We previously argued the Value style of investing was ripe for a rebound back in September 2019 but COVID-19 put a spanner in the works for the improving outlook for global economic growth and the Value style at the time.

The pandemic downturn exacerbated the market’s tendency to overreact and extrapolate, which put Value investing under significant pressure. However, the positive COVID-19 vaccine announcements in November 2020 resulted in green shoots for a potentially enduring Value rally.

We see that significant opportunities for Value stocks remain from the wide value spreads on offer. Ahead of spreads narrowing as economies rebound, now is the time to position portfolios in Australian Value stocks.

(As a brief reminder, a 'Value' stock is where the share price appears low relative to its intrinsic value based on common market value measurements).

Value performance has been under pressure

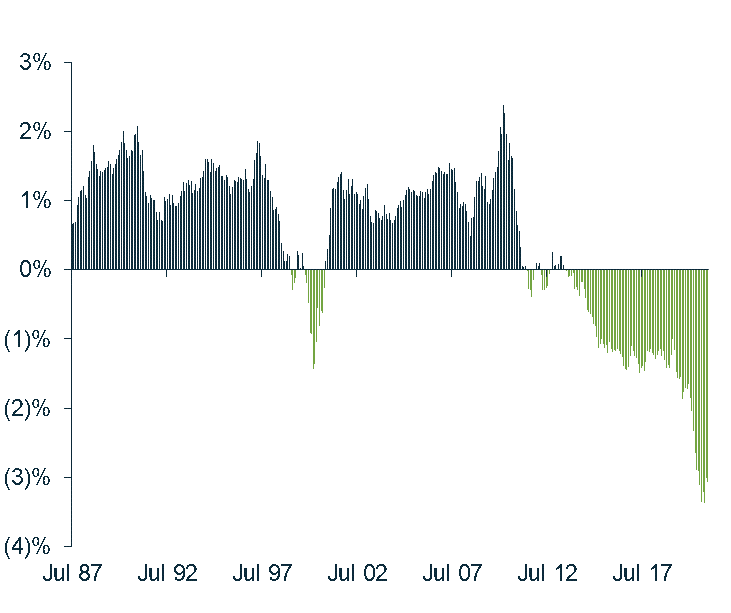

Traditionally, history has shown that Value style (based on the MSCI World Value Index) has typically outperformed the broader index (MSCI World Index) over the long term. However, over the last 12 months (through to 20 January 2021), the 10-year rolling return deficit between Value and Growth styles has more than doubled the previous large deficit during the tech bubble, and Value has given up nearly 40 years of cumulative outperformance over Growth.

MSCI World Value – MSCI World: Rolling 10-year annualised relative return differential

