Part 1 of ‘Investing against the herd’ focussed on resisting the emotional responses which are natural instincts for most investors. In part 2, we confirmed consumer sentiment is indeed at its maximum after a period of strong share market performance – and just before the fall.

In Part 3, we test the theory that if we invested against the herd by selling some of our shares when sentiment is bullish, and buying more shares when sentiment is bearish, then we ought to be able to avoid some of the buy-high, sell-low mistakes and be better off in the long run. You may be surprised to find out just how much money you could be losing or making by following the herd.

We look at three theoretical portfolios from September 1974 when the Westpac Consumer Sentiment Surveys were first published.

The first portfolio is a ‘passive benchmark’ portfolio that consists of 50% shares and 50% cash, and is re-balanced back to this 50/50 asset mix at the end of each month. All dividends and interest are re-invested.

In addition, we also run two active portfolios: a ‘follow the herd’ portfolio and an ‘against the herd’ portfolio.

These active portfolios also have a neutral 50/50 shares/cash asset allocation, but the weights of shares can range between +/- 20% from neutral (ie can range from 70% weight of shares to 30% weight for shares), depending on whether the general population is relatively bullish or bearish according to the national consumer sentiment surveys.

- In the active ‘follow the herd’ portfolio, the asset allocation for the following month is:

- 70%/30% shares/cash (ie over-weights shares) if the ‘Economic conditions for next 12 months’ index level is above 100 (ie consumers are relatively bullish about the next 12 months); and

- 30%/70% shares/cash (ie under-weights shares) if the ‘Economic conditions for next 12 months’ index level is below 100 (ie consumers are relatively bearish about the next 12 months).

- In the active ‘against the herd’ portfolio, the asset allocation for the following month is the opposite:

- 30%/70% shares/cash (ie under-weights shares) if the “Economic conditions for next 12 months” index level is above 100 (ie consumers are relatively bullish about the next 12 months); and

- 70%/30% shares/cash (ie over-weights shares) if the “Economic conditions for next 12 months” index level is below 100 (ie consumers are relatively bearish about the next 12 months).

Therefore, the active portfolios are making moderate (20%) tilts toward or away from shares based on the weight of consumer sentiment each month.

