The post-Covid period for asset markets is well advanced. This period has featured both higher inflation and higher interest rates compared to the pre-Covid period. Rising bond yields have pushed down bond prices and compressed equity market price earnings ratios (PERs). Property capitalization rates have increased and checked property valuations. Cash flows from leveraged assets have decreased due to debt facilities being re-negotiated to higher rates.

However, the era of asset price compression will continue for a short period before petering out in 2024. Whilst higher risk-free rates have caused an adjustment to the intrinsic values of all assets, it is now mainly behind us because inflation is clearly declining – and investment grade interest rates for investors will surely follow. In particular the risk-free rate of return (the ten-year bond rate) looks well anchored below 5%.

Balanced returns look good in 2024

With both inflation (already) and cash rates peaking (over the next 3 months) Australian asset markets are resetting and investors can take comfort that balanced portfolio returns stand on firmer ground. Inside a balanced portfolio lower risk yield can replace higher risk yield because investments such as corporate debt and/or asset backed securities now generate appropriate yields that are above inflation. For risk adverse investors, two and three government bonds are now generating a reasonable yield.

The strategic positioning of portfolios toward income-oriented investments, especially for investors reliant on higher pensions, has an aspect of urgency. This is because asset allocators (at large pension funds) will soon see that “real interest rates” (i.e. rates above inflation) are now clear to observe in corporate debt markets. Whilst corporate bond yields have risen, they are now enhanced by readings of lower inflation. The attractiveness of quality corporate debt that yields higher than projected inflation will become increasingly obvious.

The amount of money that will flow towards these “real” interest rate offers will be significant. Importantly the current corporate debt yields (and thus returns) are similar to the higher risk returns expected from equities, and that will not last.

This suggests that investment returns for balanced portfolios will not be greatly challenged in 2024. Indeed, positive returns for portfolios will be generated from the stronger income that will flow from fixed income asset classes (debt and credit). A balanced portfolio that invests across growth and income assets should be appropriately tilted towards income and more so as if an investor is mature and required to withdraw higher pensions.

Allocations to growth assets that generate dividends or rental streams should be maintained because economic growth will reward these asset classes post 2024. Investors need to rebalance portfolios with an eye focused on income and the other eye on the assets that will perform when the interest rate cycle plateaus during 2024. This is because Australia’s economic growth post 2024 seems assured as demand flows across the economy from a surge in population.

Higher bond yields have impacted the risk asset valuations

Higher ten-year bond yields (and substantially lower bond prices) are now set, and we can observe that yields are 3% to 4% above pre-Covid levels. These higher yields (“risk free rate of return”) are contesting intrinsic valuations of other assets based on their cashflow generation.

If the cash flows from low-risk assets increases, then so too must the required cash flows from higher risk assets. These cash flows don’t just suddenly appear from business operations or rental streams. Rather, the market yield rises as the market price for these assets is forced lower. That explains the asset deflation cycle that we have been in, but the good news is that we are well through this cycle.

