In his testimony before Congress in 1912, American financier and investment banker, J.P. Morgan stated:

“Gold is money. Everything else is credit.”

In this article we look at the definition of money and discuss why many still regard gold as ‘real’ money.

According to the classic definition, money must have three fundamental properties:

- It must function as a medium of exchange – that is any item that is widely accepted to facilitate transactions between buyers and sellers of goods and services.

- It must be a unit of account – that is a standard unit of measurement for the value of goods and services.

- It must also be a store of value – that is any item that holds its value over time.

Commodities as money

Money was invented because of the shortcomings of barter, the act of trading one good or service directly for another one.

Commodities – items for which there was consistent, broad-based demand – were particularly sought-after. These special items could be on-traded for a wider choice of goods at some time in the future. Thus, certain commodities acquired monetary value.

Once commonly used in parts of Asia, Africa and Oceania, cowrie shells were a popular form of commodity money.

When the convict colony of New South Wales was established in 1788, the authorities saw no need for money. This policy led to the acceptance of rum (or strong alcoholic spirits) to fulfil the role.

As well as shells and alcohol, commodities used as mediums of exchange have included barley, salt, peppercorns, tea, cocoa beans, silk, silver and gold.

Of these, the last two were most widely acceptable and hence most strongly identified as money.

Why is gold valuable?

Some people argue gold has little or no intrinsic value. It’s undeniable, however, that its relative rarity and beauty has intoxicated humanity for millennia.

In The Power of Gold, Peter L. Bernstein, declares:

“Gold has motivated entire societies, torn economies to shreds, determined the fate of kings and emperors, inspired the most beautiful works of art, provoked horrible acts by one people against another, and driven men to endure intense hardship in the hope of finding instant wealth and annihilating uncertainty.”

Associated with power and wealth for as long as humanity’s collective memory can recall, gold has always been valuable and will continue to be so in the future. The first gold coins appeared in Lydia as long ago as the 6th century BC. The ancient Anatolian kingdom recognised other vital properties of gold as a suitable material for coins.

Gold is malleable enough to be easily worked, resistant to tarnish, and all but indestructible. As the prime example of commodity money, the value of gold coins is linked to their weight and precious metal content.

Representative money

The idea of ‘representative money’ emerged in Europe during the 17th century. Its roots lay in the receipts issued by goldsmiths to their depositors. Not only could these promissory notes be exchanged for their face value in metal, but they became a convenient way of making payments.

In 1694, the Bank of England was the first public bank to issue official notes which could be exchanged by the ‘bearer’ for gold.

By the late 19th century, many of the world’s paper currencies were pegged to gold at a set price per ounce under an international monetary system known as the Gold Standard.

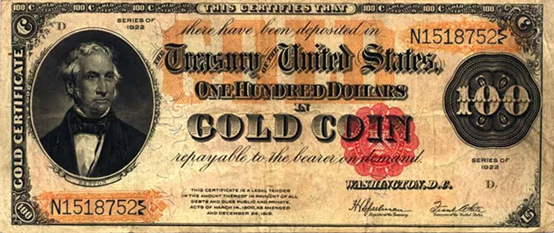

Gold certificates, used as paper currency in the United States from 1882 to 1933, were freely convertible into gold coins. (Image credit: Public domain)

While the use of gold as an international means of valuing currencies was helpful in stabilising rates of exchange for trade, it also restricted governments’ ability to print money at will.

In this article, Nick Liondis states:

“The appeal of a gold standard is that it arrests control of the issuance of money out of the hands of imperfect human beings. With the physical quantity of gold acting as a limit to that issuance, a society can follow a simple rule to avoid the evils of inflation.”

However, the ever-increasing demand for paper money put the Gold Standard under enormous strain during the 20th century. Banks were simply unable to hold enough gold and the failure of the final effort to reform the system after World War II prompted US President Richard Nixon to announce the suspension of dollar convertibility to gold in 1971.

Fiat money

The new era hailed the predominance of ‘fiat money’. A Latin word meaning ‘let it be done’, fiat is defined in modern dictionary terms as a ‘decree’ or an ‘order’.