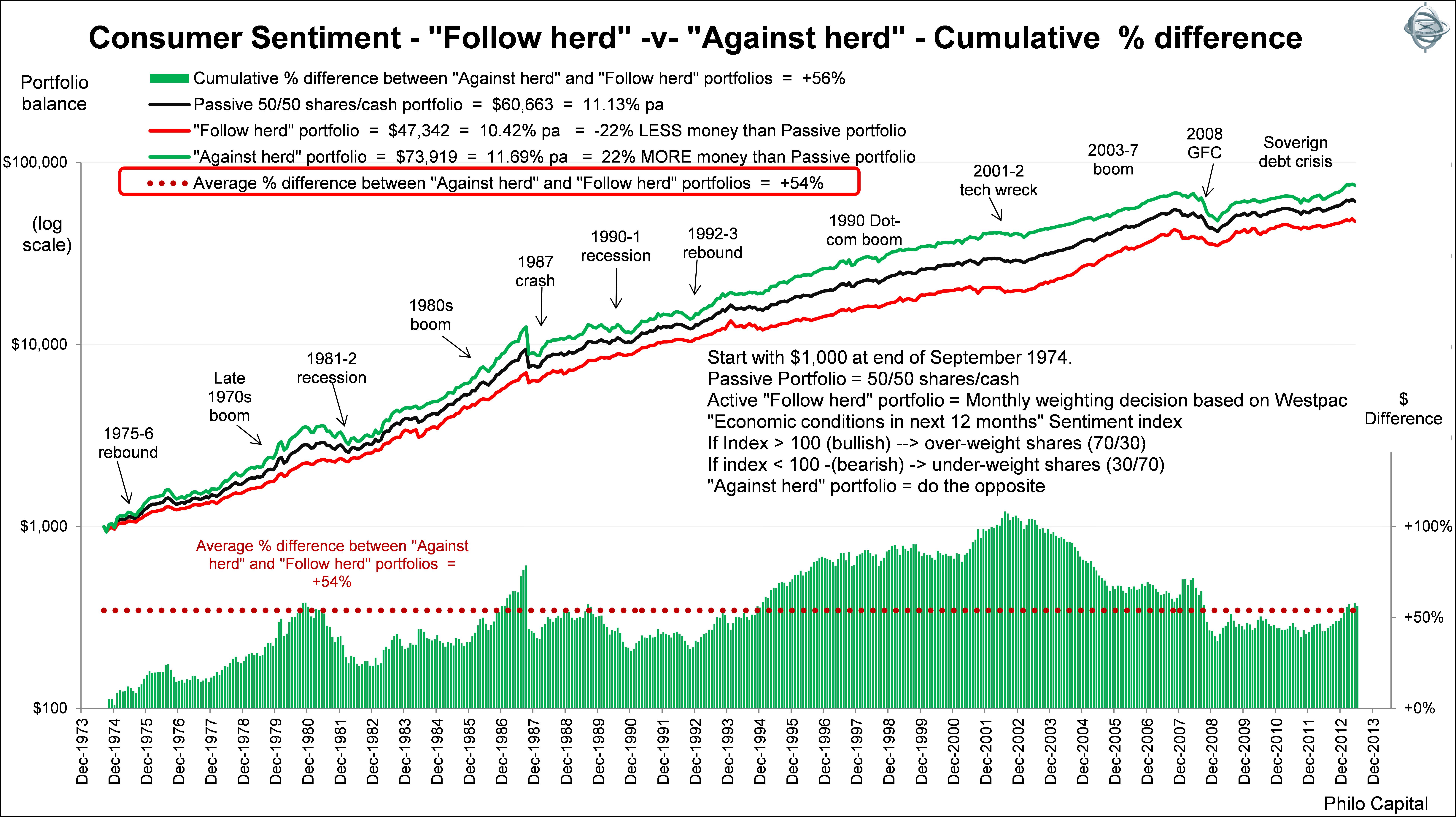

The following chart shows the results. Three portfolios were started with $1,000 and re-balanced each month using the above rules using the Consumer Sentiment Survey results for the prior month.

What are the findings?

The passive benchmark (50/50) portfolio (black line) is re-balanced back to 50/50 shares/cash each month, and would have grown from $1,000 in September 1974 to $60,663 by June 2013, which is 11.1% pa compound total return over the period. (All returns are before taxes and transaction costs but before franking credits. The impacts of these factors would be similar in all portfolios since all three portfolios would need to be rebalanced each month due to market movements alone).

The active ‘follow the herd’ portfolio (red line) is overweight shares in months in which consumers were bullish in the prior month and underweight shares in months in which consumers were bearish in the prior month. The ‘follow the herd’ portfolio would have grown from $1,000 at the start to $47,342 over the same period (10.4% per year). So, by following the herd by buying more shares when the market sentiment is bullish and reducing the weight of shares when sentiment is bearish, the end balance is 22% lower than with the passive 50/50 portfolio.

The active ‘against the herd’ portfolio (green line) is underweight shares when consumers were bullish and overweight shares when consumers were bearish. It would have grown from $1,000 to $73,919 over the same period (11.7% per year). This total return of 11.7% per year over the whole period is 0.56% per year higher than the passive benchmark static portfolio, and 1.27% per year higher than the ‘follow the herd’ portfolio. By going against the herd, the end balance of the ‘against the herd’ portfolio is 22% higher than with the passive 50/50 portfolio.

The bottom section of the above chart shows the extent to which the ‘against the herd’ portfolio would have been higher than the ‘follow the herd’ portfolio over time. At all times the ‘against the herd’ portfolio is ahead of the ‘follow the herd’ portfolio.

On average over the whole period, the 'against the herd' portfolio is some 54% higher than the 'follow the herd’ portfolio and is still around 50% higher after nearly 40 years. 50% higher balances from going against the herd compared to following the herd is a big difference. It means 50% more wealth, 50% more income, and 50% better lifestyle - from just going against the herd and moderately tilting the balanced portfolio against the weight of public opinion at each stage over the 40 year period.

Some conclusions from these findings

Following the herd is a basic human instinct but it destroys wealth. Going against the heard and doing the opposite of what the herd is doing can generate excess returns over and above doing nothing. But it is very difficult to go against the tide and ignore all the hype - especially at the tops of booms and in the depths of the busts.

However, doing the opposite of what the herd is doing - ie selling in booms and buying in busts - is not actually necessary to be a successful investor. If all you do is ignore the herd and avoid buying in booms and avoid selling in busts, then you are avoiding the two most dangerous wealth destruction zones, and you are still going to be better off than probably 90% of investors and fund managers in the market.

Successful investing is mostly about avoiding risks and not blowing up your money. Whether you are rich or poor in 20 or 30 years’ time when you are going to really need the money, is mostly a function of whether or not you make ‘buy-high, sell-low’ mistakes in the critical wealth destruction zones along the way.

Although the relationship between these sentiment measures and subsequent returns from shares has been statistically significant and, when used as a contrary indicator in portfolio decisions, would have led to superior portfolio outcomes (as illustrated above), I am certainly not suggesting that people should follow this plan. It is included here merely to demonstrate that following the herd would have led to a significant destruction of wealth over the past 40 years, relative to doing nothing, and especially relative to going against the herd and doing the opposite.

In the proprietary portfolio models used in our investment process, we do not use the Consumer Sentiment Surveys because the historical data series is not long enough (we require a minimum of 50 years history), and our measures are more robust.

However they are interesting to look at as additional evidence of the general market sentiment and what the herd is thinking and doing. In other words, we use it as evidence of warning signs and not confirmations. For example, if we are bullish on shares when the general market is also bullish, that is more of a warning sign for us than a comfort.

Surveys like these are regular reminders of the need to ignore the market hype and general sentiment and focus instead on the facts.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.