“I should have computed the historic covariance of the asset classes and drawn an efficient frontier. Instead, I split my contributions fifty-fifty between bonds and equities."

- Nobel Laureate Harry Markowitz, father of Modern Portfolio Theory, when asked about his personal retirement account. He is 91 years old.

It is rare to look inside a private multi-sector fund managed by someone like Chris Cuffe who sees an endless stream of deals and investment managers every year. While many investors spend most of their time deciding which shares to buy, the allocation between different asset classes is far more important for long-term returns. A study by Vanguard (the second-largest asset manager in the world) of 580 balanced funds in Australia showed that 90% of the return from a portfolio comes from asset allocation between sectors. That leaves only 10% for everything else, including selection of particular shares.

What is this portfolio and its objectives?

Chris Cuffe founded Australian Philanthropic Services (APS) in 2010 to open and administer charitable fund structures known as private ancillary funds and public ancillary funds (PAFs). For details on these structured, tax-effective giving vehicles, read here. APS also established its own public ancillary fund, known as the APS Foundation, to allow people with as little as $50,000 to set up a sub-fund in a name of their choosing. The money is combined into a single charitable fund for which Chris is the Portfolio Manager.

Each year, sub-fund holders donate to charities at least 4% of the prior 30 June balance, although some give more. The fund has grown to over $70 million in a relatively short time. The higher the investment returns generated by the fund, the more is available for charities.

The investment strategy seeks to achieve an after-fees return at least equal to CPI + 4% per annum, measured over rolling 7-year periods. Although the known minimum outflow is 4%, Chris can take a genuine long-term perspective because the donors do not redeem due to market circumstances, as they might with an open-ended managed fund holding personal assets. Liquidity is important as donors can give to charities at any time, but the portfolio does not need to be invested only in low-yielding cash or fixed interest to preserve the balance.

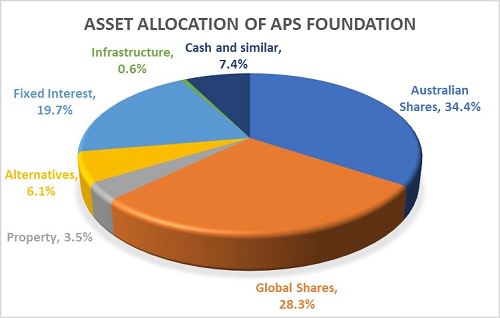

Chris believes that the best way to achieve the investment objective is to hold a significant portion of growth-oriented investments such as shares, with the additional benefits of franking credits. He also wants some exposure to income-oriented investments such as cash, fixed income securities and lowly-geared property and infrastructure securities. There is tactical asset allocation when sharemarket valuations appear stretched or a better risk/return trade-off is expected away from shares.

The bottom-up starting point

Unlike most multi-sector managers, Chris does not start by targeting a specific asset allocation. Instead, he builds the portfolio from the bottom up. He looks at individual investments on their merits based on the return target, expected time frame to achieve the return and likelihood of capital loss. The asset allocation is more an outworking of this method and a risk check. That is, he watches the amount in each asset sector to ensure the portfolio does not become more concentrated in one asset class than he desires.

He pays little regard to the so-called ‘growth/defensive’ split because he believes such categorisation is too vague. It implies precision when the world of investments is imprecise. He prefers the ‘growth/income’ distinction, which refers to where the majority of return is expected to come from.

For a previous article by Chris on the difficulties of Tactical Asset Allocation, see here.

Investments held at 30 June 2018

The broad investment ranges allow 25% to 75% in either growth-oriented or income-oriented.

Growth-oriented investments (72.3%)

Australian shares (34.4%):

- Unlisted managed funds/IMAs (31.6%) – Aberdeen Australian Small Companies Fund, Auscap Long Short Australian Equities Fund, DS Capital Growth Fund, EGP Concentrated Value Fund, The Level 18 Fund, Pengana Australian Equities Fund, TDM Asset Management IMA, The Wattle Fund, LHC Capital Australia High Conviction Fund, Wentworth Williamson Fund, Third Link Growth Fund

- Shares directly held (2.8%) – comprising 5 securities listed on the ASX

International equities (28.3%):

- Listed investment companies (6.2%) – Future Generation Global Investment Company, Magellan Global Trust, VGI Partners Global Investment

