With the proliferation of cheap passive and factor-based product being sold to retail investors, the importance of demonstrating ‘value for money’ has never been more important for active fund managers.

The recent decision by US fund manager Fidelity to offer an index product for free (zero fee!) clearly hit the mark when it comes to an effective marketing campaign. In the first month, this strategy reportedly raised over US$1 billion. Clearly loss leading, but Fidelity will make money lending the stock to the ‘short-sellers’ and by attracting fee-paying clients to their client brokerage platform and asset management products.

Aside from the impact on the established index providers, consider the effect on ‘active’ portfolios on their platforms that run a traditional ‘benchmark aware’ approach. Regulators are also interested. Late last year, the New York Attorney-General and the UK Financial Conduct Authority proposed rules to crack down on closet indexers. The spotlight is firmly pointed on what represents true value for money when it comes to charging retail fees.

Institutional mindset

Benchmark aware or closet index managers run low tracking error and lower active share strategies largely for commercial reasons.

Institutional investors (pension funds) traditionally hired a fund manager to deliver investment returns aligned with an allocated risk budget, which is based on a broader strategic asset allocation decision. The unintended consequence has been a proliferation of benchmark hugging. So, what is wrong with that? Outcomes for clients have largely been achieved within a tight range. The problem lies with the cost for that offering in the retail market. If a client is paying small institutional fees, a reasonable return is still possible. However, such an outcome net of fees falls rapidly for retail clients, who are generally charged higher fee levels for the same portfolio.

Brand risk versus investment risk

For an asset management organisation with a mature client base and a strong reputation, running a retail strategy with a lower tracking error can be a way to harvest fee revenue. By constructing a portfolio with tight constraints around a benchmark, if the manager has a bad year they won’t underperform so much that their investors get nervous. Will clients fire the manager if they return the benchmark +2% or -2%? Probably not, if they have a strong brand.

Running a portfolio with low tracking error and low active share can mean a large proportion of the portfolio is already represented in the index. As a result, an unattainably high percentage of the ‘active’ stock decisions must be correct to deliver any outperformance after fees. That said, there have been many examples of highly-skilled fund managers running large portfolios in well-established institutions, who can achieve this consistent outperformance. Constraining a manager places greater emphasis on the consistency of correct decisions and discipline of process. It could be argued these individuals would be better suited to running a less-constrained approach with capped levels of assets in their own boutique investment management environment.

The true cost for retail investors is opportunity cost

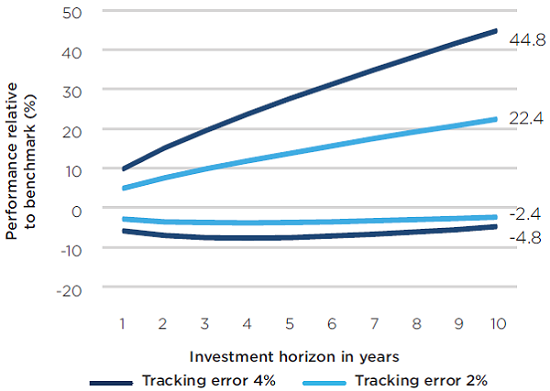

The impact of limiting a skilled manager can be displayed in a simple theoretical model [Klement 2016]. The chart below shows the best and worst excess return outcomes (using a 95% confidence interval which implies a 2 standard deviation as shown in the chart) for a fund manager who has a reasonable level of skill and ability to outperform. In more technical language, the skill in this example is an 'information ratio' of 0.5, implying consistent performance above the index relative to the active risk taken. This manager is managing two theoretical portfolios, one with a tracking error of 2% (light blue) and a second portfolio with a tracking error of 4% (dark blue).

Theoretical model – best and worst return outcomes

Source: Fidante Partners

In the worst possible case, with this manager underperforming, the lower tracking error results in the underperformance of the fund being halved. This is a reasonable outcome for the client and has protected some of the downside. However, the real cost of constraining a skilled manager is that the client upside is effectively halved if the manager performs well. In this theoretical example, in any given year the upper limit of the best possible scenario is reduced from 9.8% outperformance to 4.9%. The impact is over 20% when compounded over ten years.

Value for money in active management comes back to the skill of an investment manager

Core to this example is selecting a skillful manager that will consistently outperform over the longer term. If a retail investor can identify a skillful manager who has freedom to exercise that skill, this is likely to lead to the best outcome for retail investors. Conviction, skill and a consistent and disciplined process are key attributes Fidante Partners look for when partnering with boutique investment managers.

Tim Koroknay is a Senior Investment Specialist at Fidante Partners, a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any individual.

For more articles and papers from Fidante, please click here.