MSCI World Value/Growth Cumulative relative return

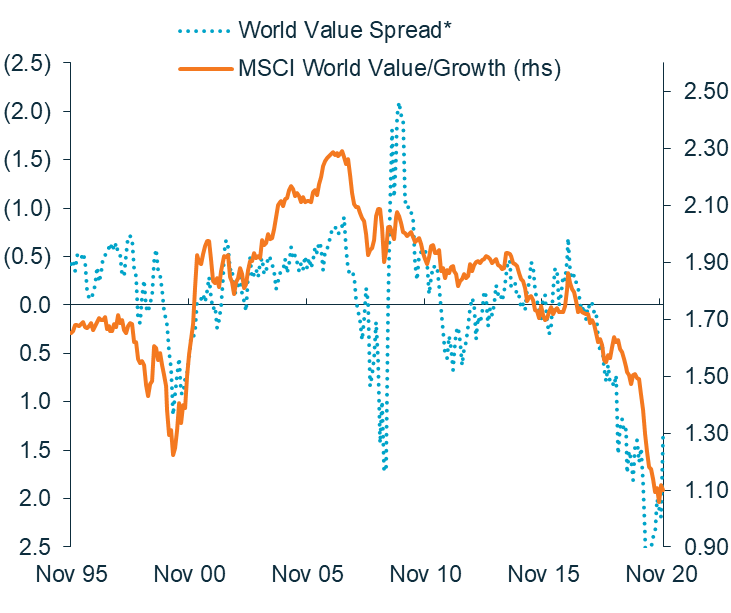

Source: Martin Currie Australia, FactSet, as at 20 January 2021

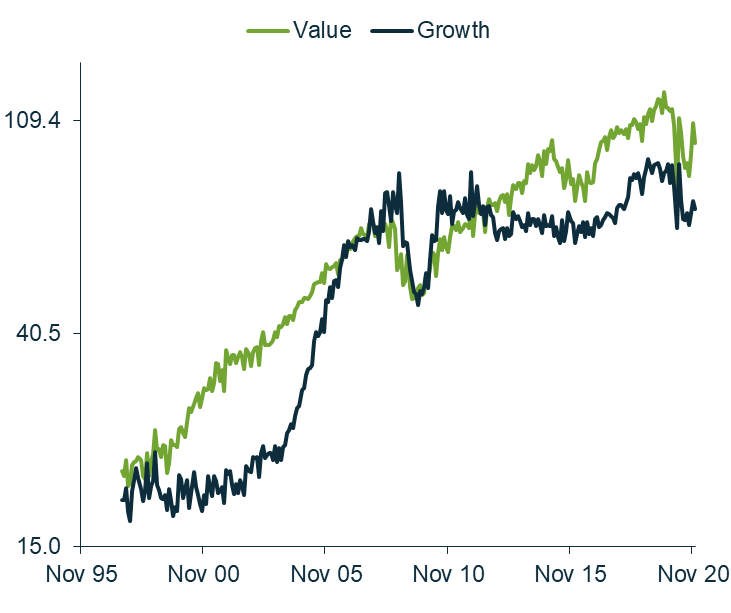

But EPS for Value have been consistent with Growth

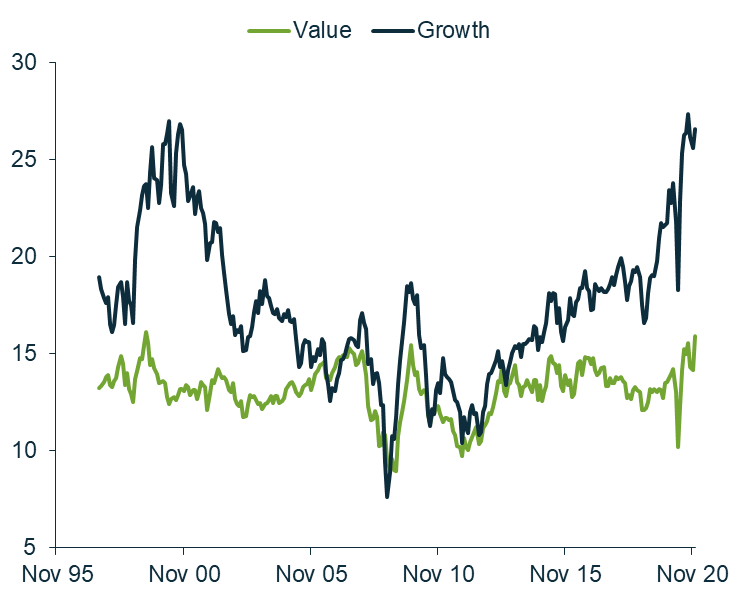

Despite that, earnings per share (EPS) performance between the styles has been remarkably similar over the last 25 years. This means that the returns differential has been primarily driven by a multiple re-rating for growth stocks. That is, the price people are willing to pay for growth stocks despite similar earnings prospects has been significant.

Cyclicality of world and Australian Value spreads

We have in the past created a ‘world’ Value spread based on an extreme valuation dispersion environment using a composite of typical value metrics including current P/E, next 12-month P/E, dividend yield and Price/Book).

I have now extended the analysis to Australia, using the MSCI Australia Value and Growth indices.

