we use everyday are listed overseas, especially the majority of growing brands revolving around technology, like Google and Amazon. Brands have historically been good investments as they have pricing power. How often do you see Starbucks dropping its coffee prices when prices of beans go down? Compare this to commodity companies like BHP which have to take whatever the market pays. Of the top 100 brands measured by brand value, only five are from Australia (source: Brandz).

Invest in companies that ‘buy commodities, sell brands’

Warren Buffet has become widely successful, mainly because of four words: “Buy commodities, sell brands”. He invests in companies like Coca-Cola. Brands tend to be durable investments as customers seek them out as they know what to expect from the product and service. Apple is a modern day brand example. The semi-conductor chips they buy are commodities but their services and high quality brand differentiates them from competitors allowing them to charge high prices for their products.

We should be more comfortable with these foreign companies. How often do you buy something from BHP? We all have Apple iPhones (it has been estimated we look at our phones 214 times a day) but hardly anyone in Australia buys the shares.

Global provides more options at cheaper prices

Going global gives you access to more items at cheaper prices. You can benefit from all the brands and trends you see every day. Because there are so many disruptive companies investors have plenty of choice leading to better valuations than if they were listed here in Australia. As investors we have figured out it is better to put our money in bank shares rather than bank deposits but what about other trends like ordering over the internet and electronic payments? In Domino’s case, going global gives you a higher quality pizza at a cheaper price.

Jason Sedawie is a portfolio manager at Decisive Asset Management, a growth-focused global fund. Decisive owns shares in Domino’s Pizza (DPZ), Starbucks (SBUX), PayPal (PYPL) and Visa (V). This article is for educational purposes only.