Australians aged 50 or more would recall the surprise 30 years ago – late on the afternoon of 9 December 1983 – when our mollycoddled dollar was floated.

The float is, in my view, the most significant change affecting the Australian economy - and investor choice - of the past 70 years. And that claim stands tall, even though our exchange rate to the US dollar (94 US cents at time of writing) is close to where it finished (92 US cents) on the first day of the float three decades ago.

Prior to the float, four officials (from the Reserve Bank, Treasury Finance and Prime Minister’s Department) set the daily value of our exchange rate in trade-weighted terms. Their all-too-predictable moves made a motza for speculators at the expense of taxpayers - and set up capital flows that largely stripped monetary policy of its effectiveness.

In the run up to December 1983, many people pointed to the need for the Australian dollar to more responsive to market forces. But no-one in the market or the media expected Treasurer Paul Keating to go all the way and allow a clean float of the exchange rate. He also announced the end of the tight web of exchange controls, including on Australians wanting to invest overseas, that were introduced as emergency measures in World War II.

The surprise added to the impact of the float. As Paul Kelly wrote in the early 1990s, “The float transformed the economics and politics of Australia. It harnessed the Australian economy to the international market place – its rigours and ruthlessness. It signaled the demise of the old Australia – regulated, protected, introspective.”

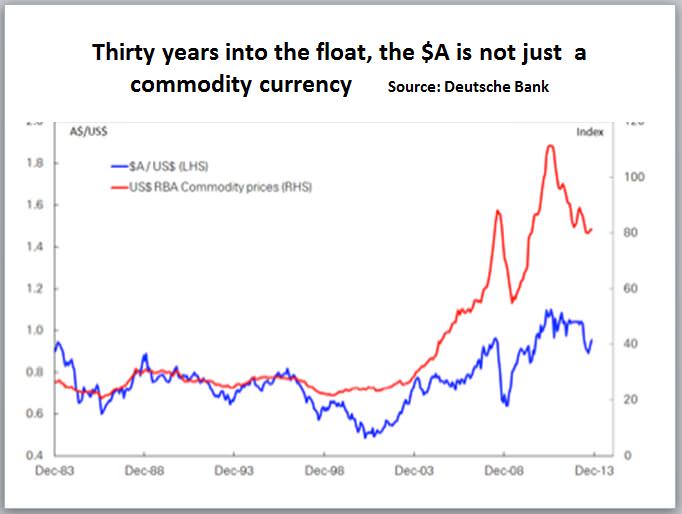

In the first 20 years of the float, the Australian dollar largely moved up and down with commodity prices. These days, other influences are also at work, such as interest rate differentials, our sovereign ranking and the strength or weakness of the US dollar against the major currencies.

The floating dollar has significantly reduced the impact on Australia’s economic pulse of swings in the global economy, just like good shock-absorbers on a car smooth a drive along a bumpy road. For example, the sharp fall in our exchange rate during the Asian crises of the late nineties and in the GFC softened the impacts on our economy of those massive disruptions in the economies of our trading partners. And the currency appreciations when world growth accelerated in 2004 and particularly during the recent resource booms helped avoid the over-heating of the economy.

The float has made Australian monetary policy more effective. No longer does the Reserve Bank have to purchase or sell Australian dollars to keep the Australian dollar at the target level (or range) – transactions that would generally lessen the impact of its monetary action. The long run of low inflation, including during the recent mining booms, and the enviable record of also going more than 20 years without serious recession would not have been possible without the float.

Of course, it’s not always been easy sailing. When the Aussie dollar fell to 48 US cents in 2001 and again when it peaked a little above 110 US cents in 2012, the exchange rate moved further than the fundamental influences on the currency would seem to have required. Those extreme levels of the currency caused serious pain in some sectors of the economy. Even now, the Australian dollar is a good deal higher than a lot of people would like it to be – and is defying efforts by the Governor of the Reserve Bank to talk it down.

But what would have happened had we maintained a managed exchange rate? The answer, in part, is that events such as the strong commodity prices and mining boom of recent years would have likely have resulted in a burst of inflation that would also have hurt Australian competitiveness – and created all sorts of problems for most Australians, especially investors.

Don Stammer is an adviser to the Third Link Growth Fund, Altius Asset Management, Centric Wealth and Philo Capital. The views are his alone.