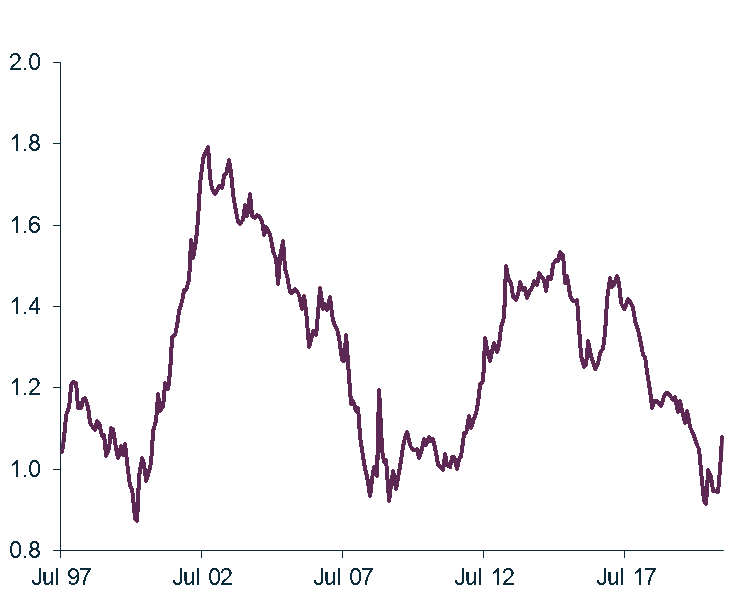

For the Australian indices, the Value vs. Growth performance dynamic has been much more cyclical than it has been for the world indices, with less of a structural decline over the last 10 years given the more consistent quality characteristics of Australian Value and Growth companies.

World Value spreads and MSCI World Value/Growth cumulative relative return

MSCI Australia Value/Growth: Cumulative relative return

Source: Martin Currie Australia, FactSet, as at 20 January 2021

*Composite of current P/E, next twelve-month P/E, dividend Yield and P/B for MSCI World

Return differential for Australian stocks also driven by Growth re-ratings

EPS growth for Australia Value stocks have been superior to Growth, especially post the GFC. As such, the returns differential has been primarily driven by a multiple re-rating for Growth stocks to an extreme equal to the tech bubble.

MSCI Australia: Next 12-month EPS by Style (log scale)

MSCI Australia: Next 12-month P/E by Style

Source: Martin Currie Australia, FactSet, as at 20 January 2021

2020 created the largest valuation opportunity ever

Calculating the ‘Australia’ Value spreads based on the same metrics as above, we can see a similar trend to the global Value spreads. Looking at when valuation spreads reach extreme levels (>1) has been a good predictor of stronger future Value returns.

On this basis, the year 2020 witnessed the largest valuation spreads on record for the MSCI Australia indices.

Furthermore, we believe Martin Currie Australia's proprietary discounted cash flow (DCF) based Value spreads are the best measure for the Australian market given they are forecast Growth and quality adjusted.

Comparing the composite MSCI World and Australia Value spreads with our in-house ‘return to fair value’ based Value spreads (for both the S&P/ASX 200 and our portfolio), the pattern is similar and each show the extreme level of spread in 2020.