- Unlisted managed funds/IMAs (17.3%) – Antipodes Global Fund (Long Only), Magellan Global Fund, Paradice Global Small Mid Cap Fund, TDM Asset Management IMA, VGI Partners Master Fund

- Shares directly held (4.7%) – comprising 7 securities listed on various international markets

Property (3.5%):

- Unlisted property trusts - Portgate Estate (Port of Brisbane – industrial property), IIG TAC Property Trust (60 Brougham Street Geelong – commercial property), Quintessential 036 Trust (39 Brisbane Avenue, Barton, ACT – commercial property), IIG K5 Property Trust (25 King, Brisbane Showground - commercial property), Terra Australia Partners III Fund, Folkestone Sydney Airport Hotel Fund

Alternative assets (6.1%):

- Unlisted managed funds/IMAs (4.0%) – Atrium Real Assets Fund, TDM Asset Management IMA, Champ IV Trust A, Armitage Private Equity

- FundUnlisted and listed shares directly held (2.1%) – Tellus Holdings, Global Value Fund

Income-oriented investments (27.7%)

Infrastructure assets with low gearing/development (0.6%):

- Managed fund (0.2%)– Magellan Infrastructure Fund (hedged)

- Listed investment company (0.4%) – Argo Global Listed Infrastructure

Fixed interest (19.7%):

- Unlisted managed funds/IMAs (17.0%) – Morgan Stanley IMA, MINT Partners IMA, PIMCO GIS Income Fund, Lannock Sophisticated Investor No. 1 Unit Trust, Elstree Enhanced Income Fund, CLR Portfolio Note, Western Asset Macro Opportunity Bond Fund, Invesco Zodiac US Senior Loan Fund

- Directly held (2.7%) – comprising 3 fixed interest securities

Cash, franking credits receivable and other receivables (7.4%)

Some features which are notably different to, say, the average SMSF or personal portfolio, include:

- Share selection is outsourced to fund managers. Chris believes it is possible to identify talented managers who deliver excess returns over the long term. He is not concerned if a fund manager underperforms an index over a one-, two- or three-year period. He judges managers over rolling five-year periods. Chris has decades of experience and market contacts to draw on, and not all these managers are available to retail investors.

Although many of the managers have agreed to rebate their fees (both management and performance), Chris is willing to invest in some funds or securities where fees are not waived. He will pay fees if the after-fees return is expected to be attractive from investing with one of the limited number of managers who can consistently provide attractive after-fees returns.

- The international equity allocation at over 28% is significantly higher than the average SMSF and most Australian balanced funds, based on Chris recognising the global opportunities in sectors not available in Australia.

- Fixed interest funds are used for income and capital protection, often taking advantage of higher-yielding sectors beyond traditional government and corporate bonds. He is a fan of the private debt markets (for example, loans to businesses starved of traditional bank borrowings) because returns are seen as disproportionally high compared to the risk of capital loss.

- He does not regard volatility in the value of a security or fund as a measure of ‘risk’, instead viewing risk as the possibility of permanent capital loss.

- He has little regard for how competitor funds invest and is not a fan of ‘following the Joneses’.

- Asset allocation close to the maximum for growth-oriented assets is possible with a long-term perspective, which gives flexibility to take more risk than a portfolio subject to outflow if short-term performance is poor.

Fund performance

Although few, if any, of the donors watch the investment performance in the way they might with their personal portfolio, and short-term performance is almost irrelevant to Chris, it’s interesting to see how the fund has performed relative to its target and indexes. With a since-inception (1 July 2012 to 30 June 2018) return of 12.9% pa against inflation of 2.1%, it’s clearly meeting its objective and helping build the amount available for charities. Holders of sub-funds can see their balance at any time and know how much they have to give each year.

APS manages all aspects of the APS Foundation (including administration, compliance, arranging investment management, and facilitating the yearly audit) for a fee of 1% pa. Chris provides his services to APS pro bono, as do most of the external fund managers. Some may earn fees but are still used where an attractive post-fee return is expected.

For further information on charitable giving using Public or Private Ancillary Funds, contact APS at [email protected].

Graham Hand is Managing Editor of Cuffelinks. Chris Cuffe is a Co-Founder of Cuffelinks; Portfolio Manager of the charitable trust, Third Link Growth Fund; Chairman of Australian Philanthropic Services (APS); Chairman of Hearts and Minds Limited (all in a pro bono capacity) and Non-Executive Director of various companies. The views expressed are not personal financial advice and do not consider the circumstances of any individual.