Remember the excesses of the pre-Covid era

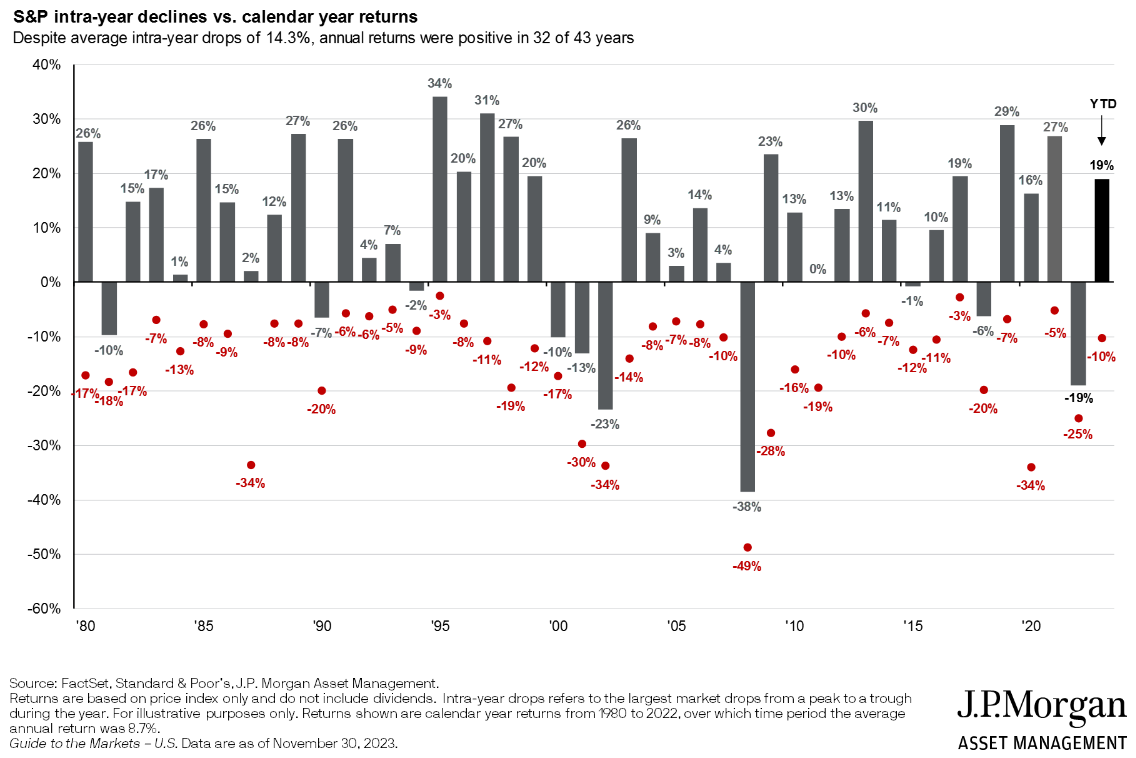

While asset price “down cycles” are not uncommon (and they generally last short periods), it is clear that the post GFC, pre-pandemic periods and during the pandemic itself, were dominated by ridiculously low interest rate settings, and these created an immense speculative asset inflation cycle. The chart below tracks the US S&P 500 index returns and illustrates that low rates propelled the index higher in most years. The correction of 2022 (negative 19%) was well overdue.

Thus, excessive asset prices are adjusting in this post-Covid era. The extent of this price adjustment will result from the interplay of higher required returns (the rising risk-free rate) against observations of and predictions for growth.

Understanding the interplay of interest rates on market prices of assets allows investors to understand the scenarios that flow from higher interest rates. It assists investors to look at past market behavior and understand what the driving influences were. It informs investors how extreme market behaviour or pricing can be suddenly checked or reversed. Importantly, it puts into context the past when compared to the present and guides investors in their decision making.

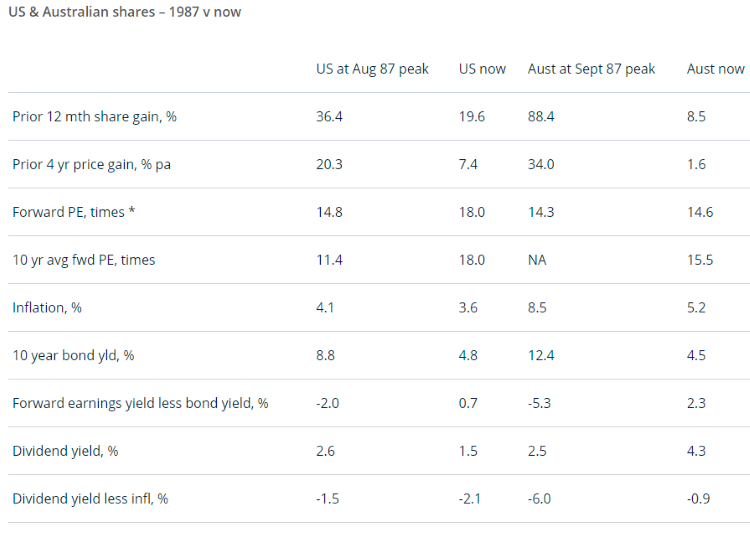

Can today’s interest rates lead to a market crash like 1987?