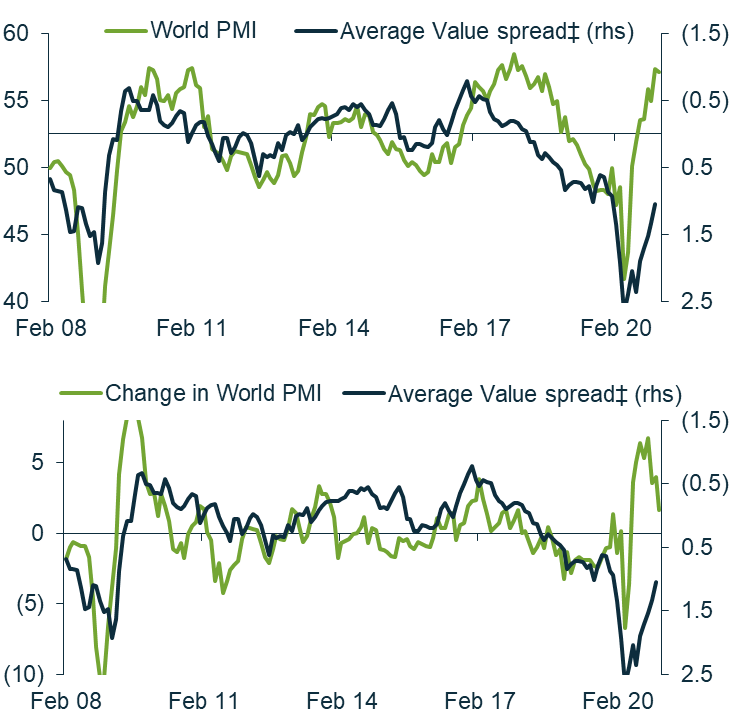

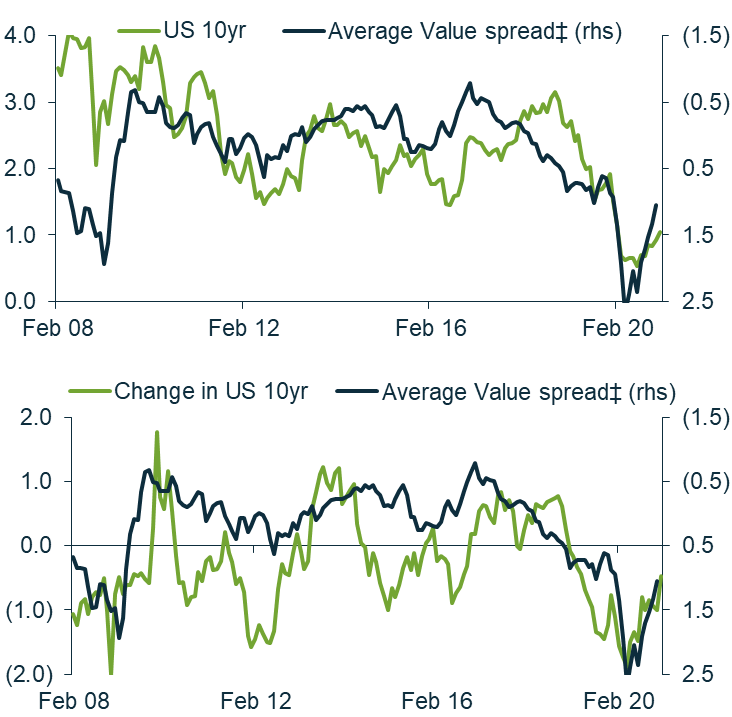

Recovery in economic growth and bond yields a leading indicator for Value

We have previously highlighted the historically tight correlation of Value spreads with economic growth and bond yields, in particular since the GFC. The COVID-19 induced recession in 2020 has resulted in significant declines in both growth and yields, and this is really what has pushed Value spreads to unprecedented levels.

The improvement in World PMI and US 10-year bond yields since mid-2020 has resulted in a bottoming of the Value vs Growth performance deficit in Q3 2020, but Value spreads surprisingly appear to be disconnected from the positive moves.

This is possibly because we are at the turning point, the extent of the QE programmes of late, or the market just doesn’t believe the data yet.

Given the likely ongoing recovery of economic growth and bond yields as the vaccine is rolled out and the world recovers from COVID-19, we believe that spreads will again tighten, and continued significant Value outperformance is likely.

Economic growth and Value spreads

Bond yields and Value spreads

Source: Martin Currie Australia, FactSet, as at 20 January 2021

‡Average of composite MSCI World & MSCI Australia and MCA Value Equity RTFV – S&P/ASX 200 RTFV spreads

Bigger opportunities in Australian stocks than Global

The Value vs Growth cycle is more cyclical and less structurally challenged for the Australian market than it is for the world, suggesting that it is better to gain Value exposure via Australian equity allocations than the global equity allocation.

Many global Value portfolios are reliant on narrow index relative positions in banks, energy and Europe rather than the dominant technology and healthcare in US stocks. However, Australian Value exposures are not dependent on structural or geographic bets, and offer more diverse sector opportunities. Australian Value stocks are also not up against the high-quality global tech companies.

Supporting this, the Australian MSCI Value index has shown a much more significant upturn in performance since the vaccine, reflecting cyclical forces overcoming structural whereas this is less evident in global indices.

Note that when we talk about opportunities in Value stocks, we don’t mean to say that they are poor quality companies versus their Growth counterparts. Maintaining quality in portfolios is integral given the prevailing economic uncertainties.

Many of the key stocks which we believe are undervalued by the broader market have particularly good quality characteristics. For example, these include:

- Nine Entertainment, which is benefiting from the shift to video/online, and has cost-out driving its EPS acceleration;

- Star Entertainment, which will benefit from the reopening in Australia and is not reliant on international travel;

- Inghams Group, who is seeing the end of drought bringing lower feed costs, and experiencing growing demand for cheap chicken protein;

- Worley, where renewable projects in solar and wind are driving large revenue growth;

- the big 4 Australia banks, which are seeing the post-COVID-19 loan provision unwind increasing both EPS and DPS; and

- Medibank Private, who is dominating industry profitability and has the ability to acquire to produce high returns.

Value spreads are lagging the upward trend in PMI and yield, whereas we would expect a much tighter correlation. We believe that as the recovery continues, there is more room to go in the Value rally that started in November 2020. The timings of style cycles are notoriously hard to predict, so investors need to be positioned in quality Australian Value stocks now to capitalise on narrowing spreads.

Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.