From this time on, the world’s major currencies were no longer linked to a physical commodity, but to the will (and creditworthiness) of the governments that issued them.

Fiat increases governments’ abilities to stimulate their economies by increasing the money supply – simply through printing more notes or through measures such as quantitative easing, which has been described as creating money out of thin air.

However, increasing the money supply faster than growth in real output is a major cause of inflation – the decline of purchasing power of a currency over time.

The curse of inflation

History is littered with examples of currencies that have fallen victim to extreme inflation, among them the German papiermark, Hungarian pengo and Zimbabwean dollar which became worthless in the face of rapidly-rising prices.

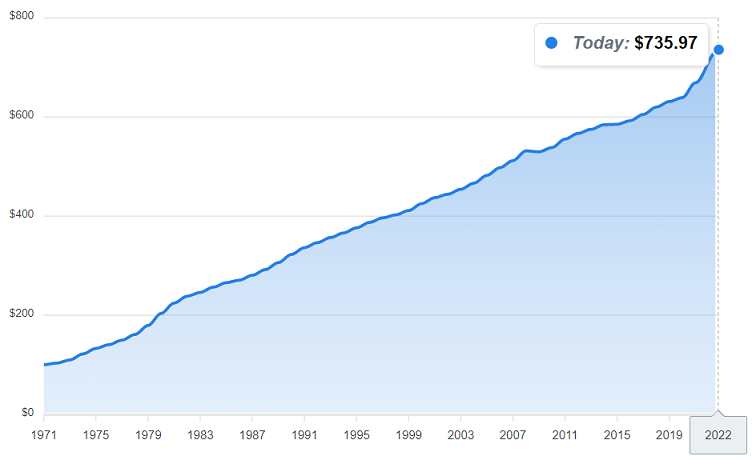

Even the mighty US dollar is far from immune from the effects of inflation. Since 1971, the greenback has lost huge amounts of purchasing power. According to inflationtool.com, average annual inflation in the US during this period to 2022 equals 3.99%, meaning that US$100 in 1971 are equivalent to US$735.97 today.

Inflation timeline in the United States (1971-2022)

(equivalence of US$100 due to compound inflation and CPI changes)

Source: inflationtool.com, accessed 19 September 2022.

This has serious implications for savers and investors, and challenges the contention that money, under its classic three-pronged definition, is a long-term store of value.

As George Selgin has written:

“To insist that money must serve as a ‘store of value’… begs the question: in what meaningful sense could Papiermarks be said to have served as a ‘store of value’ in Germany during the autumn of 1923?”

Where gold shines

Judged against this viewpoint, fiat currency fails the definition of money and yet even when it becomes almost worthless, continues to be regarded as a unit of account and medium of exchange.

On the other hand, gold, which served as money for a long period of time, no longer retains these two characteristics. You can’t easily buy something with a gold coin! What gold has done, however, is retain a historical store of value characteristic.

Among the studies that have analysed this assertion in depth is Roy Jastram’s seminal work The Golden Constant. Originally published in 1977, it examined gold’s purchasing power from 1560 in Britain and in the US from 1800. Economic adviser Jill Leyland, who updated the work to look deeper into the post-1971 world, said it is: “the first statistical proof of gold’s property as an inflation hedge over the centuries.”

Central banks around the world – the very institutions that replaced gold with paper – understand this well, evidenced by the continuation of their buying spree that’s now at a 30-year high. As the De Nederlandsche Bank is often quoted:

“A bar of gold always keeps its value. Crisis or not. That gives a safe feeling. The gold holdings of a central bank are therefore a beacon of confidence.”

What can we conclude?

From the above discussion, it’s possible to conclude that:

- The role of paper money as an easy medium of exchange that is recognised and accepted globally will continue.

- Inevitably, fiat currencies will remain subject to manipulation and failure.

- Since 1971, the price of gold has floated against global currencies and as such rises whenever they weaken.

- Although no longer a primary form of currency, gold can be used as an effective hedge against inflation.

Gold acts as an insurance policy against inflation and global uncertainties and is an asset diversification strategy for risk management.

Sawan Tanna is the Treasurer of The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.