To this question, the following table (published early October 2023) informs us that today’s markets are nowhere near the extremes seen before the 1987 crash. For instance, whilst today’s PERs are comparable to 1987, back then bond yields were significantly higher. Further, the surge in Australian stock prices over 1 and 4 years prior to the 1987 crash were extraordinary. Analysis of our current market makes clear that we are not in a speculative bubble with the Australian equity market paddling sideways.

* The forward PE is based on 12 mth ahead consensus earnings expectations. The forward earnings yield is the forward PE inverted. Source: Reuters, AMP

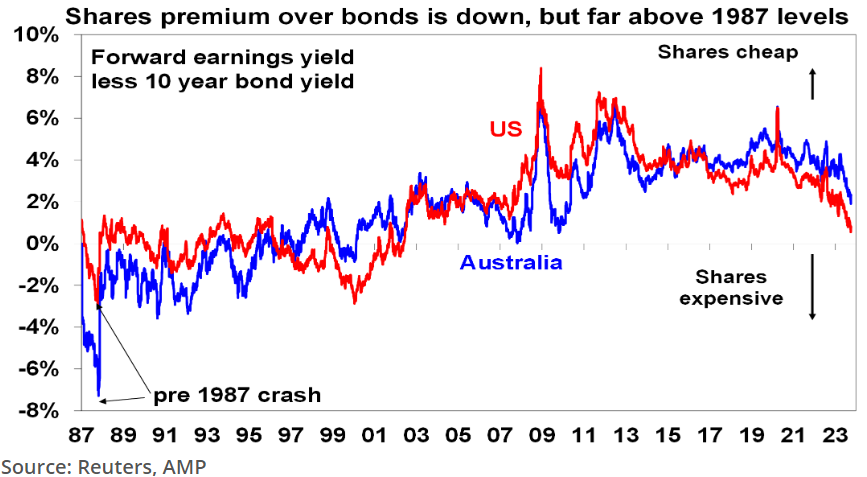

The earnings yield of a company is the inverse of the PER. Therefore, as bond yields rise, then the market will force earnings yields to rise and PERs fall. If PERs don’t fall in relation to rising bond yields, then shares become less attractive. Investors that are offered higher yields will adjust their allocations within their multi-asset portfolio.

Australian shares might not be particularly cheap, but neither are they particularly expensive. Indeed, the chart below shows that shares on a relative basis, in the face of rising bond yields, have merely become somewhat less attractive. Axiomatically, as bond yields move lower with inflation expectations then shares will become more attractive.

Higher interest rates support a rebalance to income assets

The key points I want to emphasise from the analysis above are these:

- Whilst Government bond yields have risen, they are still below inflation and arguably still not producing adequate returns. However, the rise in bond yields and particularly in corporate debt, do now offer investors solid income out to 3 years in duration;

- While property assets have devalued (market values) with higher interest rates, they will begin to recover as income grows from rental flows benefiting from inflation. Leveraged property has been hardest hit, but the tailwinds for economic growth suggest property will continue to be a good long term investment – expect a recovery in 2024;

- International equities have been highly volatile over 2022 and 2023 as higher bond yields challenged valuations. Australian investors have been protected by a weak currency and should stay alert to the risk of an AUD revaluation in 2024 that could arise once our cash rates rise above inflation;

- Australian equities continue to generate high franked income but with limited capital growth opportunity. The equity index remains dominated by resource and financial companies and their performance will continue to dictate the trajectory of equity market returns. However, the outlook for emerging companies outside the ASX 200 has become increasingly attractive after 2 years of underperformance. Look for a sharp recovery in small company indices through 2024.

While 2024 promises to deliver positive returns across all asset classes, the returns from income asset classes have become increasingly attractive. Balanced portfolios should continue to deploy both cash and cash flows to Australian corporate debt paper and target a 7% return with less volatility and more stability in portfolio values. If 7% does not seem adequate, then it is worth reflecting that bond markets have lost about 30% of their value over recent years. Steady returns are far better than volatile returns that detract from the benefits of compounding – which is an investor’s best friend.

John Abernethy is Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.